US Open: Wall Street opens lower however bulls try to regain control 🔴

- Indexes slightly lose at the opening of the session

- 10-year bond yields also drop

- USD remains mostly unchanged

On the last day of the week, indexes in the USA open lower. This week has been exceptionally volatile for the markets. It began with sharp declines and panic related to recession and Carry Trade in Japan. However, a calm stance from FOMC representatives and a lower number of unemployment benefit claims in the USA on Thursday allowed bulls to recover most of the losses. Today, indexes in the USA also open slightly lower, but the losses are not being deepened, and it seems that bulls are even trying to take control. The US500 is down 0.10%, the US2000 loses 0.30%, and the US100 drops the most - 0.40%. Today’s declines may also partly stem from yesterday’s strong gains and profit-taking by short-term investors. Yields on American bonds also drop after testing the area around 4.00% again.

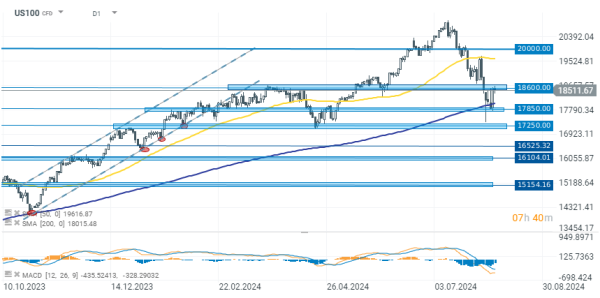

US100

The technology company index closed yesterday with a gain of over 3.60%, breaking out from the support zone above 17800 points. The rise stopped only at the next resistance zone below 18600 points. From below, the index was also supported by the 200-session moving average SMA. Breaking through the support zone around 18600 points will be crucial for the continuation of this movement.

Source: xStation 5

Company news

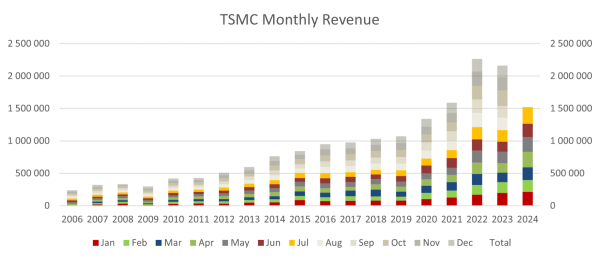

Taiwan Semiconductor Manufacturing (TSM.US) gains over 1% following an announcement of approximately 45% year-over-year jump in July revenue. The company, which supplies chips to major tech companies like Apple and Nvidia, reported a revenue of NT$256.95 billion ($7.94 billion) for July.

Gilead Sciences (GILD.US) reported a 5% year-over-year rise in Q2 product sales, totaling $6.9 billion. This growth was driven primarily by strong demand for its HIV and liver disease medicines, which offset declining sales from its COVID-19 therapy, Veklury.

Take-Two Interactive Software (TTWO.US) gains over 5% after the company forecasted sequential increases in net bookings for fiscal years 2026 and 2027, in anticipation of its highly awaited Grand Theft Auto VI game release next fall.

Unity (U.US) surged almost 10% despite the company reported a 16% year-over-year drop in Q2 revenue and revised its full-year revenue forecast downwards for its strategic portfolio. This revision follows the departure of its CFO, Luis Visoso, and represents a cautious approach by new CEO Matthew Bromberg, who is aiming to reset the company’s portfolio to better position its Grow Solutions business for recovery.

Paramount Global (PARA.US) gains 2% following a mixed Q2 performance. The company fell short of revenue and subscriber growth targets, mainly due to a sharp decline in its TV media division. However, it exceeded profit expectations and the company announced a cost-cutting plan that includes laying off about 15% of its U.S. workforce.

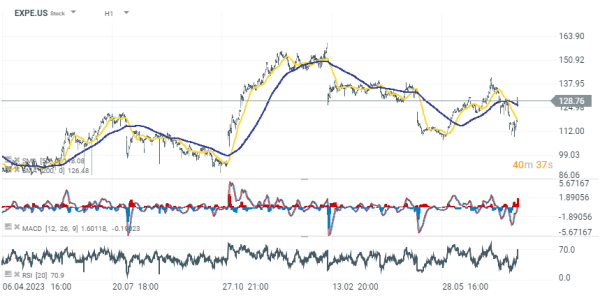

Expedia (EXPE.US) surged over 10% after exceeding Q2 expectations and reporting a 10% increase in Room Nights, with Brand Expedia growing nearly 20%—its fastest rate since Q1 2023. Total gross bookings rose 6% year-over-year to $28.8 billion, fueled by an 8% increase in lodging bookings and an 11% rise in hotel bookings.