UK banks brace for lower profits after 2023 success

Slowdown in earnings expected

The UK's biggest high street banks are set to report lower profits for the first quarter (Q1) of 2024, after a bumper 2023 which saw earnings peak as borrowing costs soared. Lloyds, Barclays and NatWest will be updating shareholders on their latest financial results this week, with analysts forecasting a slowdown from last year's highs.

Weaker Lloyds earnings expected as bank deals with car finance probe

Lloyds is expected to report a Q1 profit of £1.7 billion on Wednesday, a significant drop from the £2.3 billion posted a year ago. Its net interest margin, a key profitability metric, is projected to edge lower to 2.93% from 3.22% in Q1 2023.

The banking giant will also face scrutiny over its exposure to the car finance market through subsidiary Black Horse. Lloyds revealed earlier this year setting aside £450 million to cover potential costs from an Financial Conduct Authority (FCA) probe into whether customers were overcharged for car loans.

NatWest’s new CEO faces shifting customer trends ahead of expected share sale

Meanwhile, NatWest is forecasted to report an operating pre-tax profit of £1.2 billion on Friday, down from £1.8 billion last year. The bank was one of the first to see customers shift into longer-term, lower-yield savings accounts late in 2023.

The results mark a new era for NatWest under fresh leadership with CEO Paul Thwaite and Chairman Rick Haythornthwaite after the departure of former chief Alison Rose last year.

Given the government plans to conduct a public share sale in the summer, these results will be crucial to establish the outlook for the bank in the near term.

Cost-cutting rules at Barclays

Barclays is set to report a Q1 pre-tax profit of £2.2 billion on Thursday, compared to £2.6 billion a year earlier. In February, it announced £1 billion in targeted cost savings for 2024 as part of a broader £2 billion reduction plan by 2026.

The restructuring aims to cut back Barclays' investment banking operations amid a tougher market environment. Investors will eye the performance of this division, which has faced headwinds from volatile markets and economic uncertainty over the past year.

Sector outlook: shift in savings and weaker loan outlook

Overall, analysts expect the Q1 results to reflect the evolving impacts as last year's interest rate hike cycle fades. With rates now plateauing, banks face customers allocating more funds into higher-yield savings accounts instead of lower-cost deposits.

Slower loan growth, potentially rising loan delinquencies, and compressing net interest margins are also expected to weigh on profits compared to 2023's peaks. After reaping outsize benefits from soaring borrowing costs, the UK banking sector now contends with a more challenging operating landscape in 2024.

Analyst ratings for Barclays, Lloyds and NatWest

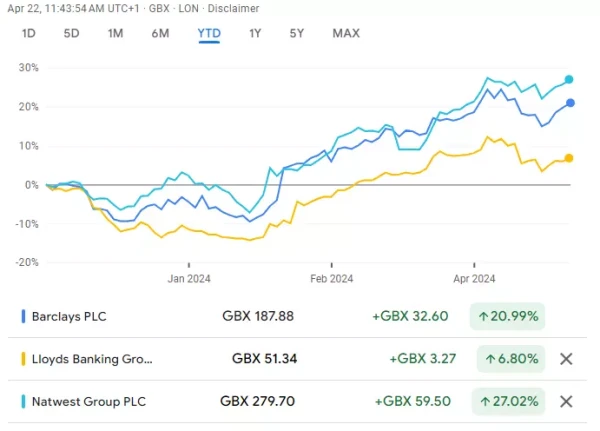

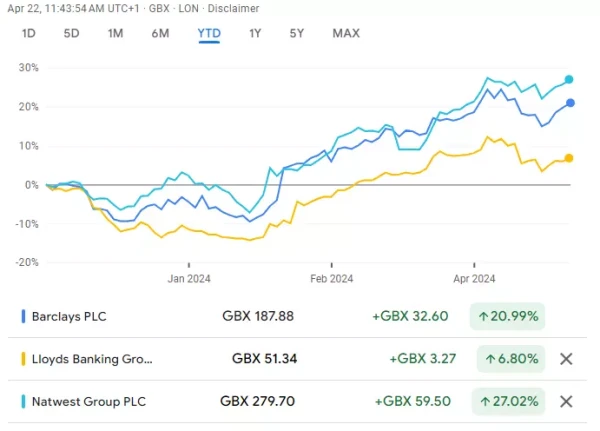

Refinitiv data shows a consensus analyst rating of ‘buy’ for Barclays PLC, Lloyds Banking Group PLC and NatWest Group PLC.

Mean of estimates for Barclays suggest a long-term price target of 250.33 pence for the share, roughly 33% higher than the current price, 59.93p for Lloyds (+17%), and 312.00p per share for Natwest, circa 12% higher than the current price (as of 22 April 2024).

With falling interest rates at first pencilled in for early summer of this year, UK bank shares began the year on a negative footing, dragging the FTSE 100 down as investors expected bank profits to decline. As rate cut expectations were pushed back to August, though, UK banks rose significantly from late-January onwards and, for now at least, remain on a positive trajectory.

Technical outlook on the Barclays share price

The Barclays share price is being supported by its February-to-April tentative uptrend line at 179.80p whilst trying to regain recently lost ground by heading towards its 193.18p February 2023 to 194.80p early-April highs. Above these beckons the minor psychological 200p mark.

Were the uptrend line to give way, though, and a fall in the Barclays share price to take it to below last week’s low at 176.24p, the 55-day simple moving average (SMA) at 170.37p may be revisited.

Far more significant support can be spotted between the April-to-September 2023 highs at 166.44p to 162.88p. While it underpins, the medium-term uptrend stays intact.

Technical analysis on the Lloyds share price

The Lloyds share price recently ran out of team around its February 2023 peak at 54.34p by topping out at 54.28p in early April. If this resistance zone were to be overcome, the January 2022 high at 56.00p would be next in line.

While last week’s low at 49.42p holds, upside pressure remains intact but a fall through this level would open the way for the December peak at 48.38p to be retested.

Further support can be found between the late May 2023 and July 2023 highs at 47.59p to 47.13p.

Technical analysis on the Natwest share price

The Natwest share price is trading in one-year highs and has the March 2023 high at 296.1p as well as the psychological 300p mark in its sights, provided that it stays above last week’s low at 267.0p.

Were last week’s low and the February-to-April uptrend line at 267.0p to give way, the mid-March high at 257.4p would be back in the picture and possibly even the August-to-October 2023 highs at 243.6p to 233.6p. This support zone also incorporates the 237.3p mid-March low.