The Road to a September Fed rate cut

Still, despite a refocused market, underlying concerns persist and while it would be unlikely that we see a re-run of the extreme market moves we saw last Monday, the upcoming data could still be highly influential on market sentiment and market movement.

It would not take much for increased market anxiety stemming from slower economic growth to resurface. Conversely, if the data (listed below) is better-than-expected then fears of a recession would be further pared back, with price momentum in risky assets (such as equity) building to the upside.

NAS100 daily chart

Preview

PreviewThe data will also feed into the debate around whether the Fed cut rates by 25bp or 50bp in the September FOMC meeting, and as we see the outcome of each data release the market will be able to price an outcome around the Fed meeting with increased certainty.

Do the Fed cut by 25bp or 50bp?

We don’t live in an ideal world, where all data comes in hotter or worse than expected in a linear fashion – but there will be data points that the market will place far greater emphasis on – such as the nonfarm payrolls and the CPI report.

The ultimate bull case for equity markets, and the USD, is that the upcoming US growth and labour market data points come in better-than-expected (when the consensus numbers are known). At the same time, inflation continues to moderate, in turn, putting the Fed in a less urgent position for them to cut in September by 25bp.

Should we see growth and labour market data come in not just lower than expected, but where the rate of change shows deterioration from the prior months' data – and there is no certainty that all the data points will follow this path - then this scenario sees a more urgent 50bp cut come onto the table.

The rate of inflation is more of a challenge to this playbook. It is easier for the Fed to ease by 50bp if inflation continues to offer the Fed confidence it is headed towards its 2-3% target range.

It becomes a challenge if we see a hotter-than-expected core CPI print, especially if the year-on-year rate were to lift from its current pace of 3.3%. This quasi-stagflation dynamic would make cutting 50bp problematic and would clearly negatively impact market sentiment.

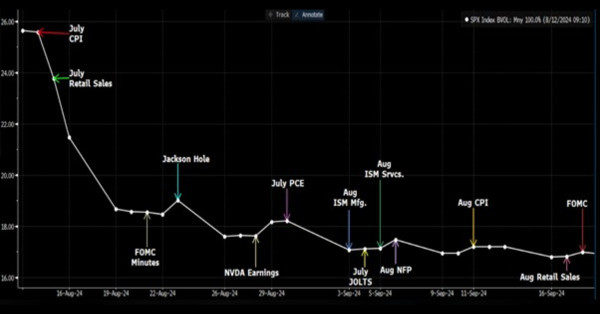

The key data points to navigate into the September FOMC meeting

Preview

PreviewIn the graphic, we breakdown the key data points seen in the US labour market, growth and inflation data, as these will go some way to influencing the Fed’s call to cut by 25bp of 50bp. Importantly, it will also feed through into the pricing of the USD, US equity, and gold.

We look ahead to US CPI, and while the Fed set policy to core PCE inflation (seen on 30 Aug), there are elements that economists can take from both the PPI and CPI basket and make a strong assumption of where PCE inflation will land.

My loose playbook for the US CPI is as follows:

Above 0.35% m/m – US interest rate swaps would reduce expectations for easing at the September FOMC meeting towards 25bp-30bp, with the USD rallying vs all G10 currencies, and the NAS100 and gold likely trading lower. The cries of ‘stagflation’ may be heard more liberally.

Between 0.2% m/m - 0.3% m/m – While the Fed has recalibrated its inflation focus to an equal consideration with the labour market, a print below 0.25% m/m may see relief buying of risk markets and modest USD selling - where the move in markets will be determined by market positioning.

Below 0.2% m/m – US interest rate swaps would likely price 40bp of cuts for the September FOMC meeting, with the USD trading lower, and NAS100 and gold seeing further relief buying.

We then look ahead to US retail sales, where the consensus is for 0.4% m/m growth and 0.1% m/m on the ‘control group’ element. Given the focus on consumption and household spending, the outcome here could be quite influential on rates pricing and market sentiment.

Chair Powell to guide the market at Jackson Hole

Next week the focus turns to the Jackson Hole Symposium, where the world’s more influential central bankers meet, and notably, we will hear from Fed chair Powell. With the US CPI and retail sales data known, we could get a strong steer on whether the Fed is leaning towards a 25bp cut – which is the current base case - or open the door to a more dramatic 50bp cut.

S&P500 implied volatility ‘term structure’

Preview

PreviewWe can look at the options market and see the implied volatility attached to expiries around each of the key event risks. Simplistically, the higher the level of implied volatility (which is expressed as an annualised standard deviation) the more demand there has been to buy options for this date. In essence, the higher the implied volatility the greater the impact on price movement that data release or central bank meeting/speech is expected to have.

The markets are data-dependent, so keep these event risks firmly on the radar, as they should have a significant bearing on sentiment and market direction.