US Open: Wall Street in mixed sentiment a day before the Fed decision 📃

- Indexes are slightly gaining at the start of the session

- Once again, companies with smaller market capitalization are favored

- The dollar index is up 0.20%

- Yields are noted without major changes

In the USA, indexes open in mixed spirits, with slight favoritism toward growth among smaller-cap companies. There's a mild nervousness typical for the period before the Fed's announcement. Stock market investors are holding off on purchases until the decision and speech by Chairman Jerome Powell are published. The dollar is gaining amid greater uncertainty, and gains slightly accelerate after the publication of JOLTS new job data and consumer sentiment by the Conference Board.

-

Goldman Sachs Group Inc. CEO David Solomon said that a scenario of two 25 basis point rate cuts later this year is becoming more likely. Just two months ago, the bank predicted no cuts at all.

-

JPMorgan predicts that the Federal Reserve will continue reducing its balance sheet (quantitative tightening, QT) until the end of the year, despite some frictions in the repo markets as indicated by elevated Secured Overnight Financing Rate (SOFR) rates.

-

According to JPMorgan's analysis, the current issues in the financing markets are limited to specific areas and do not suggest widespread liquidity problems that would require stopping QT.

US500

Today, the US500 contracts for the SP500 index are flat. At the beginning of the session, the index slightly gained, but generally remains without major changes around the 5500-point level. In case of a continued correction, the nearest support zone at 5350 points should be considered. On the other hand, the MACD indicator has cooled off, signaling a slowdown in momentum, which in previous months indicated a local bottom in the upward trend.

Source: xStation 5

Company News

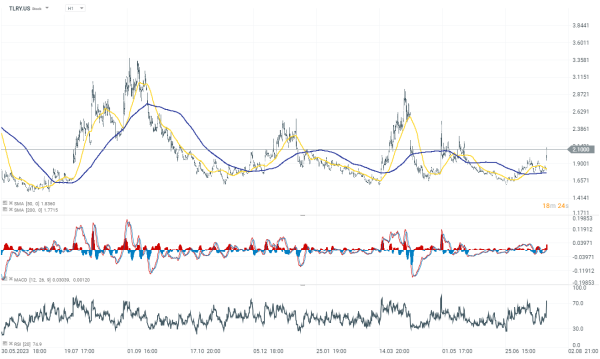

Tilray (TLRY.US) stock gains 16.50% as the company reported a 24% year-over-year increase in revenue for the fourth fiscal quarter, with a notable 127% increase in beverage-alcohol revenue to $76.7 million. The company also saw a 146% rise in gross profit within this key segment. Tilray significantly reduced its quarterly loss to $15.4 million from the previous year's $119.8 million, largely due to reductions in non-cash expenses.

F5 (FFIV.US) gains over 10% following its announcement of better-than-expected fiscal third-quarter results and a promising outlook for the fourth quarter. The company expects earnings per share to be between $3.38 and $3.50 on projected revenue of $720 million to $740 million for the upcoming quarter, surpassing analyst expectations. Additionally, the company anticipates approximately 12% non-GAAP earnings per share growth for fiscal year 2024, with total revenue approximating $2.8 billion.

SoFi Technologies (SOFI.US) gains 1.60% after raising its 2024 earnings and revenue guidance post strong second-quarter results. The company forecasts third-quarter adjusted net revenue between $625 million and $645 million, and it raised its full-year GAAP EPS forecast to $0.09-$0.10, up from $0.08-$0.09. SoFi also expects significant member growth and maintains a strong capital ratio projection.

PayPal Holdings (PYPL.US) climbed 8% after the company reported second-quarter results that exceeded expectations, raised its full-year 2024 earnings guidance to $3.88-$3.98 per share, and increased its share repurchase plan to $6 billion. The company anticipates high single-digit non-GAAP EPS growth and mid-single-digit revenue growth for the third quarter of 2024.

CrowdStrike (CRWD.US) fell nearly 9% amid potential legal threats from Delta Air Lines, which hired lawyer David Boies to seek damages related to a major technical outage. The news has negatively impacted investor sentiment, although no lawsuit has yet been filed.

Lattice Semiconductor (LSCC.US) dips also by 9% following a disappointing second-quarter performance and a weak revenue outlook for the third quarter, projecting sales between $117 million and $137 million, well below expectations.