US Open: Wall Street indices under pressure from an appreciating Dollar 💲💲

- Indices open lower on the last day of the week.

- The dollar index (USDIDX) gains for another consecutive day.

- Yields on 10-year bonds drop to 4.50%.

In the US, indices lose at the opening of the cash session, thereby increasing the likelihood of a second consecutive bearish week. The supply pressure is supported by the strengthening dollar, and yields remain high despite today's declines. The nervous situation in global markets results from higher CPI readings this week and the increasing risk of escalation in the Iran-Israel conflict. Higher CPI readings have shifted the expectations for the nearest rate cuts by the Fed to September this year. Meanwhile, the escalation of the conflict leads to capital flight towards less risky assets such as the dollar and gold.

Investors' attention will also be focused on the beginning of the quarterly earnings season in the USA. Today, the first reports have already been published by banks including Blackrock, JP Morgan, Citigroup, and Wells Fargo.

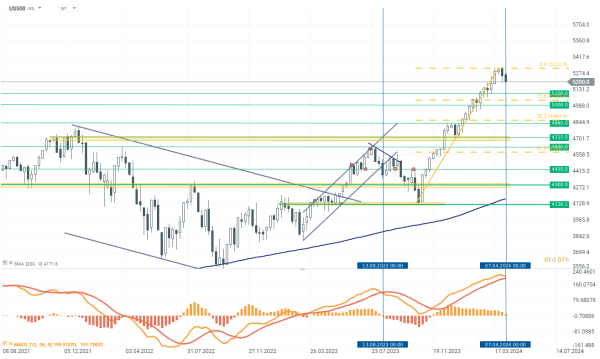

US500 (W1 interval)

The dynamics of recent increases in the index have definitely stopped, and technical indicators are even beginning to suggest an upcoming trend change. If today's trading closes with a loss, it will be the second consecutive bearish week. What's more, the MACD indicator is close to crossing two EMA averages, which will signal a change in momentum. The last such crossing was observed on August 13, 2023, which then marked nearly 10 weeks of declines amounting to 8%. Today's session close will be crucial. The first levels in such a scenario will be 5100 and 5000 points. Otherwise, the upper limit for bulls remains at 5250-5300 points.

Source: xStation 5

Corporate News

-

Coupang (CPNG.US) gains over 10% after the company announced a 58% increase in its monthly membership fee, now 7,890 won, effective April 13 for new members and August for existing ones. This marks the second recent fee increase since 2022, justified by expanded benefits like discounts and free delivery for Coupang Eats.

-

Applied Digital (APLD.US) dips over 5% following disappointing fiscal third quarter results, missing on revenue and earnings despite a 208% year-over-year revenue growth. Challenges included power outages at datacenter facilities, though progress was noted in cloud services and a new 100 MW datacenter.

-

Nurix Therapeutics (NRIX.US) drops 6.60% after the company priced an upsized public offering of shares expected to raise $175 million, up from an initially planned $125 million.

-

JPMorgan (JPM.US) fell 5.30% as the bank issued net interest income guidance that missed analyst expectations, although slightly higher than previous forecasts. JPMorgan Chase reported a 6% increase in first-quarter profits, reaching $13.4 billion and surpassing Wall Street expectations, driven by a 9% rise in revenue and an upward revision of its full-year net interest income forecast to $89 billion. However, CEO Jamie Dimon voiced caution about the future economic landscape, citing ongoing wars, geopolitical tensions, persistent inflation, and the Federal Reserve's quantitative tightening as potential challenges.

-

Citigroup (C.US) declines 0.70% following its earning release. The bank reported a 27% decline in profit to $3.37 billion, or $1.58 per share, driven by higher expenses and credit costs, despite a revenue of $21.10 billion that slightly exceeded expectations due to strong performances in investment banking and trading. Adjusted earnings were $1.86 per share, surpassing the expected $1.23, reflecting adjustments for FDIC charges and other costs. The decrease in revenue, down 2% from the previous year, was mainly attributed to the sale of an overseas business. Notably, investment banking revenue surged by 35% to $903 million, while fixed income trading dipped by 10%, and equities trading increased by 5%. The Services division saw an 8% rise in revenue to $4.8 billion.

-

Shares of Intel and Advanced Micro Devices (AMD) fell by around 4.00% after the Chinese authorities have instructed the country’s major telecom carriers to eliminate foreign-made semiconductors from their networks. This targets mainly the US manufacturers like Intel and Advanced Micro Devices (AMD), as reported by the Wall Street Journal. This directive is part of China’s broader push towards technological self-reliance, spurred by forthcoming US restrictions.

-

Arista Networks (ANET.US): Stock plummeted 7.30% following a downgrade by Rosenblatt Securities from Buy to Sell, with a lowered price target from $330 to $210. Concerns were raised that Arista might not sufficiently benefit from sector growth compared to competitors like Nvidia.

-

Zoetis (ZTS.US) shares dropped about 7.40% after reports of adverse events associated with its osteoarthritis pain drugs, Librela and Solensia. Despite significant sales and a low incidence rate of side effects, over 20,000 cases of side effects have been recorded since 2021, affecting stock sentiment.