The FTSE Finish Line - September 09 - 2024

The FTSE Finish Line - September 09 - 2024

FTSE Rebounds From The Early September Slump, Snapping Six Days Down

On Monday, the FTSE 100 in London experienced a rebound from six consecutive sessions of declines. This was accompanied by broader gains in travel and leisure equities, which were bolstered by an optimistic forecast from the gambling group Entain. Investors are currently anticipating critical labor market data later in the week. The blue-chip FTSE 100 is up 1.1%, while the mid-cap FTSE 250 is also in the green. Last week, the FTSE 100 experienced its most unfavorable weekly performance since October 2023.

Entain's shares experience a 4.85% increase, leading the FTSE 100 index. The H2 online net gaming revenue of the British wagering firm has surpassed expectations to date, as a result of the strong demand from punters who are capitalizing on popular sporting events, such as the European soccer championship and Wimbledon. The company also observes that its H2 online revenue in the UK and Ireland has returned to year-over-year growth earlier than expected. Entain's shares have experienced a 36% decline year-to-date, in contrast to the FTSE index's 6.5% increase.

Burberry's shares have plummeted by nearly 4% to 580.6p, marking their lowest point since January 2010. The stock is the largest percentage loser on the primary stock index in London. Barclays has downgraded the stock from "EqualWeight" to "Underweight" due to concerns regarding Burberry's capacity to preserve its high-end luxury brand status. Burberry is anticipated to report a loss in the first half of 2025, and Barclays anticipates that the luxury market in China will remain "poor for longer" as a result of structural issues. The challenging environment is anticipated to persist in the upcoming year. Barclays has also decreased Burberry's price target from 820p to 540p. The stock is rated as "hold" by the majority of brokerages, 16 out of 20, and "sell" by 4 of them. As of the most recent close, the stock has experienced a nearly 57% decline year-to-date.

Heavyweight banks advanced 1.1%, while industrial metal miners and energy assets inched 1.2% and 0.7% higher, respectively. The majority of subsectors experienced an increase in trading, with the exception of personal goods, which experienced a 0.8% decline. Burberry, which was downgraded from "equal-weight" to "underweight" by Barclays, contributed to the decline, as it lost 1.7%. A survey of UK recruiters revealed that the labor market in Britain experienced a significant cooling last month, which could potentially support the argument for interest rate reductions from the Bank of England.

This week, investors are concentrating on critical labor market data and gross domestic product figures that are not available in the country. These figures are expected to provide additional insight into the Bank of England's posture on additional interest rate cuts this year. It is widely anticipated that the British central bank will maintain rates at its meeting later this month, while the European Central Bank is anticipated to reduce rates at its meeting this week.

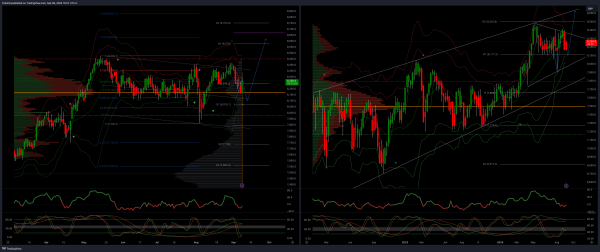

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bearish