US inflation preview: The trend is your friend

What: US August inflation report

When: 12:30 GMT (14:30 CET) on Wednesday, 11 September 2024

Expectation: Headline CPI YoY 2.5% vs 2.9% (July) and Core CPI YoY 3.2% vs 3.2% (July).

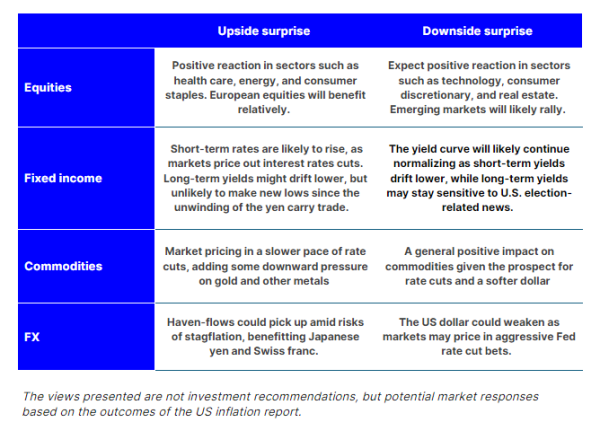

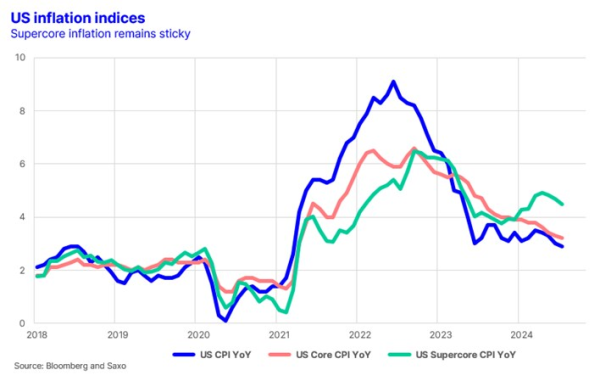

How will the market likely react? As the Federal Reserve shifts focus from inflation to the labour market and prepares for an interest rate cut next week, US inflation remains above the Fed’s target, with headline inflation at 2.9% YoY and core inflation at 3.2% YoY as of July. While headline inflation is expected to drop to 2.5% in August, core inflation is expected to stay steady, suggesting persistent inflationary pressures. For the Fed, the current downward trend in all inflation measures (see chart below) is their friend and combined with a less tight labour market, the Fed will conclude that it is time to begin the rate cutting cycle on their next rate decision meeting on 18 September.

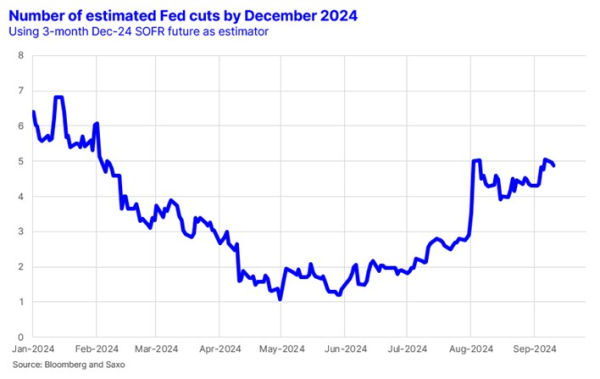

A downside surprise could lead to a more aggressive 50 basis point rate cut in September, prompting markets to expect larger cuts in the future. However, stubbornly high inflation or a rebound could dampen expectations for future rate cuts, especially with the upcoming election and potential fiscal spending increases. This could increase market volatility and raise concerns of stagflation, posing broader risks to financial markets. While a downside surprise may in the short-term be interpreted as risk-on it may indicate another sign of the economy slowing down and thus extending the rotation we are seeing in equity markets into defensive sectors.