US Open: indices test historical highs after strong macro data from the US 🎯

- US500 gains 0.50%

- US2000 rises 0.75% above 2,200 points

- Bond yields also gain

- Dollar slightly rebounds

Optimistic sentiment prevails in the U.S. stock markets after stronger data from the U.S. economy. Retail sales ultimately came out mixed, with a significantly higher headline reading and a slightly lower core reading. Meanwhile, industrial production increased by 0.8% month-over-month compared to expectations of 0.2% month-over-month. The data supports investor speculation focused on a soft landing scenario for the U.S. economy.

The stock markets reacted to the macro publications with slight increases. We also observe a rebound in the dollar and bond yields. However, stronger data did not manage to lower market expectations regarding the scale of rate cuts at tomorrow's Fed meeting. Expectations still fluctuate between a cut of 25 basis points and 50 basis points.

Small-cap companies are gaining the most today. The US2000 index gains 0.75%, breaking above the 2,200-point level. The increases are supported by expectations of interest rate cuts, and looser monetary policy is expected to improve the situation for smaller businesses in the USA. US500 is trading slightly above the historical all-time high around 5,670 points.

Source: xStation 5

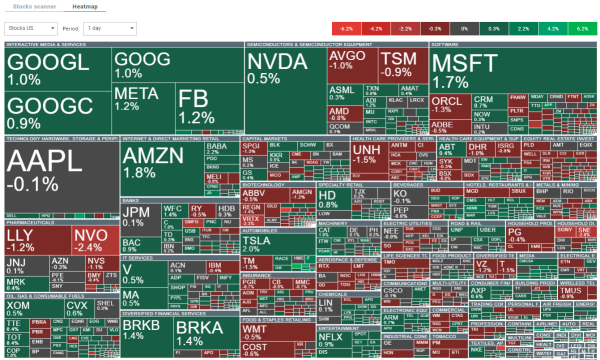

Small-cap companies are gaining the most today. However, we see that big tech companies like Microsoft, Nvidia, Alphabet, Meta, and Amazon are also performing equally well.

Source: xStation 5

Company News

Intel (INTC.US) gains 2.0% after announcing plans to restructure its foundry business into a standalone subsidiary, potentially attracting external investment. This strategic move aims to strengthen Intel's position in the competitive foundry market. Additionally, Intel secured a significant contract to manufacture a custom artificial intelligence chip for Amazon's cloud computing division, reinforcing its relationship with a major tech player.

AppLovin (APP.US) gains 3% following an upgrade from UBS to a Buy rating, citing increased revenue growth visibility.

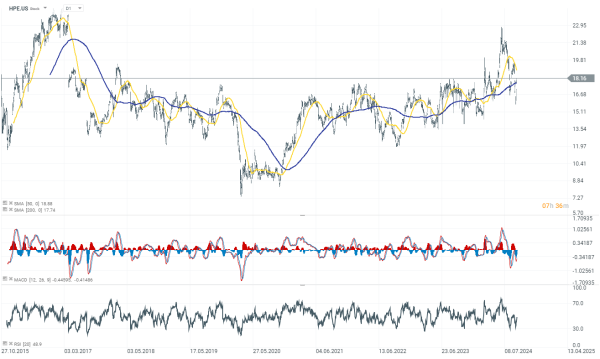

Hewlett Packard Enterprise (HPE.US) stock gains 3% after Bank of America upgraded it to a Buy rating from Neutral. The upgrade reflects anticipated cost reductions under new CFO Marie Myers, significant synergies from the acquisition of Juniper Networks, and potential margin recovery in high-performance computing and AI. BofA raised its price target to $24.

Dada Nexus (DADA.US) jumped nearly 16% after JD.com confirmed it acquired Walmart's entire stake in the company.

Microsoft (MSFT.US) gains nearly 1.80% after increasing its quarterly dividend by 10% and approving a new share buyback program of up to $60 billion.