US banks 3Q earnings preview: What to expect

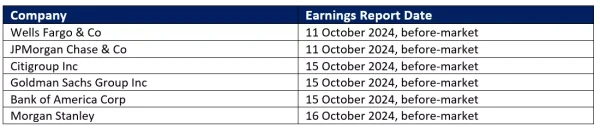

US bank stocks: Earnings schedule

The 3Q 2024 earnings parade will kick off with the major US banks, starting 11 October 2024, with JPMorgan and Wells Fargo leading the pack.

Year-to-date, the financial sector (SPDR Financial Select Sector exchange traded fund (ETF)) is the fourth best-performing sector, up 19.4% versus the broader S&P 500’s 20.4%. It is outperformed by the utilities (+28.5%), communication services (+28.4%) and technology (+26.2%) sectors.

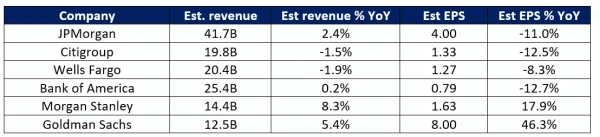

For 3Q 2024, expectations are for JPMorgan’s revenue to edge higher year-on-year (YoY) by 2.4% to US$41.7 billion. Earnings per share (EPS) is expected to be down 11% YoY.

In 2Q 2024, JPMorgan saw a 52% surge in investment banking fees YoY and a 21% jump in equities trading revenue. However, this is weighed against a higher-than-expected build-up in credit loss provisions ($3.05B versus $2.78B est), which reflects more caution around the US economic outlook. JPMorgan’s share price closed 1.2% lower on results day.

Banks’ net interest income projected to contract over coming quarters

General expectations are for the US banks’ earnings to contract over subsequent quarters, as the kickstart of the Federal Reserve (Fed)’s rate-cutting cycle could weigh on the banks’ net interest income (NII). Growth in net interest income has already been softening for four straight quarters.

A quicker reset in deposit costs compared to loan rates may offer some cushion to NII in the near term, along with a potential improvement in loan growth on lower interest rates. However, more evidence for a recovery in lending demand remains to be seen.

Previous quarter’s results revealed just a mere 2% growth in overall loan balances, with consumer loans softening for the second straight quarter. Traders will be watching for any significant pick-up in loan demand to be assured that the bank’s net interest income will come off at a more gradual pace.

Credit loss provisions to offer more clues on health of US economy

In the previous reporting quarter, a higher-than-expected build-up in JPMorgan’s credit loss provisions has given markets an economic scare ($3.05B versus $2.78B est). The stronger build-up in safety net seems to suggest that the bank may be expecting more loan defaults ahead.

Another higher-than-expected build-up (est $2.91B) could once again suggest that JPMorgan may be expecting more rough patches in the US economy. Any guidance from management will be on the lookout, with key focus on whether JPMorgan CFO Jeremy Barnum will maintain his previous view for “quite a healthy consumer” backdrop and a US soft landing.

Recovery in investment and banking activities to continue

Prevailing risk-on environment in Wall Street may continue to uplift investment activities, especially on the advisory side. The previous reporting quarter saw a 52% surge YoY in JPMorgan’s investment banking fees to $2.3B, exceeding estimates by a significant $300-million margin.

Momentum may be expected to continue in this aspect, which could drive some resilience in terms of non-interest earnings. But with the giant share of the banks’ income still revolving around NII, sentiments will remain highly sensitive to any guidance on how interest rate cuts may impact this portion ahead.

Technical analysis – JPMorgan’s share price retesting crucial support confluence

JPMorgan’s share price has been struggling lately, with the formation of a lower high displayed over the past week as an indication of some exhaustion from buyers. A crucial support confluence, where an upward trendline stands alongside its daily Ichimoku Cloud, is currently being tested at the US$204.39 level. Since September 2023, share price has managed to bounce off its daily Ichimoku Cloud on at least four occasions.

Any failure for the support confluence to hold could call for a retracement towards the US$191-US$195 range, where its 200-day moving average (MA) stands. On the upside, we may have to see a move in share price back above its US$212.95 level to signal buyers taking on greater control.