US earnings scorecard: Strong revenue growth will support equities

Key points

- Tesla faces challenges: Tesla experienced significant pressure with a 53% drop in EPS and a 9% decline in revenue year-over-year, highlighting issues with falling demand and increased competition.

- Strong growth in AI: Alphabet and Microsoft reported robust growth driven by AI demand in the cloud, with Alphabet announcing its first dividend and a $70 billion share repurchase.

- Mixed results across sectors: While tech companies like Alphabet and Microsoft showed strong growth, other sectors had mixed results, with companies like Caterpillar and Exxon Mobil facing challenges, reflecting broader economic conditions. Overall, Q1 results have been to the positive side.

Takeaways from technology earnings this next week

This week delivered the first batch of technology earnings from Tesla (can we even call technology any longer?), Meta, Alphabet, and Microsoft. From the physical worlds we also got results from Caterpillar, Exxon Mobil, and Chevron. Below are our key takeaways:

- Tesla is an EV maker under immense pressure from falling demand and intense competition forcing pricing and margin compression. Tesla is the one US large cap company that missed estimates the most with EPS falling 53% YoY and revenue declining 9% YoY. Read our take on Tesla Q1 result.

- Meta was punished for increasing the lower end of its capital expenditures guidance for 2024 and guiding Q2 revenue a bit to the weak side relative to estimates. In our view, the negative reaction from investors is overblown and Meta is still high quality compounding company.

- Alphabet and Microsoft both showed last night strong growth due to demand for AI workloads in the cloud. Alphabet grew revenue by 15% YoY and earnings by 57% YoY while Microsoft grew revenue by 17% YoY and earnings by 21% YoY. Microsoft is guiding strong Azure growth of 30-31% YoY in the current quarter suggesting demand is not tapering off anytime soon for AI workloads. Alphabet is firing on all cylinders across all business lines and rewarded investors with $70bn in additional share repurchases and announced its first dividend ever of $0.20 per share.

- Caterpillar was punished for its Q1 results despite better-than-expected earnings as the guidance for Q2 of zero growth compared to last year disappointed investors. The machinery equipment maker said Europe’s economy to continue being weak and Asia-Pacific ex China is slowing. From a macro perspective this is not a good sign.

- Exxon Mobil and Chevron have both reported Q1 results today showing a decline in both revenue and profits. Exxon is surprising positively on revenue but missing on earnings per share which is seen in pre-market trading as a disappointment. Exxon also expects its Pioneer acquisition to be approved in Q2. Chevron is surprising negatively on revenue while surprising positively on earnings. Chevron is showing strong oil-production growth and still has one of the best capital return yields (buybacks + dividends) in the energy sector.

Strong revenue growth and upside surprises bode well for equities

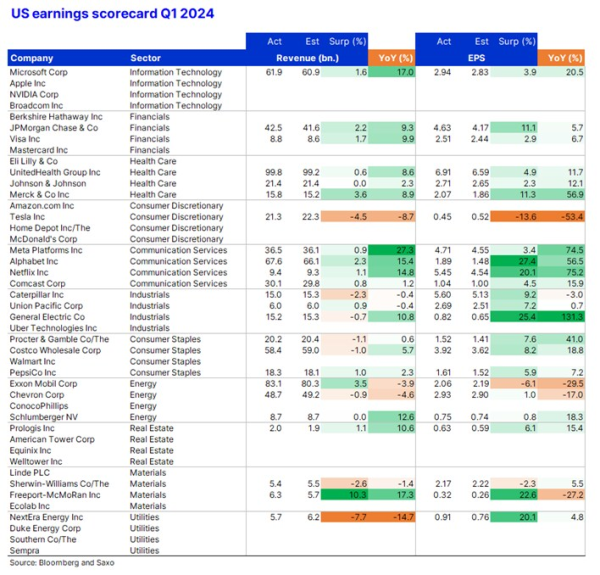

Our US earnings scorecard for Q1 2024 shows the Q1 results so far from the largest US companies in each sector. The average revenue growth among those that have reported is 6% YoY and the average EPS growth is 19% YoY. There is nothing in the Q1 earnings so far that makes us negative on US equities from an execution and outlook perspective. The issue with US equities is valuation which is higher compared to European equities which makes the latter more interesting despite a lower future growth potential.

As the scorecard shows the three biggest revenue and earnings surprises have been:

- Absolute revenue surprises: NextEra Energy (-7.7%), Tesla (-4.5%), and Merck (+3.6%)

- Absolute earnings surprises: Alphabet (+27.4%), General Electric (+25.4%), Freeport-McMoRan (+22.6%)

Earnings estimates are rising rapidly reflecting 12% earnings growth

The robust underlying growth in the US economy that we expect will continue throughout the rest of the year is supporting revenue and earnings growth among companies. Sell-side analysts have consistently increased their earnings estimates this year with the 12-month forward EPS estimate on S&P 500 now at $250 per share compared to the actual 12-month EPS of $223 reflecting expected 12% earnings growth over the next year. The forward estimate on earnings means that the S&P 500 is valued at 20.2x forward earnings.