The FTSE Finish Line - September 24 - 2024

The FTSE Finish Line - September 24 - 2024

FTSE Investors Weigh China Stimulus, As Exporters Benefit

UK equities advanced on Tuesday in line with worldwide gains, as investors welcomed new stimulus initiatives in China that boosted shares of miners and luxury-focused retailers.

The FTSE 100 benchmark index is up a modest 0.05% as early enthusiasm waned along with a pullback in US markets as consumer confidence data disappointed.

Chinese policymakers are attempting to stimulate development in the nation's faltering economy by introducing a plethora of stimulus measures, such as interest rate reduction and stock market revival initiatives. Following the statement, global equities increased, allaying some fears regarding the potential effects of a downturn in the second-largest economy in the world. Industrial miners listed in London surged 5% to a peak reached in over a month as metal prices increased due to anticipated increases in demand. Anglo American, Antofagasta, and Glencore's mining company shares increased 4.5% to 5.8%.

In single stock stories The FTSE 100 index's highest percentage loser is Smiths Group Plc, whose shares have fallen by as much as 7%. The UK engineering firm has reported a lower-than-anticipated annual profit, which was impacted by a subdued demand for its heating, ventilation, and air conditioning products and a sluggish US construction market. The headline operating profit for the full year ending July 31 is 526 million pounds ($702.4 million), which is lower than the company-compiled consensus of 535 million pounds. Smiths Group has announced that it is acquiring Modular Metal Fabricators, a company based in the United States, and Wattco, a company based in Canada, for a total of up to 110 million pounds. This acquisition is intended to enhance the company's global market presence. The stock has declined by 3% year-to-date, including the session's losses.

The Mortgage Advice Bureau's shares have increased by 10.3%, which is the largest increase among London's equities. The stock is poised to conclude a five-day losing streak. Revenue increased by 5.4%, while the financial services company reported a 31.3% increase in first-half adjusted core profit. The company reports that the initial months of 2024 have been favourable, as mortgage rates have decreased in anticipation of anticipated base rate reductions and a more stable political climate. It anticipates that the momentum will persist following the initial of several anticipated base rate reductions. Trading is consistent with expectations, according to the organisation. The stock remains down 25% this year, despite the session's gains.

Raspberry Pi shares up 8.2% at 377 pence, reports stronger-than-expected adjusted earnings of $20.9mln, up 55% compared with the proceeding year, Pi5 sold 1.1m copies in 1H, maintains full year outlook, stock 34.6% above its listing price of 280 pence.

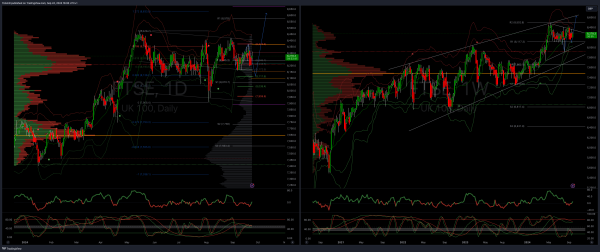

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish