Treasuries rally into Fed meeting with a September cut at stake

The US Treasury market rallied in the hours before the Federal Reserve’s July announcement, buoyed by economic data that backs the case for a September interest-rate cut.

The advances sent benchmark yields tumbling on Wednesday, with two-year yields down by as much as 4 basis points to 4.32%, the lowest since February. The yield on five-year notes dropped below 4% to the lowest since February as evidence of a softening labor market cemented expectations that policymakers will start reducing US borrowing costs this year.

While central bankers led by Fed Chair Jerome Powell will likely hold rates steady as their two-day policy meeting concludes on Wednesday, traders are keen for evidence that policymakers are ready to cut rates in September. Interest-rate swaps reflect expectations for a quarter-point rate reduction at that meeting, with a slight chance for a half-point move.

“A lot is priced in already,” said Leah Traub, portfolio manager at Lord Abbett & Co. “It will be hard for the Fed and Powell to be more dovish than the market at this point.”

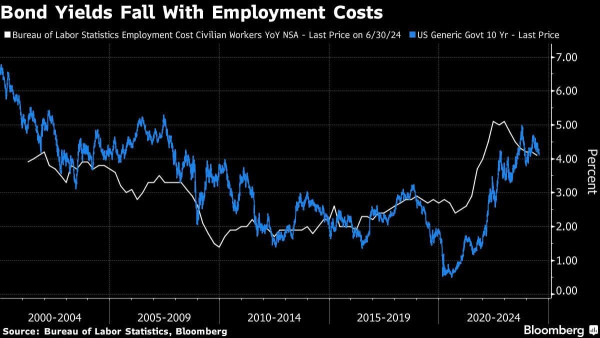

Bond yields fall with employment costs

Bond yields fall with employment costs

Economic data has been playing an outsize role in the world’s biggest bond market as traders attempt to time the start of the Fed’s easing cycle. With inflation pressures already showing signs of easing in the US, investors and Fed officials alike have shifted their focus to the job market.

Earlier on Wednesday, a private payroll report showed the US added the fewest number of workers since the start of the year. A separate government report showed a broad gauge of US labor costs increased less than forecast in the second quarter.

To Earl Davis, head of fixed income and money markets at BMO Global Asset Management, market participants are anticipating lower yields ahead when they look at the latest readings of the US labor market.

“The tone of the market is obviously bullish,” he said. “We are not going to fight that. We are heading toward the end of a business cycle. It’s better to be buyers at high yields.”

Davis said he’s overweight duration — or a measure of interest rate risk — for the first time in a year and wouldn’t be surprised to see 10-year yields fall to 3.85%. The yield on that security slipped by as much as 4 basis points to 4.1% on Wednesday.

The US government, meanwhile, said it will sell $125 billion of securities at its so-called quarterly refunding auctions next week, an amount that was widely expected by primary dealers.