US OPEN: bulls try to regain control after lower opening 🟢

- US500 and US100 are slightly gaining at the start of the session

- US2000 is trading lower

- 10-year bond yields are rising above 4.00%

- The dollar index is trading flat

The beginning of the session on the US stock market is not marked by volatility. Indices open without a clear direction, with slight gains observed in US500 and US100, while US2000 is down. Uncertainty in the stock market is also affected by the continued rebound in the dollar and the rise in 10-year bond yields, which are again higher than 2-year bond yields. Despite the sluggish opening, the bulls are attempting to take control and push the prices slightly upwards.

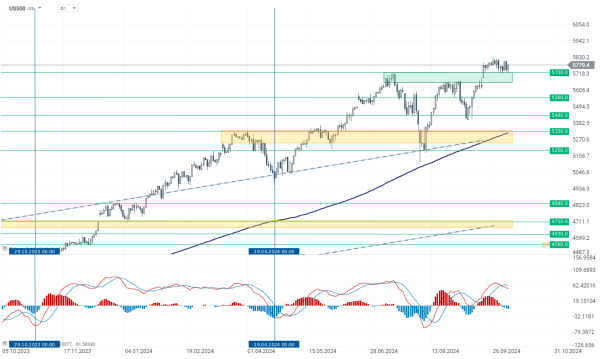

US500

The index is gaining +0.45% at the time of publication, increasing from the opening rise of +0.25%. The price of the index remains above the key support zone around 5730 points, which is currently the most important support line for the bulls. The nearest resistance to break remains at 5800 points, near the historical all-time high on US500.

Source: xStation 5

Company news

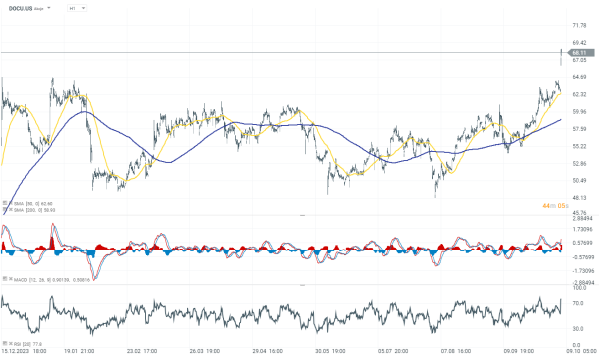

Supermicro (SMCI.US) introduced a new 3U Edge AI server capable of supporting up to 18 GPUs and featuring dual Intel Xeon 6900 series processors. Despite this launch, Supermicro's stock dropped 4.30% in early Tuesday trading. The new system is designed for low-latency AI inference tasks, particularly for LLM-based applications on-premises. This release follows Monday's announcement of deploying over 100,000 GPUs with liquid cooling systems.

JPMorgan Chase CEO Jamie Dimon emphasized that midsize U.S. banks should be allowed to merge if their boards see value, without excessive government involvement. He remains cautious about the economy, noting that achieving a "soft landing" is difficult. Dimon acknowledged that while the Fed's recent 50 basis-point rate cut is fine in the short term, long-term inflationary pressures remain due to factors like the federal deficit and geopolitical instability. He expects interest rates to stay high or even rise slightly, and reiterated the need for a strong military and economy amidst global uncertainties.

DocuSign Inc. (DOCU.US) jumped over 8.40% after the news that the stock will be added to the S&P MidCap 400 before the market opens on October 11. DocuSign will replace MDU Resources Group Inc. (MDU.US) in the index, while MDU Resources will move to the S&P SmallCap 600, replacing Chuy's Holdings Inc. (CHUY).