The U.S. PCE price index 0.3% as expected, U.S. consumer spending jumped, U.S. dollar slipped, Bitcoin stalled

Previous Trading Day’s Events (29.03.2024)

In addition, consumer spending rose by the most in just over a year last month.

“Core services inflation is slowing and will likely continue throughout the year,” said Jeffrey Roach, chief economist at LPL Financial in Charlotte, North Carolina. “By the time the Fed meets in June, the data should be convincing enough for them to commence its rate normalisation process.”

Data for January was revised higher to show the PCE price index climbing 0.4% instead of 0.3% as previously reported.

In the 12 months through February, PCE inflation advanced 2.5% after increasing 2.4% in January.

Though price pressures are subsiding, the pace has slowed from the first half of last year, and inflation remains above the U.S. central bank’s 2% target. Fed Chair Jerome Powell said on Friday that February’s inflation data was “more along the lines of what we want to see.”

Policymakers anticipate three rate cuts this year. Financial markets expect the first rate reduction in June. Most U.S. financial markets were closed for the Good Friday holiday, with the exception of the foreign exchange market. The dollar slipped against a basket of currencies on the data.

Source: https://www.reuters.com/markets/us/us-inflation-increases-moderately-february-consumer-spending-surges-2024-03-29/

______________________________________________________________________

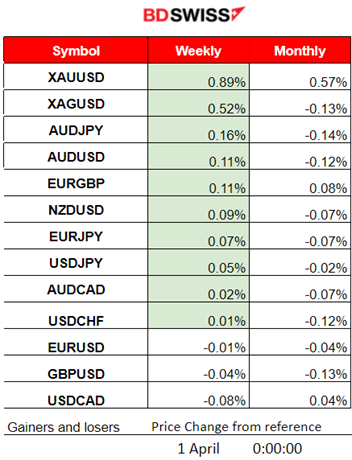

Winners vs Losers

XAUUSD moved already to the upside early gaining 0.89% so far this week. Silver follows. New month, new gains!

______________________________________________________________________

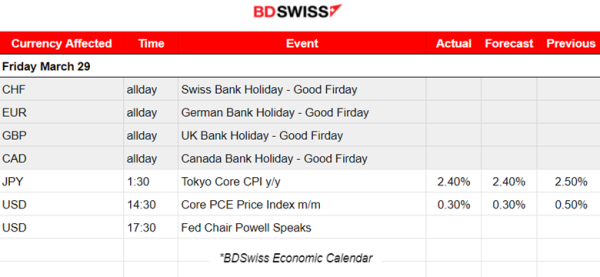

News Reports Monitor – Previous Trading Day (29.03.2024)

Server Time / Timezone EEST (UTC+02:00)

GOOD FRIDAY

- Midnight – Night Session (Asian)

Core inflation in Japan’s capital slowed in March, heightening uncertainty on how soon the Bank of Japan can raise interest rates again after exiting its radical monetary stimulus. The core consumer price index (CPI) in Tokyo, an early indicator of nationwide figures, rose 2.4 % in March from a year earlier. JPY appreciated it at that time but the effect soon faded. USDJPY dropped near 30 pips momentarily and it reversed quite soon.

- Morning – Day Session (European and N. American Session)

The core PCE price index figure was reported lower than expected at 0.3% indicating that the Fed’s preferred inflation metric actually cools despite the recent other related inflation readings that raise fears of rising prices. The Fed is still providing indications that rate cuts are coming despite inflation remaining above target. Powell says that the latest inflation data are in line with expectations. The EURUSD jumped at exactly 14:30 showing that the market reacted with U.S. dollar depreciation upon the PCE figure release.

General Verdict:

__________________________________________________________________

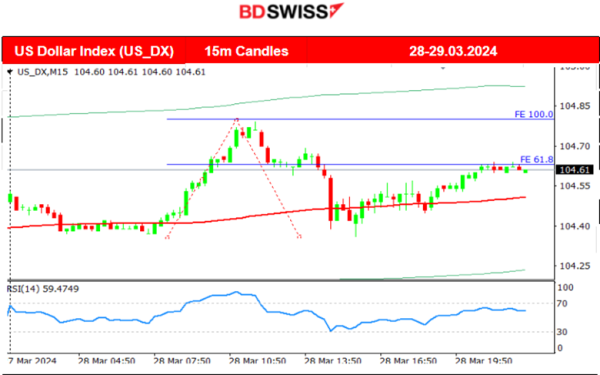

FOREX MARKETS MONITOR

EURUSD (29.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to drop early and below the 30-period MA until the start of the European session. Then the pair reversed and moved to the upside, crossing the 30-period MA on its way up. At 14:30 the pair jumped upon the PCE price index figure release and after finding resistance near 1.0803 it retraced to the MA. Is this figure enough to keep expectations for a rate cut soon in place? This would mean dollar depreciation to be in place for longer.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Since the 22nd of March, Bitcoin actually experienced a good comeback with the price moving upwards crossing the 30-period MA on its way up and showing upward momentum since the fall from the 74K USD peak.

The 68K USD level resistance was breached on the 25th of March and the price moved higher even beyond 70K USD. The 30-period MA turned sideways as the price slowed down. This week a steady upward movement took place forming a wedge until the 31st of March. On the first of April, the price broke the wedge to the downside and dropped heavily back to the support near 69K USD.

Crypto sorted by Highest Market Cap:

Volatile markets for Crypto currently without any special movement in one direction. Dogecoin is leading so far for the last 7 days with 19.4% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

S&P500 jumped to near 5270 USD on the 27th of March. This move broke the channel and it crossed the 30-period MA on its way up. 5,250 USD currently serves as a support now and its breakout might be the key to unlock a sharp drop. The market closed for the 29th of March.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 25th of March, Crude oil moved to 82.3 USD/b before retracement followed. After some consolidation period, the price moved to the downside rapidly with a reversal from the upside. This rapid downward movement boosted the probability of a retracement taking place on the 27th of March and it did as predicted in our previous analysis. The price reversed, crossing the 30-period MA on its way up and settled currently near 81.50 USD/b. On the 28th of March, we have a wedge breakout to the upside that leads the price back to 83 USD/b. The 82 USD/b was an important resistance and upon breakout, it led to the price jump. The market closed for the 29th of March.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Since the 21st of March Gold moved below the 30-period MA and remained on a downtrend until the 25th of March where it settled near the mean at 2,170 USD/oz. As predicted in our previous analysis, the breakout of the triangle caused a jump in Gold’s price to 2,200 USD/oz on the 26th of March. The intraday reversal followed and Gold settled eventually at near 2180 USD/oz. On the 27th of March Gold saw a rise again and tested the resistance at 2,200 USD/oz again. As mentioned in our previous analysis, Gold continued with the upside on the 28th of March. It experienced a great upward movement as it broke that resistance. The 2,200 USD/oz level was quite important and part of a triangle formation. Its resistance breakout led to a jump over 2,230 USD/oz. The market closed for the 29th of March.

______________________________________________________________

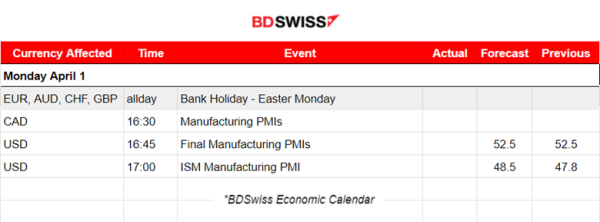

News Reports Monitor – Today Trading Day (01 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figures to be released.

- Morning – Day Session (European and N. American Session)

Manufacturing PMIs to be released today. CAD and USD pairs are expected to see more volatility than normal.

General Verdict:

______________________________________________________________