US Open: Wall Street sentiments mixed ahead of the Fed 🗽 US100 loses slightly, Resmed slumps 6%

- Indexes on Wall Street open the session slightly lower, expecting a near foregone conclusion of the first Fed rate cut in 4 years (7 PM GMT) and Powell's conference (7:30 PM GMT)

- The market is pricing in a 66% chance of a 50bp Fed rate cut; reaction to the decisions remains uncertain. US100 loses 0.2% at the open

- BlackRock (BLK.US) and Microsoft (MSFT.US) plan a joint investment of more than $30 billion in AI and infrastructure for databases and the energy sector; total financing for the entire action could be as high as approx. USD 100 billion; investment will mainly involve the US and to a lesser extent allied countries

- US Steel (X.US) shares gain slightly on new reports suggesting a final takeover decision after the November US elections; Resmed (RMD.US) slumps 6% after downgrade from Wolfe Research, initiating profit realization after reaching 1-year high

Investors opened today's session with declines, anxiously awaiting the Fed decision and Jerome Powell's speech. It seems that a decision to cut rates by 25 bps would be more in line with the Federal Reserve's communication to date, and a 50 bp cut could be perceived as an 'admission' of tardiness vis-à-vis monetary easing, which could consequently be a sure warning sign for the stock market. In the short term, however, the reaction to the Fed's decision remains largely uncertain; although a larger cut while maintaining solid readings from the economy should support Wall Street and weaken yields. U.S. real estate market data today turned out to be stronger than forecast. Monthly building permits rose nearly 5% vs. 1% forecasts, and construction starts rose 9.6% m/m vs. 6.5% forecasts, after falling 6% in July.

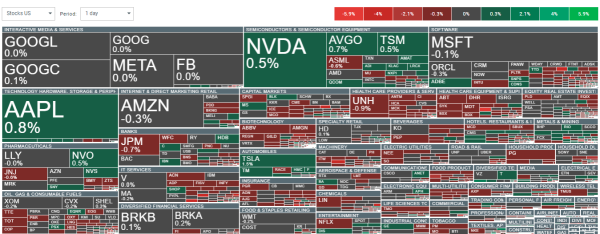

Wall Street opens the session in slightly weaker sentiment; BigTech stocks are gaining; weaker sentiment is seen in the health and medical care sector. Source: xStation5

US100 chart (M30 interval, D1)

In the short term, we see that the index has maintained its September uptrend line and is trading between the EMA50 and EMA200 momentum averages ahead of the Fed conference. A drop below 19,400 could suggest more intense downward momentum. A rise above 19,500 could open the way for bulls to test local maxima at 20,000 points.

Source: xStation5

Looking at the broad daily interval, the Nasdaq 100 futures fell below the EMA200 (red line) twice, but quickly managed to make up the stats, defending the uptrend. The main support is now at 18500 points, where the 23.6 Fibonacci elimination of the 2022 upward wave is located.

Source: xStation5

News from companies

- Shares of Edwards Lifesciences (EW.US), which specializes in devices dedicated to cardiovascular surgery, are losing 2% after Jefferies downgraded the stock to hold from buy, citing concerns about business growth prospects. However, analysts from Baptista Research upgraded the company to outperform from hold with a price target raised to $82.90 USD vs $66 today

- GE HealthCare (GEHC.US) shares gain slightly after analysts at BTIG upgraded the stock to buy from neutral previously, saying the medical technology environment for the company's medical technology business has improved.

- On Holding (ONON.US) is gaining, after Stifel raised its target price for the maker of the popular sneaker bars to $59 from $45 previously. The company is currently valued at around $50 and has gained more than 60% since its 2021 IPO.

- Shares of heavily traded Sirius XM Holdings (SIRI.US) are gaining 3% as Guggenheim Securities raised its rating on the satellite radio company, to Buy, highlighting that operating trends and free cash flow are stable and subscriber numbers are likely to increase. The company is struggling with high debt (more than $9 billion in long-term debt)

- Super Micro Computer (SMCI.US) is gaining slightly after Needham & Co. initiated coverage of the stock with a buy recommendation. Analysts say the chip company has a first-mover advantage due to its “design of GPU-based computing systems and liquid-cooled solutions.” Currently, SuperMicro still hasn't reported quarterly results and its window is ending, after which it could receive a hefty penalty at the SEC

- Shares of United States Steel (X.US) are gaining as the U.S. Security Committee granted Japanese conglomerate Nippon Steel permission to resubmit its plan to buy the U.S. steel company in a deal valued at about $14.1 billion.

- VF Corporation (VFC.US) shares gain 3% as the owner of The North Face brand was upgraded to 'outperform' at Barclays, which expects the company's fundamentals to improve over the next four to six quarters. Victoria's Secret (VSCO.US) shares are also gaining; also on the wave of recommendations from Barclays, which believes the company's worst moment for business is behind it.