US Open: strong macro data support gains on Wall Street 📣

- The dollar is posting strong gains

- U.S. bond yields are rebounding

- Indexes on Wall Street are rising

Today's strong retail sales data has triggered more market volatility than yesterday's CPI data. This is because for the past few weeks, the market has stopped fearing a return of inflation and instead has begun pricing in a potential recession in the U.S. As a result, there was a sharp increase in expectations for Fed rate cuts this year, a correction in the stock market, and declines in U.S. bond yields. The basis for this change in outlook was weaker data coming in from the labor market and a weakening consumer. However, today's retail sales report seems to have at least partially dispelled these concerns among investors.

Retail sales in July rose by 1% on a monthly basis and were significantly higher than expectations. The data has calmed the market, which is now pricing in just a 75% chance of a 25 basis point cut at the September meeting. As a result, at the opening of the cash session in the U.S., we are seeing strong gains in stock indexes, particularly among small-cap companies. The dollar and U.S. bond yields are also decidedly rebounding. Two-year bonds have returned above 4.00% and are even approaching 4.10%. Meanwhile, ten-year bond yields are gaining to 3.95% and are also nearing the 4.00% threshold.

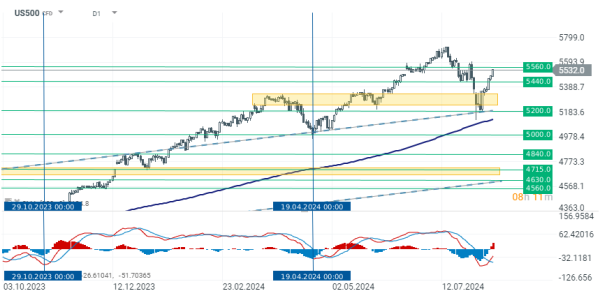

US500

The main U.S. stock index, US500, is up 1.00% today to 5,530 points, extending last week's rebound. We are seeing gains in companies across all sectors. The nearest resistance level for the bulls may be the zone above 5,550 points.

Source: xStation 5

Earnings after closing bell

Applied Materials (AMAT.US) gains 3%. The company will report FQ3 2024 results after the closing bell, with expectations of $2.02 earnings per share on $6.67 billion in revenue. Applied Materials, a leading U.S. semiconductor equipment maker, is expected to see quarterly revenue growth driven by strong demand for AI chips. Investors will also be watching for comments on the impact of trade restrictions with China.

Company highlights

Deere (DE.UE) gained more than 4% after the company reaffirms its full-year net income guidance of about $7 billion despite challenges in global agriculture and construction sectors. In FQ3 2024, Deere's net sales and revenue dropped 17% year-over-year to $13.15 billion, while net income fell 42% to $1.73 billion. CEO John May noted the company's cost-cutting measures and production adjustments to align with market conditions.

Walmart (WMT.US) stock gains over 7% after the company raised its annual net sales guidance. U.S. comparable sales grew 4.2% in Q2, exceeding expectations of 3.4%. Walmart expects consolidated net sales to increase by 3.75% to 4.75% for fiscal 2025, up from a previous forecast of 3% to 4%. CEO Doug McMillon highlighted that newer business segments like marketplace, advertising, and membership are contributing to profits and strengthening the company's business model. Stock price is also boosted after strong retail sales data, which directly correlates with Walmart business.

Alibaba (BABA.US) stock ticks higher by 1.60% despite reporting a quarterly revenue miss. FQ1 revenue rose 4% year-over-year to RMB 243.24 billion ($33.47 billion) but fell short of analyst estimates. Core domestic e-commerce sales dropped 1% as China's weak economy affected consumer confidence and spending. Competitive pressures forced Alibaba to offer discounts, impacting its profit margins.

Cisco (CSCO.US) surged nearly 10% after the company reported better-than-expected FQ4 results and issued an optimistic forecast. Despite a 10% year-over-year revenue decline, Cisco saw strong product order growth of 14%, partly due to the recent Splunk acquisition. Total annualized recurring revenue increased by 22%. The company projects Q1 FY25 EPS at a midpoint of $0.87, slightly above the estimate of $0.85, and expects revenue at a midpoint of $13.75 billion, above the $13.71 billion estimate. The FY25 revenue forecast midpoint is $55.6 billion, nearly matching the consensus of $55.61 billion.

Ulta Beauty (ULTA.US) gain over 10% after Warren Buffett's Berkshire Hathaway disclosed a new position in the company. According to its 13F filing, Berkshire acquired approximately 690,000 shares of Ulta during the second quarter, significantly boosting investor confidence and driving the stock higher.