US OPEN: KeyCorp rallies 15%, Hawaiian Electric plunges 17%

- Wall Street indices open higher

- US2000 struggles near 2,100 pts resistance zone

- KeyCorp jumps on Scotiabank investment

- Hawaiian Electric slumps after issuing going-concern warning

Wall Street indices launched new week's trading little changed, with small gains being seen at session launch for the major US indices. S&P 500 opened around 0.2% higher, Nasdaq jumped over 0.3% at session launch and Dow Jones was up 0.1%. Small-cap Russell 2000 was a top laggard with an around 0.2% bearish price gap at session launch.

Economic calendar for today's US session is empty, with investors preparing for top-tier macro releases scheduled for the later part of the week. Those include US CPI report for July on Wednesday as well as retail sales data for July on Thursday. A point to note is that this time PPI inflation data (Tuesday) will be released before CPI data, therefore it will also be watched closely for hints ahead of the key CPI release.

Source: xStation5

Source: xStation5

Russell 2000 launched today's trading little changed, just like other Wall Street indices. Taking a look at Russell 2000 futures chart (US2000) at D1 interval, we can see that the attempt to push the index below 2,000 pts mark last week was a failed one and US2000 began to recover. However, the recovery move was halted after the index reached 2,100 pts resistance zone. US2000 remains in the area, with sellers attempting to launch a pullback from there today. However, given no near-term catalysts for the bigger move, the index may continue to trade near 2,100 pts mark until Wednesday, when US CPI inflation report for July is released at 1:30 pm BST. However, should we see a break above the aforementioned 2,100 pts area, buyers attention may shift towards 2,165 pts swing area. On the other hand, should sellers remain in control, the aforementioned 2,000 pts psychological area will be the first support zone to watch.

Company News

Hawaiian Electric (HE.US) launched today's trading with a big bearish price gap. Company said it has pegged losses from estimated accrual of liabilities, linked to wildfires in Maui last year, at $1.7 billion and expressed concerns over continuing as a going-concern.

Starbucks (SBUX.US) launched today's trading higher following Wall Street Journal report released on Friday after close of US stock market session. WSJ reported that Starboard Value, a well-known activist investor, took a stake in the company and wants company's executives to take steps to boost its stock price.

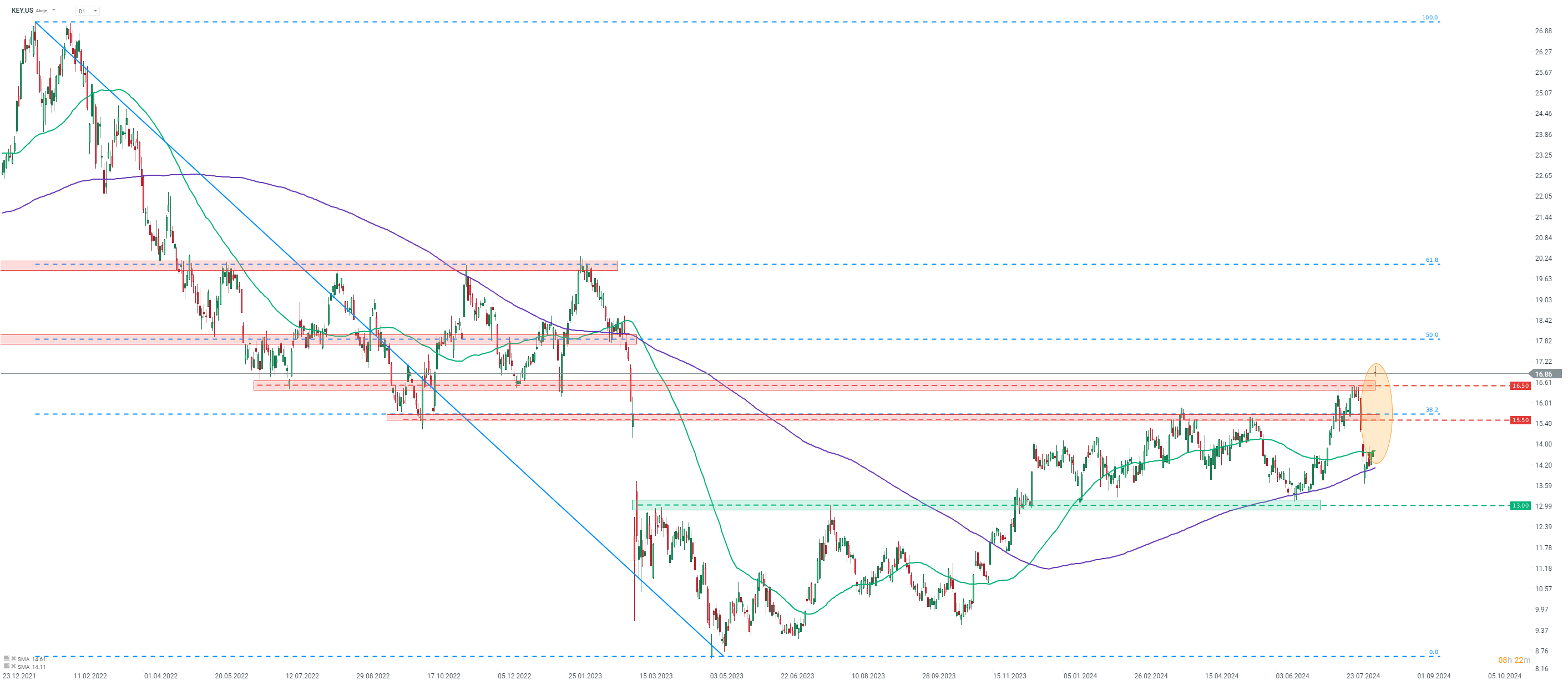

KeyCorp (KEY.US) rallies after announcing that Scotiabank has agreed to acquire 14.9% stake in the company for about $2.8 billion. Stake will be acquired via issuance of new shares at price of $17.17 per share. This represents a premium of around 17.5% over KeyCorp's closing price on August 9, 2024.

JetBlue Airways (JBLU.US) plunged at the start of today's Wall Street cash session. Company announced that it plans to sell over $3 billion in debt. JetBlue Airways said that it intends to use proceeds to repurchase a portion of its 2025 senior convertible notes as well as for general corporate purposes.

Analysts' actions

- Eli Lilly (LLY.US) upgraded to 'buy' at Deutsche Bank. Price target set at $1,025.00

KeyCorp (KEY.US) launched today's trading with an around 15% bullish price gap, after announcing that Scotiabank will take a stake in the company. Stock moved to the highest level since March 2023. Source: xStation5

KeyCorp (KEY.US) launched today's trading with an around 15% bullish price gap, after announcing that Scotiabank will take a stake in the company. Stock moved to the highest level since March 2023. Source: xStation5