The potential inflation dangers of China stimulus and geopolitics

Key points

- Chinese equities and stimulus: Chinese equities have surged 33% since September due to stimulus, but long-term growth concerns persist, with Chinese stocks underperforming globally for 14 years.

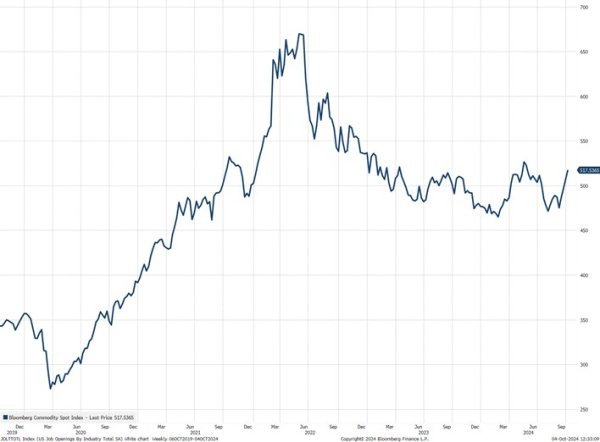

- Commodities and inflation risks: China’s stimulus and Middle East tensions are pushing up commodity prices, raising concerns about prolonged inflation and challenging expectations of U.S. rate cuts.

- Sector trends – utilities and real estate: Utilities and real estate, benefiting from interest rate sensitivity, lead the market, especially in nuclear power, which is gaining investor attention.

- Focus on AI in Q3 earnings: The upcoming Q3 earnings season will focus on AI, with technology companies' spending on AI being a key point, alongside broader investor confidence in earnings growth.

- Upcoming economic data: Key reports include U.S. inflation, Q3 earnings (PepsiCo, JPMorgan), and consumer sentiment, with inflation expectations remaining higher than market pricing.

Are China stimulus and geopolitics going to push inflation higher?

Chinese equities have gained another 10% this week pushing gains to 33% since the lows in September as the Chinese government has pulled out the stimulus bazooka. As we argued in our equity update last week there are good reasons tactically to jump on the Chinese rally, but for longer term investors there are still fundamental questions about China’s growth model that are too uncertain. As a result we are still sceptical of this Chinese rally. Investors should not forget that Chinese equities have underperformed MSCI World for 14 years now.

China’s stimulus was already bidding up commodity prices, but the events in the Middle East have added to the pressure. Biden’s comments yesterday that Israel may target Iran’s oil assets in its retaliation move lifted crude oil by 5%. The Bloomberg Commodity Spot Index is now up 10% from the lows in August and if commodities continue to surge beyond the highs from mid-May then spot commodity prices are suddenly in territory not seen since early 2023. Chinese stimulus and Middle East tensions could be the exact cocktail will cause inflation to linger for longer and prove the market’s current expectations of six US rate cuts by June next year to be too optimistic.

Utilities and real estate are the big proxy bond trades in equities

Utilities and real estate have been the two best sectors in the third quarter as investors are rotating into these two sectors as they both represent the highest sensitivity to falling interest rates. Utilities have the added benefit of being part of the AI boom through higher demand for electricity driven by AI data center construction. Within utilities we have seen an even bigger move in those US utilities with exposure to nuclear power. Constellation Energy that recently signed an agreement to refurbish and reactivate the old Three Mile nuclear power plant in a partnership with Microsoft has seen massive change in investor demand. What is odd about the move in nuclear related utility stocks is that sell-side analysts have not meaningfully lifted their expectations for revenue growth. So either investors are seeing something that analysts are not, or else a bubble like dynamic is evolving in US utilities.

Q3 earnings season is all about AI

We will only do a minor teaser of the Q3 earnings season today, so you will have to have wait for the bigger thoughts next Friday. Earnings estimates on the S&P 500 Index have continued to increase with the 12-month forward EPS estimate up 9.5% this year. With the S&P 500 Index up almost twice that this year has been a year of earnings multiple expansion indicating that investors have grown more confident about the outlook. This also aligns well with our recent risk-on outlook presented in our quarterly outlook – read our macro outlook and equity outlook for more insights.

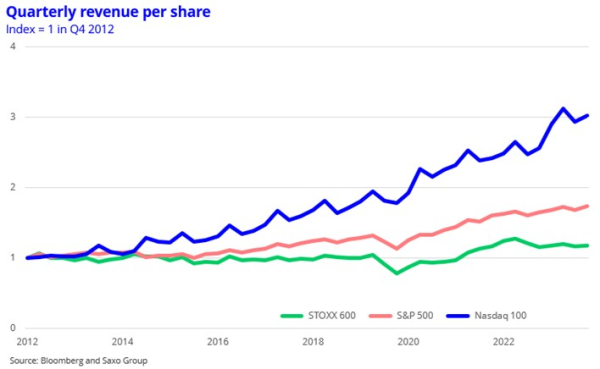

As the chart below shows, the revenue growth in the US technology sector continues to outpace that of the general market and especially Europe. This only means that this earnings season will once again be all about technology earnings and especially evolving around the AI theme. Last earnings season the AI capital expenditures theme, the question of whether Microsoft and Google can continue to spend as much as they do on AI chips, was the main reason why technology stocks started declining in July. This question will be key again in the upcoming earnings season.

The week ahead: Q3 earnings season, US inflation, and US consumer sentiment

- Earnings: The Q3 earnings season kicks off with the key earnings to watch being PepsiCo (Tue), Delta Air Lines (Thu), JPMorgan Chase (Fri), and Wells Fargo (Fri). Investors will watch the loan provisions that JPMorgan and Wells Fargo are setting aside as important signals on credit markets and then of course reading their outlook for the US economy. PepsiCo is expected to report a meagre 1.5% YoY revenue growth highlighting the continuing impact on many consumer staples categories. Another question is whether obesity drugs are beginning to impact the results of these companies including PepsiCo.

- US inflation: The US September inflation report is out Thursday and is expected unchanged core inflation at 3.2% YoY while the headline inflation figure is expected to drop to 2.3% YoY down from 2.5% YoY in August. The various core measures are the key to observe. The US services core inflation is still running at around the 4% annualised level so inflation can quickly flare up again if commodity prices continue to rise. The inflation report will also be critical for setting expectations ahead of the FOMC rate decision meeting on 7 November. The market is currently pricing one rate cut of 25 bps, but it has moved in the direction of 50 bps.

- US consumer sentiment: On Friday the US October preliminary University of Michigan consumer sentiment is being released with expectations at 70.0 vs 70.1 in September. US consumer sentiment has improved over the previous two months and significantly since the low point in June 2022 when consensus was expecting a recession to start in 2023. While the headline figure is important the sub-report on consumers’ 5-10 year inflation expectations is also interesting as consumers expect long-term inflation at 3.1% annualised which is far above market pricing at around 2.4%.

Previous weekly equity market updates

- Is China back, or what? (27 September 2024)

- The Fed’s great balancing act (13 September 2024)

- Nvidia earnings will show another quarter of explosive growth (23 August 2024)

- The big rebound in equities, Palo Alto earnings on tap (16 August 2024)

- European banks: Strong Q2 earnings as rate cuts loom (14 August 2024)

- Low recession probability, strong earnings, and US inflation (9 August 2024)

- Election drama, Tesla bounce, and earnings kick-off (5 July 2024)

- US election heats up, Alfen rout, and Micron earnings (28 June 2024)

- French election, king Nvidia, and FedEx earnings (21 June 2024)

- Tech rally, inflation surprise, and EU trade war (14 June 2024)

- AI bonanza drives new highs and dangerous index concentration (7 June 2024)

- Chinese setback, AI woes, and ECB decision (31 May 2024)

- Nvidia earnings, electrification boom, and bubbles (24 May 2024)

- New all-time high on speculative stocks comeback (17 May 2024)