US Open: EURUSD erases losses after strong ADP; US2000 gains 0.70%🔔

- Indices open flat, except for US2000.

- EUR/USD erases losses following ADP release and is even gaining now.

- Super Micro Computer (SMC.US) falls 25%.

- Yields on 10-year bonds are down, while 2-year yields are up.

There’s a lot happening in the U.S. market today. Before the cash session opened, we saw several important data releases, including the ADP labor report and the preliminary Q3 GDP reading. Right after the session opened, a new home sales report was also released. Adding to the macroeconomic landscape are the ongoing earnings season and the turbulence around Super Micro Computer (SMC.US).

At the start of the session, US2000 is leading the gains, up 1.10% (currently +0.70%), driven by strong macroeconomic data. Small-cap companies are more sensitive to Fed monetary policy and macroeconomic shifts. Therefore, positive data—such as solid GDP and ADP reports that lower the risk of a U.S. economic slowdown—have a favorable impact on US2000. US500 is trading around its opening level, down just 0.05% at 5,880 points, while US100 is down 0.40%, trading at 20,660 points.

US2000 (D1 Interval)

Currently, the index is up 1.10% (currently +0.70%), reaching 2,276 points and approaching the upper limit of the consolidation channel. For some time now, US2000 has been trying to break above the 2,300-point barrier. On the downside, the key support zone remains at 2,200 points. A strong macroeconomic environment and a dovish Fed stance will definitely support the bulls.

Company News

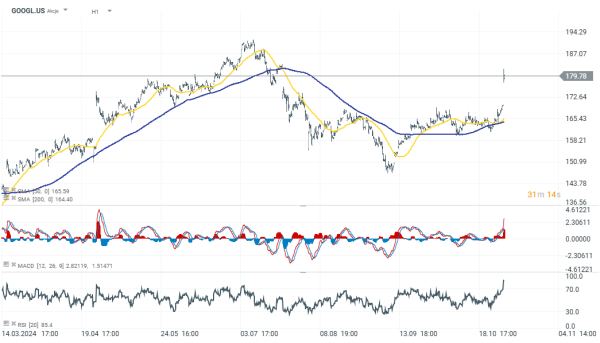

Alphabet (GOOGL.US) gains 5.60% as the company exceeded Q3 expectations, with Google Search and YouTube Ads both increasing revenue by 12%, reaching $49.4B and $8.92B, respectively. Although Google Network slightly declined to $7.55B, total ad revenue grew 10% year-over-year. Other areas also performed well, with subscriptions, platforms, and devices up 28% to $10.7B, and Google Cloud growing 35% to $11.35B.

Snap (SNAP.US) increased by 15% after surpassing Q3 expectations with a 15% revenue increase to $1.37B, driven by a 9% rise in daily active users to 443M. Snapchat+ subscribers doubled to 12M, and Spotlight users reached 500M monthly. For Q4, Snap forecasts revenue between $1.51B and $1.56B and adjusted EBITDA between $210M and $260M, though rising stock-based compensation may impact full-year guidance by 4-5%.

Reddit (RDDT) surged 34% after its Q3 revenue grew 68% year-over-year, driven by a 47% increase in daily active users. The company’s Q4 revenue outlook of $385M to $400M, alongside an adjusted EBITDA forecast of $110M to $125M, well exceeded the consensus, reflecting Reddit's rising user engagement and popularity.

Advanced Micro Devices (AMD.US) dropped nearly 8.80% as its Q3 earnings and Q4 guidance slightly missed expectations. While revenue rose 18% year-over-year, with data center sales up 122% and PC processor sales up 29%, gaming and embedded segments saw declines of 69% and 25%, respectively. Q4 revenue guidance of $7.2B to $7.8B was below the consensus midpoint of $7.55B.

Eli Lilly (LLY.US) fell 12.50% due to weaker-than-expected Q3 results, as GLP-1 weight loss drugs Mounjaro and Zepbound missed forecasts, despite 20% year-over-year revenue growth. The company revised its 2024 guidance down, with adjusted EPS now expected between $13.02 and $13.52, missing the $13.45 consensus, and revenue between $45.4B and $46B, slightly under market expectations.

Super Micro Computer (SMCI.US) plunged nearly 28% after its auditor, Ernst & Young, resigned amid concerns initially raised by Hindenburg Research. The company, while disputing the decision, has initiated an internal review and is looking for a new auditor, though it maintains that FY2024 results will not be materially affected.

The Kraft Heinz Company (KHC.US) fell by 3.50% following mixed Q3 results and a 2.9% sales decrease. The company expects 2024 organic sales growth to reach the lower end of its -2% to 0% guidance, with full-year adjusted EPS also forecasted at the low end of $3.01 to $3.07, versus a $3.02 consensus.