US Open: Wall Street struggles for direction at the market open 🧭

- Indexes gain at the opening of the session

- Weaker dollar supports stock quotes

- Bond yields strongly gain

At the beginning of the new week, markets in the USA open slightly higher, extending better moods in Europe as well as earlier in the Asia-Pacific region. Gains on Wall Street are supported by a weakening dollar. The USDIDX index is quoted almost 0.15% lower. Interestingly, the yields of U.S. bonds are indicating a different direction, gaining today to the level of 4.43%. These levels were last seen at the end of November 2023. The high volatility in USD and yields could be a harbinger of the upcoming CPI and PPI reports this week. These reports will likely bring increased volatility, and high inflation readings may confirm a longer period of high-interest rates in the USA.

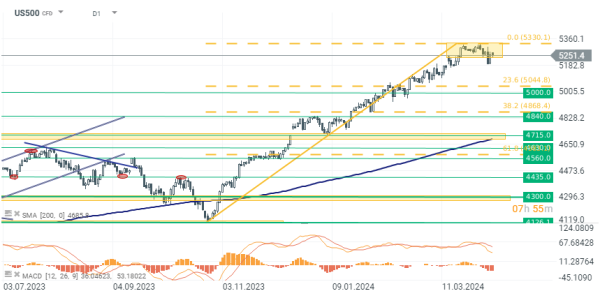

US500

The indexes in the USA are moderately gaining at the beginning of the session. US500 is quoted at 0.05% and US100 around the opening levels. However, the gains have already been partially erased, as they earlier reached above 0.10%. US500 futures on the S&P500 index are starting to give back some of the gains after Friday's session. The nearest support point is now the level of 5190 points, marked by the local bottom last week and local peaks at the beginning of March.

Source: xStation 5

Company News

EHang Holdings Limited's (EH.US) gains 11.80% following the acquisition of the Production Certificate (PC) from the Civil Aviation Administration of China for its EH216-S eVTOL aircraft. This marks the first PC issued in the global eVTOL industry and is a significant milestone towards mass production and commercial use of the eVTOL aircraft.

Fastly (FSLY.US) increases over 5.30% after a recommendation upgrade to Overweight from Neutral by Piper Sandler. Analysts anticipate benefits from growing market share and favorable pricing, considering the current stock valuation as presenting a positive risk-reward scenario.

Cryptocurrency related companies are recording a substantial gains as Bitcoin surpassed the $72,000 level. Notable rises included Coinbase Global (COIN.US) by 6.80%, Riot Blockchain (RIOT.US) by 1.9%, Marathon Digital Holdings (MARA.US) by 1.28%, Hut 8 Mining (HUT.US) by 4.8%, Cleanspark (CLSK) by 5.20% or MicroStrategy Incorporated (MSTR.US) by 8.17%.

Source: xStation 5

Palatin Technologies (PTN.US) gains over 18% following the announcement of positive Phase 3 data for their drug candidate PL9643, intended for treating dry eye disease. The successful results met the co-primary endpoint of pain relief and several secondary symptom endpoints. These findings were shared at the American Society of Cataract and Refractive Surgery meeting.