UK CPI drops to a two-year low, pushing the FTSE 100 to a seven-month high

The FTSE 100 surged in early trading on Wednesday as the latest inflation figures showed consumer prices had risen less than expected in the last 12 months. Headline CPI came in at 3.9% year-over-year in November, the lowest level in two years. Analysts had been expecting the figure to drop to 4.3% from 4.6%. Core inflation also dropped more than expected to 5.1% from 5.7%.

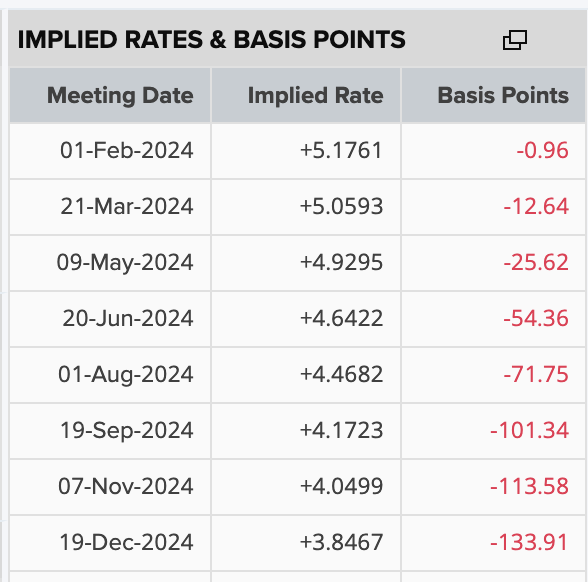

The softer data underpinned expectations for the Bank of England to start cutting rates sometime next year. As per Reuters data, before the data and the FOMC’s surprise dovish tilt last week, markets were pricing in the first cut from the BoE sometime in the third quarter of 2024. As of Wednesday morning, the first full 25bps cut is priced in for May, but there are 13bps of easing priced in by March. By year-end, markets anticipate 134bps of easing, which would entail five 25bps cuts in 2024.

Source: refinitiv

Source: refinitiv Past Performance is not a reliable indicator of future results.

This seems to contradict the messaging that came from the BoE in their meeting last week. The central bank failed to acknowledge rate cuts, going as far as to reiterate that further rate rises could be possible if needed. Markets failed to believe this, and the Federal Reserve is mostly to blame for that. Their unexpected dovish tilt opened the door for other central banks to welcome talk about easing, but neither the BoE nor the ECB took the bait. Regardless, markets see the Fed’s change in position as the turning point in monetary policy across central banks in developed economies, which means they expect the BoE to follow suit sooner or later.

The BoE’s reluctance to show a dovish inclination at their meeting on Thursday last week weighed on UK stocks, especially those most sensitive to rates. The FTSE 100 shed over 1% as the central bank remained firm in its hawkish stance, but Wednesday’s softer CPI data has pushed the index to a seven-month high.

FTSE 100 daily chart

Source: tradingview

Source: tradingview Past Performance is not a reliable indicator of future results.

Meanwhile, the British Pound has slumped back against the Dollar. Unlike with stocks, or currency pairs, most of the momentum driving them comes from rate differentials. Essentially, when markets perceive each central bank will start cutting rates and how it compares to others. The currency of the central bank that is expected to cut rates later could be favoured given the positive carry trade. For GBP/USD, the perception that the BoE may cut rates sooner than expected has weighed on the pair, even as the Fed’s cutting schedule has also been brought forward since last week’s meeting.

The chart shows a pattern of lower highs which is generally a bearish setup. That said, the RSI is holding above the midline suggesting further support could appear before the pair drops below 1.26.

GBP/USD daily chart

Source: tradingview

Source: tradingview Past Performance is not a reliable indicator of future results.