US Open: indices extend euphoric gains following dovish Fed decision 🎯

- US500 Hits New All-Time High

- The Small-Cap Index Gains the Most

- The Dollar Consolidates, Halting Further Declines

- Two-Year Bond Yields Drop

Indices on Wall Street opened higher, following gains in the futures market. Contracts (US500) on the S&P 500 index hit new highs above 5700 points, gaining 2.50% today. Investors' risk appetite is clearly fueled by yesterday's Fed decision and the subsequent conference with Chairman Jerome Powell.

The decision to cut interest rates by 50 basis points was dovish and unexpected by most analysts. However, the market positively assessed the Fed's intentions. The gains in the stock market can be attributed to the exceptionally optimistic stance of the Fed and assurances of the strength of the U.S. economy. The decision to cut rates more aggressively essentially signals victory over inflation. Presenting it differently could have implied an admission of past communication errors. Despite the stock market and cryptocurrency gains, the dollar is reluctant to lose value, indicating that this decision may have already been priced in. Currently, we are witnessing more euphoric gains in the stock market.

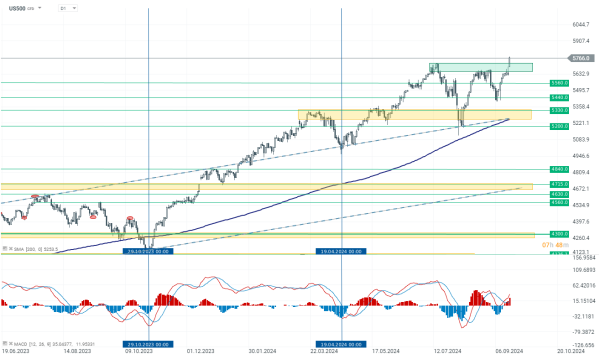

US500 (D1 Interval)

The US500 index is dynamically breaking above the last resistance zone at just below 5700 points. It can be said that the price remained in consolidation over the past three summer months. Although the bulls are currently in full control, retesting the 5700-point level cannot be ruled out. The nearest targets for the current gains could be psychological round levels like 5800, 5900, and 6000 points.

Source: xStation 5

Company News

NIO (NIO.US) gains 2.00% after starting deliveries of its new ES8 electric SUV in Europe. The ES8, based on NIO's NT 2.0 platform, is the sixth model available in the European market. Despite potential tariffs on Chinese EVs, NIO continues its European expansion, leveraging competitive pricing and EU Commission cooperation to maintain profitability in the region.

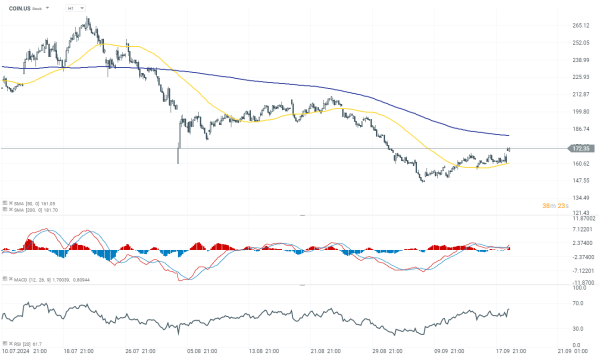

Cryptocurrency-related Companies surged in response to Bitcoin's over 4% rise to around $62,000. Significant gainers included Coinbase (COIN.US +6.3%), Riot Platforms (RIOT.US +2.4%), Marathon Digital (MARA.US +3.6%) and CleanSpark (CLSK.US +4.3%).

Plug Power (PLUG.US) stock gains nearly 2.30% after securing a 25 MW order for PEM electrolyzer systems from BP and Iberdrola’s joint venture in Spain. The project aims to decarbonize the Castellon refinery by producing green hydrogen, replacing gray hydrogen, and reducing CO2 emissions by 23,000 tons annually. The project may expand to 2 GW of electrolysis capacity.