US Open: indices struggle for direction on the opening, small-cap stocks lead gains 🟢

- US500 gains 0.10%

- US2000 gains 1.30% to 2,300 points

- The dollar remains strong

- Morgan Stanley gains 7% at the open after quarterly results

At the start of the U.S. cash session, indices are opening without a clear direction, except for the US2000 index (Russell 2000). The positive sentiment among small-cap companies can be attributed to investors' growing confidence in a "soft landing" scenario—returning interest rates to lower levels without triggering an economic recession. Additionally, the sentiment is bolstered by very strong quarterly results from Morgan Stanley, which is up over 7% at the opening of the cash session.

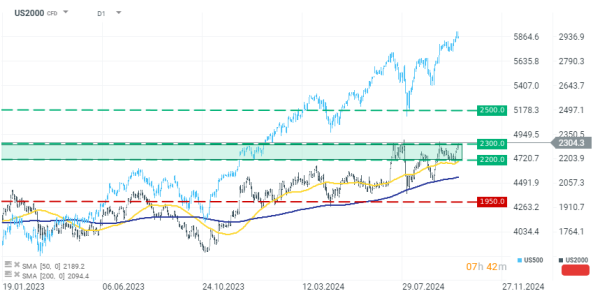

US2000

At the time of publication, the index is already up 1.40% to 2,300 points. This is a major resistance level and the upper boundary of the consolidation channel. These levels have been tested three times since July 2024, and each time we observed a return to declines and a deeper correction. If the bulls manage to permanently break through the 2,300-point zone this time, we can expect a continuation of the upward trend.

Source: xStation 5

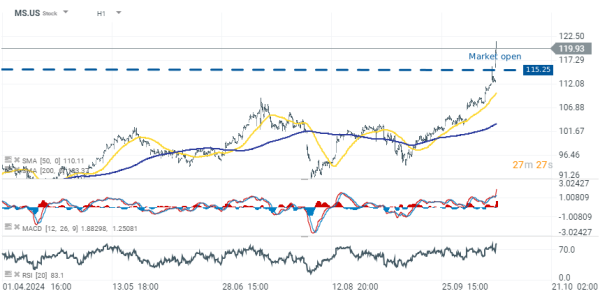

Company News

Morgan Stanley (MS.US) gains almost 7% after better-than-expected Q3 2024 earnings, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%.

J.B. Hunt Transport Services (JBHT.US) gains 4.80% after Q3 earnings beat estimates, despite a 2.8% year-over-year revenue decline. Key drivers included growth in the JBI segment and higher revenue per load in ICS. Excluding fuel surcharges, the revenue decrease was less than 1%.

U.S. Bancorp (USB.US) stock opens 4.75% higher after better-than-expected Q3 earnings, driven by growth in net interest income. The bank maintained stable Q4 guidance and reaffirmed its full-year outlook for net interest income and adjusted non-interest income.

United Airlines (UAL.US) surged 9.80% after exceeding Q3 expectations and announcing a $1.5 billion share repurchase program. The company forecasted Q4 earnings of $2.50 to $3.00 per share, significantly higher than the prior year.

ASML (ASML.US) dropped over 4.70% after reporting weaker-than-expected Q3 bookings, with a 53% sequential decline. Despite strong Q3 net sales and income, concerns over 2025 revenue due to export controls contributed to the decline.

Interactive Brokers (IBKR.US) fell 3.24% after mixed Q3 results. Although revenue grew by 20% year-over-year, net interest margin decreased, contributing to the stock's decline.

Novavax (NVAX.US) plummeted nearly 16.40% following an FDA clinical hold on its COVID-19 and flu vaccine trials, citing safety concerns after a trial participant developed motor neuropathy.