US OPEN: Wall Street trades flat, Applied Materials drop after earnings

- Wall Street indices trade flat

- US100 tests 19,600 pts resistance zone

- Applied Materials drops after fiscal-Q3 earnings

Wall Street indices trade little changed during the final trading session of the week. S&P 500 trades flat, Dow Jones drops 0.1%, while Nasdaq and small-cap Russell 2000 trade 0.1% higher. Economic calendar for the remaining part of the day is empty. University of Michigan data released at 3:00 pm BST turned out to be better-than-expected but showed long-term inflation expectations unexpectedly staying unchanged. Nevertheless, no major reaction on the market was spotted to this data release.

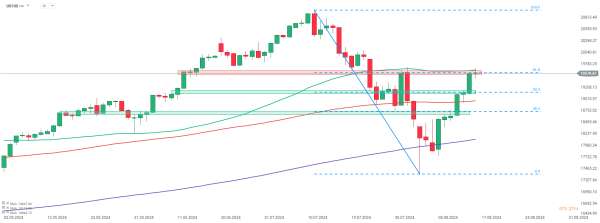

Source: xStation5

Source: xStation5

Recovery move on Nasdaq-100 futures (US100) is taking a pause today. Index reached the 19,600 pts area, marked with previous price reactions, 50-session moving average (green line) and 61.8% retracement of the downward move launched in mid-July 2024. A break above this zone would pave the way for a return towards recent all-time highs near 21,000 pts mark. On the other hand, should the index begin to pull back, the first potential support zone to watch can be found near 50% retracement in the 19,150 pts area.

Company News

Applied Materials (AMAT.US) trades lower after company reported fiscal-Q3 results. Company reported 5.5% YoY increase in revenue to $6.78 billion (exp. $6.68 billion), driven by an almost-8% increase in Applied Global Services sales. Gross margin improved from 46.4% a year ago to 47.4% now (exp 47.1%) while adjusted EPS improve from $1.90 a year ago to $2.12 now (exp. $2.03). Company expects fiscal-Q4 sales to reach $6.53-7.33 billion (exp. $6.93 billion) and adjusted EPS to reach $2.00-2.36 (exp. $2.15)

Texas Instruments (TXN.US) announced its has signed a tentative agreement under which it will receive $1.6 billion in funding from CHIPS Act to help set up 3 chip manufacturing facilities.

Analysts' actions

- Estee Lauder (EL.US) downgraded to 'neutral' at Bank of America. Price target set at $100

- Lumen Technologies (LUMN.US) downgraded to 'underweight' at Wells Fargo. Price target set at $4.00

- Fox News (FOXA.US) upgraded to 'overweight' at Wells Fargo. Price target set at $46.00

- Microchip Technologies (MCHP.US) upgraded to 'overweight' at Piper Sandler. Price target set at $100

In spite of reporting rather solid fiscal-Q3 earnings, Applied Materials (AMAT.US) launched today's trading lower. However, around half of the drop has been erased already. Source: xStation5

In spite of reporting rather solid fiscal-Q3 earnings, Applied Materials (AMAT.US) launched today's trading lower. However, around half of the drop has been erased already. Source: xStation5