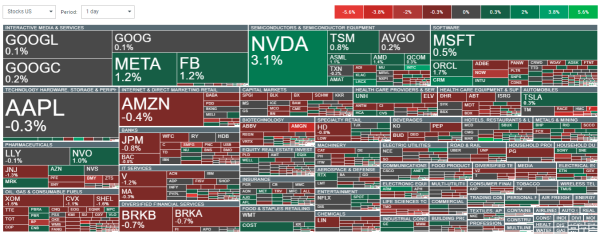

US Open: Nvidia gains 3.2%, leading bulls on Wall Street again📈US100 gains 0.2%

- Wall Street gains slightly; Nvidia (NVDA.US) lead US large caps with more than 3% rise; Amgen (AMGN.US) declines 5%, pressuring DJIA

- August US new home sales slightly higher than expected, but still weaker MoM (-4.6% vs -5.3% exp. after 10.6% in July); prices lower almost 5% YoY

- Hewlett Packard (HPE.US) gains amid higher recommendation in Barclays, citing AI; SPACs rise on Fed rate cuts optimism

Today US stock market slightly gains, with almost 0.2% rise in Nasdaq 100, but flat S&P 500 and 0.4% decline on DJIA. 10-year treasury yields are almost 4pp higher today, at 3.77%; USDIDX rebounds more than 0.3%, above 101. OECD called US economy 'robust', seeing US Federal Reserve cutting rates to 3.50% by end 2025, with ECB also cutting to 2.25% by the end of next year.

Nvidia and Intel (INTC.US) lead today gains across the semiconductor sector. Bristol-Myers Squibb (BMY.US) loses more than 3% today; almost 5% loses another pharmaceutical giant, Amgen - despite optimistic comments from TD Cowen analysts. Source: xStation5

Nvidia and Intel (INTC.US) lead today gains across the semiconductor sector. Bristol-Myers Squibb (BMY.US) loses more than 3% today; almost 5% loses another pharmaceutical giant, Amgen - despite optimistic comments from TD Cowen analysts. Source: xStation5

US100 (D1 interval)

Futures on Nasdaq 100 (US100) defended major support zones at EMA200 (red line), now continuing uptrend above 23.6 Fibo at 20,000 points, with 'higher low', giving more technical fundamentals for further increases. Major resistance zone is set at 21,000 points, near ATH from July 2024. Important support is at 19,500 points level, where we can see 38.2 Fibo of the upward trend, started in April 2024.

Source: xStation5

Source: xStation5

Nvidia pops on AI infrastructure spending optimism

Mizuho analysts in a recent Bain Technology report projected that the market for AI hardware and software could grow to as much as $990 billion by 2027 from about $185 billion now, calming some worries about spending trends and budgets, amid uncertain ROIC from the AI investments. According to analysts, there is still almost 0 clarity around CAPEX growth rates for 2026, despite optimism around 2025 calendar year.

- Despite that analysts signalled that demand "will continue to grow as [large-language models] expand capabilities to processing multiple data types simultaneously (text, images, and audio) and as venture capitalists pour even more money into AI startups." "If data center demand for current-generation GPUs doubled by 2026 - a reasonable assumption given current trajectory - suppliers of key components would need to increase their output by 30% or more in some cases,"

- Also, power-purchase agreement inked by Microsoft Corp. (MSFT.US) and Constellation Energy Corp. (CEG.US) was optimistic for AI stocks. Analysts asked 'Would [Microsoft] sign a 20-year nuclear-power-purchase/supply agreement with Constellation Energy spending $1.6 billion alone to restart the facility that doesn't begin power [generation] until 2028 if they planned to slow or pare back current capex growth and AI investment? No'.

Also Nvidia CEO, Huang completed his trading plan adopted earlier this year, ended with $713M through NVDA stock sales (Rule 10b5-1 trading plan) with an average price of appx. $119 per share. The plan was set to be effective through March 2025, but Huang sold all the shares six months before the expiration. Now, Huang could adopt another plan to sell more shares, but it's still unclear will he do it or no.

NVDA.US (interval D1)

Source: xStation5

Source: xStation5