US Dollar Faces Selling Pressure Amid Soft US PPI, Fed Speculation

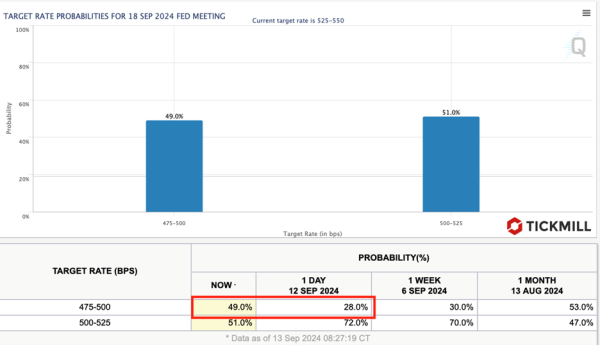

The US Dollar is under considerable selling pressure on Friday, driven by the soft US Producer Price Index (PPI) data and heightened expectations of a Federal Reserve pivot. The PPI data, which came in lower than expected, signaled that inflationary pressures are subsiding. This has led to increased speculation that the Fed could reduce interest rates by 50 basis points at its next policy meeting. According to the interest rate derivatives, the probability of such a move has surged to 49%, up from just 28% prior to the data release:

This shift in market sentiment is significant for the forex markets. A dovish Fed could send the US Dollar into further decline, boosting risk assets like equities and high-beta currencies such as the Euro and Pound Sterling. Historically, when the Fed takes an aggressive stance on policy normalization, it tends to improve risk sentiment and drive flows into riskier assets, which could support continued strength in the Euro.

However, it’s worth noting that the Fed’s decision is far from set in stone. With inflation still above target and the US economy proving resilient in many areas, a more measured approach could prevail. If the Fed opts for a smaller rate cut or holds rates steady, the Dollar could regain some lost ground, especially if the Eurozone’s economic outlook continues to deteriorate.

The European Central Bank’s recent decision to cut its Rate on Deposit Facility by 25 basis points to 3.50%, though widely expected, sends a clear message about the Eurozone's fragile economic environment. However, the lack of a pre-defined interest rate cut path in the ECB’s forward guidance was a significant point for market participants. ECB President Christine Lagarde emphasized a data-driven approach, signaling that future rate decisions will depend on the evolution of inflation and other key indicators.

This nuanced stance could be a double-edged sword for the Euro. On one hand, the absence of a definitive easing cycle gives the ECB flexibility, allowing it to respond to economic changes without being locked into a path of continual rate cuts. This has boosted the Euro, as markets perceive that the ECB is not in a rush to continue aggressive easing. On the other hand, the Eurozone economy continues to struggle with weak demand and slowing industrial production, which poses a downside risk to the Euro in the long term.

Market participants are expecting one more rate cut before year-end as price pressures are anticipated to ease further. ECB policymaker Joachin Nagel’s comments on declining wage growth and improving core inflation add weight to this outlook. However, if economic data continues to disappoint, the ECB could find itself under pressure to cut rates more aggressively, which may weaken the Euro in the future.

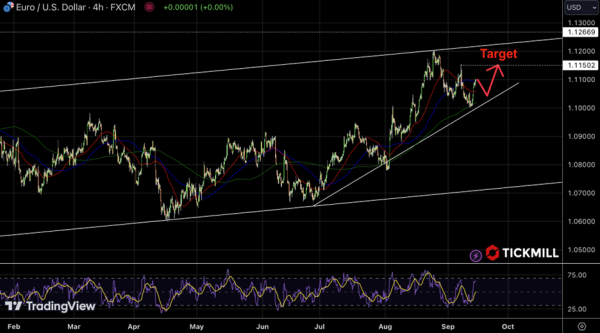

For the EUR/USD pair, the key level to watch is 1.1150. A sustained break above this level could signal further upside, especially if the Fed continues to pivot towards rate cuts. However, any signs of economic weakness in the Eurozone or a hawkish surprise from the Fed could trigger a reversal: