US OPEN: Wall Street opens higher, Texas Instruments rallies 7%

- Wall Street indices open mostly higher

- US100 halts recovery move at 38.2% retracement

- Texas Instruments jumps 7% after earnings

Wall Street indices launched today's trading little change, in spite of a big post-earnings jump in Tesla shares. S&P 500 opened 0.2% higher, Dow Jones gained 0.1% at the opening, Nasdaq jumped 0.6%, while small-cap Russell 2000 slumped 0.4%

Source: xStation5

Source: xStation5

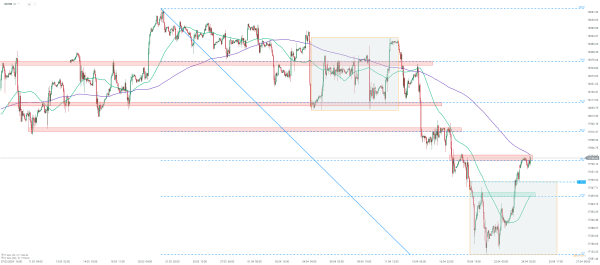

Post-earnings spike in Tesla shares, in spite of earnings itself being a disappointment, is supporting Nasdaq-100 futures (US100) today, making the index the best performing Wall Street benchmark. Taking a look at US100 chart at H1 interval, we can see that the index broke above the upper limit of a local market geometry at 17,585 pts yesterday and continued to gain overnight. However, advance was halted at the 17,775 pts resistance zone, marked with previous local high, 200-hour moving average (purple line) and 38.2% retracement of the downward impulse launch in the second half of March 2024. Supply-side reaction to this hurdle signals the index may resume decline. If this is the case, the near-term support to watch can be found in the 17,500 pts area, where 23.6% retracement can be found.

Company News

Vertiv Holdings (VRT.US) rallies at double-digit pace following release of Q1 earnings. Company reported net sales of $1.64 billion (exp. $1.62 billion), driven by $925 million in Americas net sales. Adjusted operating margin reached 15.2% (exp. 13.5%), with company's largest geographical market (Americas) being also its most profitable one with a margin of 20.3%. Net orders jumped 60% YoY during the period. Adjusted EPS of $0.43 was higher than $0.36 expected. Vertiv expects Q2 net sales of $1.90-1.95 billion (exp. $1.9 billion) and Q2 adjusted EPS of $0.53-0.57 (exp. $0.55). Company also upgraded its full-year forecast and is now expecting net sales to reach $7.54-7.69 billion, up from previous range of $7.52-7.66 billion. Full-year adjusted EPS is now seen at $2.29-2.35, up from previous forecast of $2.20-2.26.

Texas Instruments (TXN.US) trades higher after reporting better-than-expected Q1 results. Company reported a 16% YoY revenue drop to $3.66 billion (exp. $3.60 billion), with Analog segment revenue dropping 14% YoY to $2.84 billion (exp. $2.81 billion). Operating profit dropped 34% YoY to $1.29 billion (exp. $1.12 billion). Research & developments expenses were 5.1% YoY higher at $478 million (exp. $468 million), while capital expenditures increased 27% YoY to $1.25 billion (exp. $1.21 billion). Adjusted EPS declined to $1.20 from $1.85 a year ago. Texas Instruments expects Q2 revenue of $3.65-3.95 billion (exp. $3.78 billion) and EPS of $1.05-1.25 (exp. $1.17).

General Dynamics (GD.US) reported 8.6% YoY drop in Q1 revenue to $10.73 billion (exp. $10.28 billion). Technologies segment revenue declined 0.8% YoY to $3.21 billion (exp. $3.22 billion), Marine Systems revenue increased 11% YoY to $3.33 billion (exp. $3.04 billion) and Combat Systems revenue rallied 20% YoY to $2.10 billion. Aerospace revenue increased 10% YoY to $2.08 billion (exp. $2.28 billion). Company-wide operating margin reached 9.7% (exp. 10.2%), with Combat Systems having the highest margin at 13.4% (exp. 13.9%). Order backlog increased 4.3% YoY to $93.7 billion. Adjusted EPS reached $2.88 (exp. $2.91). Company reported a negative free cash flow of $437 million, while market expected a positive $881 million.

Texas Instruments (TXN.US) launched today's trading with a big bullish price gap. While the company reported results that were weaker than a year ago, they were better than expected. Stock broke above resistance zone ranging around $175 mark and reached the highest level in almost 9 months. Source: xStation5

Texas Instruments (TXN.US) launched today's trading with a big bullish price gap. While the company reported results that were weaker than a year ago, they were better than expected. Stock broke above resistance zone ranging around $175 mark and reached the highest level in almost 9 months. Source: xStation5