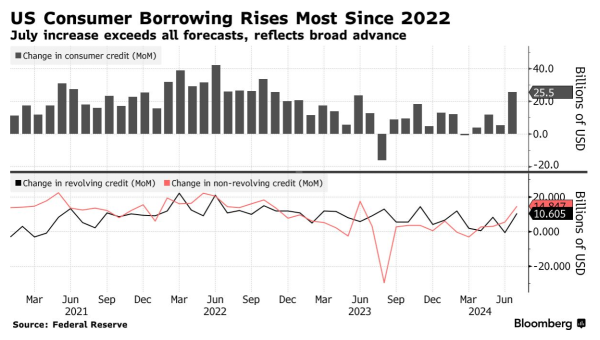

🗽US Consumer borrowing rising at record pace since late 2022💵What's next for TNOTE?

According to Federal Reserve data released yesterday (Monday, Sept. 9), the total amount of outstanding consumer loans in the U.S. rose by $25.5 billion in July compared to June. The result exceeded all forecasts by Bloomberg analysts and turned out to be the highest since late 2022. Expectations suggested an increase of $2 billion, up from the previous reading of $8.93 billion (revised downward, to $5.23 billion). Total U.S. consumer loans rose 6% year-on-year in July to $5.093 billion.

- The share of outstanding auto loans, delinquent at least 30 days, was the highest since 2010. The share of new credit card defaults rose to 9.05%, the new highest level in nearly 12 years.

- Revolving debt, including credit cards, rose month-on-month by $10.6 billion; this was the highest reading in five months. Non-renewable loans (vehicle loans/student loans), rose by $14.8 billion in more than a year.

- The recent increase in debt contributed to the largest increase in retail sales since early 2023. This mainly included an increase in vehicle purchases.

A rising percentage of outstanding credit card loans and demand for high-interest debt, along with the near multi-year lows in the savings rate of U.S. households, could mean increasing pressure to reduce consumer spending momentum. Also, the Fed's interest rates, while likely to fall starting in September, will take many quarters before they begin to have a significant impact on Americans' household budgets, which were first 'hit' by high inflation and now, with the savings rate falling, are likely to begin to weigh on interest rates. Currently, the percentage of consumers in default is still relatively low at 3.2% (New York Fed report from August), but baseline projections suggest an increase from these levels.

TNOTE (W1)

US 10-year bond futures have risen recently, from levels not seen since 2005; a return above 120 would provide medium-term confirmation of a change in trend. Currently, yields on 10-year U.S. Treasury bonds are at 3.71%; naturally, their decline has favored TNOTE's gains; further 'recessionary' concerns around the economy's momentum overseas, along with the start of a monetary easing cycle, could provide more fuel for bulls, while surprises on the inflation side, more robust data and a possible rebound in oil prices from currently oversold levels could put renewed downward pressure.

Source: xStation5

Source: Federal Reserve, Bloomberg Finance L.P.