US OPEN: Wall Street indices erase losses from the market open 📌

- PCE data did not cause major changes in the market

- Bond yields erase gains after yesterday's GDP report

- The dollar gains despite initial losses after the PCE report

Stock markets in the US lose in the first hour of trading on the last day of the week. However, the declines are not significant and are gradually being recovered by the bulls. At the time of publication, the declines had already been erased and the indices are gaining around 0.10%. Investors lack a clear catalyst for a specific move. Today's PCE data was indeed higher than expected on an annual basis, but monthly figures were in line with consensus. Additionally, the difference between the actual report and expectations was not significant. Yesterday's GDP data somewhat mixed the markets. On one hand, the US economy shows signs of stabilization, with annualized GDP growth at just 1.6%, lower than the expected 2.6%. However, on the other hand, inflationary pressure persists, which may motivate the Fed to keep rates at a higher level. Today, US bond yields are erasing yesterday's gains after the GDP report. The dollar remains strong, with the USDIDX index gaining 0.25%.

Mixed signals also reached stock market investors yesterday after the cash session closed. On one hand, reports from Alphabet and Microsoft turned out to be very positive surprises. On the other hand, reports from Intel or Meta the day before were received negatively.

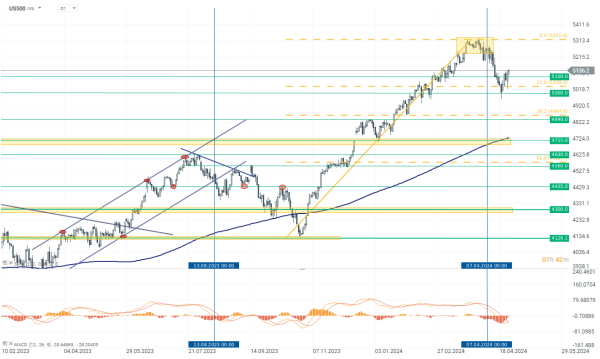

US500

The index of the largest companies on Wall Street opens today at a slight loss, but now declines are reduced. Last week, the bulls managed to hold support at the 5000 point level. The current correction has reached the 23.6% Fibonacci retracement of the last upward move. In the coming days, defending the 5000-5040 point zone will be crucial. Otherwise, the next levels of interest are around 4840 points.

Source: xStation 5

Company News

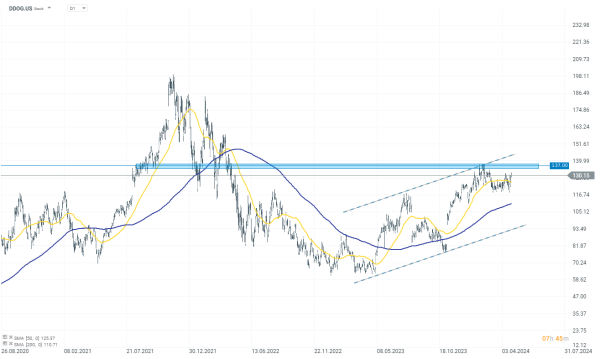

Alphabet (GOOGL.US) gains as much as 11% following a better Q1 earning, driven mainly by a 21% Y/Y increase in YouTube ads revenue. Other revenue sources also saw substantial growth, with subscriptions, platforms, and devices up by 18%, and Cloud segment revenue growing by 28%. The operating margin expanded significantly from 25% to 32%. Additionally, Alphabet authorized a new $70B share buyback program and declared a cash dividend of $0.20 per share.

Microsoft (MSFT.US) shares surged about 3.2% after exceeding FQ3 earnings expectations. Total sales rose 17%, fueled by a 31% Y/Y growth in Azure, highlighting strong demand for AI technologies. For Q4, Microsoft forecasts sales between $63.5B and $64.5B, slightly below the consensus of $64.57B, with Azure expected to grow between 30% and 31% in constant currency.

Snap (SNAP.US) jumped 23% after a positive Q1 earnings report and optimistic Q2 outlook. The company projects Q2 revenues between $1.225B and $1.255B, indicating a Y/Y growth of 15% to 18%, surpassing the consensus estimate of $1.21B. Snap expects daily active users (DAU) around 431M in Q2 and estimates adjusted EBITDA between $15M and $45M.

Intel (INTC.US) shares plunged 11.6% following mixed Q1 results, missing revenue expectations despite a 9% Y/Y growth. The company's outlook was also disappointing, forecasting revenue between $12.5B and $13.5B, well below the consensus of $13.61B, with an adjusted EPS forecast of $0.10 per share, significantly lower than the expected $0.25 per share.

Datadog (DDOG.US) gains over 4% in early market trading on Friday after Microsoft's strong financial results (one of its key partners). The company, which also partners with Amazon Web Services and Google Cloud, received a boost earlier in the week when Wells Fargo upgraded its rating to Overweight and raised its price target to $150.

Source: xStation 5