Three Reasons to Stay Bearish on Gilts After the UK Autumn Budget

Three Reasons to Stay Bearish on Gilts After the UK Autumn Budget:

- Rising Inflationary Pressure: The budget poses inflation risks, with higher wages and National Insurance costs increasing labor expenses, especially in hospitality. GBP100 billion in public investment could further drive inflation, worsen skills mismatches, and crowd out private borrowing.

- Elevated Gilt Issuance: Gilt issuance rises to GBP300 billion this year, plus GBP94.9 billion over four years, raising sustainability concerns. Careful management is needed to avoid market disruptions and negative impacts on investor sentiment and pricing.

- Fiscal Sustainability Concerns: Despite growth initiatives, the OBR's lowered post-2026 forecasts suggest limited benefits. High borrowing and tight fiscal space raise concerns about economic shock resilience and borrowing costs.

Keep reading to dive deeper and learn just how high 10-year Gilt yields could climb, along with ways to gain exposure to this trend…

Gilt yields are rising today, one day after the UK Autumn Budget, primarily because the announced budget implies a significant increase in government borrowing. Specifically, the Debt Management Office (DMO) has outlined plans for GBP300 billion in gilt issuance for 2024-25, an increase of GBP20 billion from previous estimates. This expanded borrowing requirement puts pressure on gilt prices, pushing yields higher as investors demand more return to absorb the growing supply of government debt.

Looking ahead, there are compelling reasons to anticipate that Gilt yields may continue to rise. Inflationary pressures stemming from the budget—such as higher minimum wages and increased employer National Insurance contributions—could prompt markets to expect a more cautious approach from the Bank of England concerning rate cuts. This mix of increased inflation risks and higher supply expectations is likely to exert sustained upward pressure on yields over the longer term.

Here are three key reasons why Gilt yields may continue to surge in the next few weeks:

- Rising Inflationary Pressure:

- The budget introduces significant inflationary risks. For instance, large increases in the minimum wage and employer National Insurance costs will likely raise labor costs in many sectors, particularly low-paid service industries like hospitality. This could exacerbate wage inflation and lead to higher prices in these sectors, contributing to broader services inflation.

- The planned GBP100 billion in public investment over five years, though aimed at stimulating economic growth, may further fuel inflation in the medium term. Additionally, skills mismatches could worsen, driving up wages in certain sectors. This increased public investment could crowd out private sector borrowing and put upward pressure on interest rates.

- Impact on Gilt Issuance:

- The budget necessitates higher levels of gilt issuance, amounting to GBP300 billion for the current fiscal year and an additional GBP94.9 billion spread over the next four fiscal years. This significant increase adds to concerns about the sustainability of government borrowing.

- The issuance strategy has shifted focus from short-term to medium- and long-term gilts, requiring careful management to prevent market disruptions. The DMO has planned to diversify issuance across various maturities and maintain a regular schedule of syndications and auctions, which could impact investor sentiment and the pricing of gilts.

- Slower Growth and Rising Concerns Over Fiscal Sustainability:

- While the budget aims for growth and investment, the Office for Budget Responsibility (OBR) has revised growth forecasts lower from 2026 onwards, suggesting limited long-term economic benefits from these measures. The fiscal rules, while providing a framework for stability, offer limited headroom, raising concerns about the government’s ability to respond to economic shocks without additional borrowing.

- The upward revisions in future borrowing requirements suggest sustained high levels of gilt issuance, which could increase the cost of borrowing for the government and potentially affect the broader economy.

Key Technical Levels to Watch for 10-Year Gilt Yields

Following the UK Autumn Budget, 10-year Gilt yields have broken through resistance at 4.35%, advancing to 4.43%, a level last reached during the autumn of 2023. The overall sentiment remains bearish, with yields showing potential to test the next resistance at 4.75%. If yields manage to break above this significant level—which aligns with the 2023 peak—they could extend their upward trajectory toward the 5% mark, a level not seen since before the 2008 Global Financial Crisis.

Did you know that Gilts can be shorted though the purchase of the following UCIT ETFS?

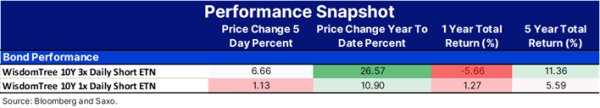

You can gain short exposure to 10-year Gilts through the WisdomTree 10Y 3x Daily Short ETN (3GIS) and the WisdomTree 10Y 1x Daily Short ETN (1GIS).

- 3GIS offers leveraged exposure, meaning it seeks to deliver three times the daily inverse performance of 10-year Gilts. This makes it suitable for short-term trading strategies, as compounding effects can lead to significant deviations from expected performance over time if held longer.

- 1GIS provides a straightforward, one-to-one inverse exposure, which is less volatile and more appropriate for longer holding periods compared to leveraged options.

Risks: Both ETNs carry risks, including the potential for significant losses, especially with the leveraged 3GIS. Daily resets mean that market volatility and compounding can lead to unexpected outcomes, so these instruments are generally best for short-term trading rather than long-term holding. Additionally, ETNs are subject to credit risk of the issuer. Always consider these factors and consult with a financial advisor if needed.

Click here to discover three practical strategies for investors to preserve capital and navigate the uncertainties of the UK bond market.

Other recent Fixed Income articles:

29-Oct Rate Cuts and Rising Yields: The BoE’s Budget Dilemma

24-Oct Prepare for the UK Autumn Budget: Top Insights and 3 Must-Consider Investment Strategies

22-Oct What the "Trump Trade" Means for Your Bond Portfolio – And How to Protect It

21-Oct Navigating the ECB's Rate-Cutting Cycle: Key Insights and 3 Smart ETF Strategies.

02-Oct Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges.

30-Sept Italian BTPs: Shining Brighter Than French OATs.

25-Sept Insights into this week's US Treasury auctions: 2-, 5-, and 7-year overview.

23-Sept Eurozone PMI Panic: What’s Next for Investors?

23-Sept Recession Red Flags: Europe’s PMIs and Yield Curve Sound the Alarm

18-Sept 4 Short-Term Bond ETFs to Maximize Returns Over Money Market Funds

18-Sept 4 Short-Term Bond ETFs to Maximize Returns Over Money Market Funds

16-Sept Bank of England Preview: Rates on Hold, but Inflation and QT Shape the Outlook

11-Sept Why U.S. Treasuries Look Expensive Ahead of the Upcoming Rate-Cutting Cycle

10-Sept Election Faceoff: Harris and Trump’s Policy Differences and What They Mean for Your Portfolio

06-Sept ECB Monetary Policy Decision Preview: A Post-Summer Balancing Act

04-Sept Stretched Valuations: Why the Bond Market's Next Move Hinges on Jobs Data

03-Sept The Reality Behind the UK’s Gilt Sales – It's Not About Confidence in the Government

02-Sept Bonding with Buffett: How the Oracle’s Stock Picks Can Boost Your Bond Portfolio

30-Aug Austria’s 2086 Bond Flop: What It Means for Ultra-Long European Debt

29-Aug Capitalizing on Fed Rate Cuts: A Guide to Emerging Market Local Currency Bonds

29-Aug Uncovering Value: The Strength of European Investment-Grade Bonds

28-Aug Insights into this week's US Treasury auctions: 2-, 5-, and 7-year overview.

22-Aug Wage Growth and Economic Resilience Challenge Market Expectations for Aggressive ECB Rate Cuts

20-Aug Understanding U.S. Treasury Auctions: What You Need to Know

19-Aug Insights into this week's US Treasury auctions: 20-year U.S. Treasury bonds and 30-year TIPS.

16-Aug No Signs of Imminent Recession: Why Bond Investors Should Approach Insurance Rate Cuts with Caution

14-Aug Markets Skeptical Despite Positive UK Inflation Report

09-Aug Yield Curve is Disinverting: Lessons from Past Crises

07-Aug Stable Bond Spreads and Robust Issuance Make a 50 bps Rate Cut in September Unlikely

06-Aug Insights into this week's US Treasury refunding: 3-, 10-, and 30-year overview.

05-Aug Why Investors Must Pay Attention: BOJ’s Hawkish Moves Could Roil Global Markets

30-July BOE Preview: Better Safe than Sorry

29-July FOMC Preview: A Data-Dependent and Balanced Approach

24-July Market Impact of Democratic vs. Republican Wins

23-July Insights into this week's US Treasury auctions: 2-, 5-, and 7-year overview.

16-July Insights into this week's US Treasury auctions: 20-year U.S. Treasury bonds and 10-year TIPS.

15-July ECB Preview: Conflicting Narratives – Rate Cuts vs. Data Dependency

15-July Understanding the "Trump Trade"

11- July Bond Update: Faster Disinflation Paves the Way for Imminent Rate Cuts, but Risks of Economic Reacceleration Remain

09-July Insights into This Week's U.S. Treasury Auctions: 3-, 10-, and 30-Year Tenor Overview and Market Dynamics.

08-July Surprise Shift in French Election Fails to Rattle Markets for Good Reasons.

04-July Market Optimism Ahead of French Elections Drives Strong Demand for Long-Term Bonds

01-July UK Election Uncertainty and Yield curve Dynamics: Why Short-Term Bonds Are the Better Bet

28-June Bond Market Update: Market Awaits First Round of French Election Voting.

26-JuneBond Market Update: Canada and Australia Inflation Data Dampen Disinflation Hopes.

30-May ECB preview: One alone is like none at all.

28-May Insights into this week's US Treasury auctions: 2-, 5-, and 7-year tenors overview.

22-May UK April’s Consumer Prices: Markets Abandon Hopes for a Linear Disinflation Path.

17-May Strong trade-weighted EUR gives ECB green light to cut rates, but bond bull rally unlikely

14-May UK labor data and Huw Pill's comments are not enough for a bond bull rally

08-May Bank of England preview: Rate cuts in mind, but patience required.

06-May Insights into this week's US Treasury refunding: 3-, 10-, and 30-year overview

02-May FOMC Meeting Takeaways: Why Inflation Risk Might Come to Bite the Fed

30-Apr FOMC preview: challenging the March dot plot.

29-Apr Bond Markets: the week ahead

25-Apr A tactical guide to the upcoming quarterly refunding announcement for bond and stock markets

22-Apr Analyzing market impacts: insights into the upcoming 5-year and 7-year US Treasury auctions.

18-Apr Italian BTPs are more attractive than German Schatz in today's macroeconomic context

16-Apr QT Tapering Looms Despite Macroeconomic Conditions: Fear of Liquidity Squeeze Drives Policy

08-Apr ECB preview: data-driven until June, Fed-dependent thereafter.

03-Apr Fixed income: Keep calm, seize the moment.

21-Mar FOMC bond takeaway: beware of ultra-long duration.

18-Mar Bank of England Preview: slight dovish shift in the MPC amid disinflationary trends.

18-Mar FOMC Preview: dot plot and quantitative tightening in focus.

12-Mar US Treasury auctions on the back of the US CPI might offer critical insights to investors.

07-Mar The Debt Management Office's Gilts Sales Matter More Than The Spring Budget.

05-Mar "Quantitative Tightening" or "Operation Twist" is coming up. What are the implications for bonds?

01-Mar The bond weekly wrap: slower than expected disinflation creates a floor for bond yields.

29-Feb ECB preview: European sovereign bond yields are likely to remain rangebound until the first rate cut.

27-Feb Defense bonds: risks and opportunities amid an uncertain geopolitical and macroeconomic environment.

23-Feb Two-year US Treasury notes offer an appealing entry point.

21-Feb Four reasons why the ECB keeps calm and cuts later.

14 Feb Higher CPI shows that rates volatility will remain elevated.

12 Feb Ultra-long sovereign issuance draws buy-the-dip demand but stakes are high.

06 Feb Technical Update - US 10-year Treasury yields resuming uptrend? US Treasury and Euro Bund futures testing key supports

05 Feb The upcoming 30-year US Treasury auction might rattle markets

30 Jan BOE preview: BoE hold unlikely to last as inflation plummets

29 Jan FOMC preview: the Fed might be on hold, but easing is inevitable.

26 Jan The ECB holds rates: is the bond rally sustainable?

18 Jan The most infamous bond trade: the Austria century bond.

16 Jan European sovereigns: inflation, stagnation and the bumpy road to rate cuts in 2024.

10 Jan US Treasuries: where do we go from here?

09 Jan Quarterly Outlook: bonds on everybody’s lips.