US Open: Bullish Friday following banks' Q3 results

After yesterday's stagnation, US equities have entered Friday on an upbeat note. S&P500 trades 0.4% higher, Dow Jones rebounds 0.6%, small-cap Russell 2000 adds 0.75%, whilst Nasdaq has quickly escaped the red, gaining 0.08% at the moment.

The premarket trading was dominated by large-scale banks who revealed their Q3 2024 results, showing robust performance despite initial worries (like in the case of JPMorgan Chase) and aggressive interest rate cut in September. The slightly higher-than-expected PPI reading has been well absorbed by the market, without driving the volatility. In fact, the Volatility Index continues its decline, losing almost 2.3% after opening.

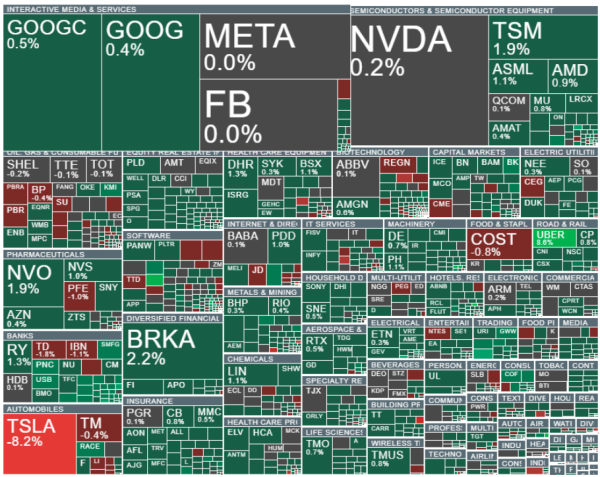

Volatility currently observed on the US’ stock market. Source: xStation5

The contracts for S&P500 reach new highs after rebounding upon hitting 23.6 Fibonnaci level. The EMAs remain in the bullish pattern, with the index trading above 20- and 50-period averages (light and dark purple respectively). RSI knocks at the door of the overbought area, signaling a potential interest for the bears. Source: xStation5

Corporate news:

Tesla (TSL.US): electric automaker shares drop XX% after Cybercab robotaxi reveal missed the mark and lacked in significant details. Musk aims at launching the self-driving vehicle by 2027 at the $30,000 price point. The analysts underline that the event didn’t deliver any potentially attractive prospects for the near-term, but rather focused on the vision around Tesla’s AI and autonomous vehicles ambitions.

BlackRock (BLK.US): world’s largest asset manager’s shares gain XX% at the opening, following better-than-expected Q3 2024 results and record level of assets under management. BlackRock’s net revenues outperformed the market consensus in almost every segment, with long-term inflows and equity net inflows being at the top of the game. Return on equity increased to 13%, drawing further attention to the company's ability to grow its assets across various segments.

- Assets under management: $11.48 trillion vs $11.19 trillion expected (+26% YoY)

- Total net inflows: $221.18 billion vs $127.2 billion expected

- Long-term inflows: $160.17 billion vs $100.02 billion expected

- Adjusted EPS: $11.46 vs $10.40 expected (+5% YoY)

- Revenue: $5.20 billion vs $5.0 billion expected (+15% YoY)

BNY Mellon (BK.US): according to its Q3 2024 earning report, Bank of New York Mellon has become the first bank in history to surpass $50 trillion in assets under custody and administration. The bank's investment services fees rose 5% to $2.34 billion, while income from foreign exchange jumped 14% to $175 million, among other better-than-expected metrics.

- Assets under custody and/or administration: $52.1 trillion vs $51.08 trillion expected

- Assets under management: $2.14 trillion vs $2.08 trillion expected

- Adjusted EPS: $1.52 vs $1.42 expected

- Revenue: $4.65 billion vs $4.55 billion expected

- Net interest revenue: $1.05 billion vs $1 billion expected

Wells Fargo (WFC.US): the bank has underperformed with regards to analyst’s estimates, with profits declining significantly due to subdued loan demand and higher payments to depositors. Wells Fargo’s interest income is expected to continue its decline throughout the rest of 2024, following Fed’s recents interest rate cut. Nevertheless, better-than-expected EPS allows further gains on the company's shares.

- Net income: $5.11 billion vs $5.78 billion year before

- Net interest income: $11.69 billion vs $11.88 billion expected (-11% YoY)

- Revenue: $20.37 billion vs $20.41 billion expected

- EPS: $1.42 vs 1.28 expected and $1.48 year before

- Total average loans: $910.3 billion

- Total average deposits: $1.34 trillion vs $1.35 trillion expected

JPMorgan Chase (JPM.US): despite preparing for higher loan losses, the largest U.S bank by assets outperformed the market expectations, as per strong Q3 2024 results. Worth noting metrics driving bank’s success are growth in investment banking fees by 31% and higher-than-expected total assets under management ($3.90 trillion)

- Managed net interest income: $23.53 billion vs $22.8 billion expected

- Adjusted revenue: $43.32 billion vs $41.9 billion expected

- EPS: $4.37 vs $3.98 expected

- Net income: $12.9 billion vs $12.1 billion expected (-2% YoY)

- Total loans: $1.34 trillion vs $1.33 trillion expected

- Total deposits: $2.43 trillion vs $2.4 trillion expected