The FTSE Finish Line - September 06 - 2024

The FTSE Finish Line - September 06 - 2024

FTSE Fading Into The Close As Investor Sentiment Shaken By US Jobs Data

The energy and mining sectors pulled down the UK's main stock index on Friday, as investors processed yet another disappointment in the U.S. jobs report. The August payrolls came in below estimates, but investors quickly reduced their expectations that the Fed would start its cutting cycle with a 50bp reduction. August non-farm payrolls were 142k, little lower than expected (160k), and the previous estimate was revised down to 89k from 114k. The unemployment rate also decreased, from 4.3% in July to 4.2% in August. Hours worked and earnings show that the labor market might not be as soft as headline statistics suggested. The FTSE 100 blue-chip index decreased by 0.73%.

Precious metal miners led gains in response to rising gold prices, while industrial metal miners and energy were among the sectors that were most severely affected. The real estate sector was the top performer, while industrial metal miners and chemical stocks were the largest laggards for the week.

Rolls-Royce's stock fell 1.8%, topping the FTSE 100 index's losses. Following an engine fire on a Cathay Pacific aircraft earlier this week, Europe's aviation safety agency ordered inspections of the fuel hoses on several Rolls-Royce XWB-97 engines powering Airbus A350-1000 aircraft. In order to minimize any short-term disturbance and comply with the upcoming mandate, Rolls-Royce said they are actively collaborating with authorities. The stock has increased by almost 60% so far this year.

The European Central Bank is expected to lower rates and the Bank of England is expected to hold this month, while the argument centers on whether the US central bank would reduce interest rates by 25 or 50 basis points to spur growth. A survey revealed that in order to boost the economy of the country, an additional one trillion pounds in investment will be needed over the next ten years. Meanwhile, data showed that British house prices surged last month at the quickest annual pace since late 2022

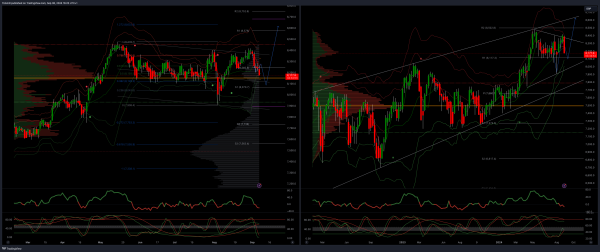

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish