US PCE Preview: Key to Fed’s Rate Cuts

Key points:

- The US June PCE release will be pivotal for the Fed to determine if disinflationary trends continued throughout Q2.

- A lower-than-expected PCE reading could bolster hopes for a September rate cut, potentially weakening the US dollar and supporting equities unless demand concerns arise. Conversely, a higher PCE print could diminish the likelihood of a rate cut, strengthening the US dollar and pressuring stocks.

- USDJPY remains the most susceptible as markets assess the Fed’s rate cut prospects and BOJ is expected to hike rates next week.

US economic data continues to be a significant driver of market movements, with investors closely analyzing these releases to gauge the Federal Reserve's potential actions.

Later today, at 12:30 GMT, the Fed's preferred inflation measure, the Personal Consumption Expenditures (PCE) price index, will be released. Market participants are particularly focused on this report as it will influence expectations for Fed rate cuts.

The Context

The market expects the following for the PCE data:

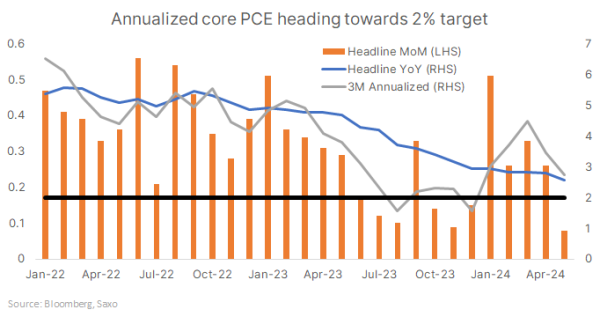

- Headline PCE: 2.4% YoY (from 2.6% prev) and 0.1% MoM (from 0.0% prev)

- Core PCE: 2.5% YoY (from 2.6% prev) and 0.2% MoM (from 0.1% prev)

This suggests that the market is positioned for a slight pickup in June PCE from the very low May numbers, but still come in below the monthly gains of 0.3% seen in February, March and April.

However, yesterday’s advance Q2 GDP data revealed that the core PCE price index increased at a 2.9% annualized rate for Q2, exceeding expectations of 2.7%. This may push the June print higher, or lead to upwards revisions for April or May. This would cast doubt on a September rate cut, which markets have largely priced in.

Potential Market Reactions

- Lower PCE Print: If core PCE comes in below 0.3% MoM, it could bolster expectations for a rate cut in September. This scenario might weaken the US dollar and support equities. Anything below 0.1% before rounding could also increase the odds of a rate cut as early as next week, given recent narrative of an economic slowdown and equity market correction. This could weaken the US dollar, but equity markets could become gripped with recession concerns and potentially see further downside pressures.

- Higher PCE Print: Conversely, an unexpected increase in the PCE figures, with core PCE at or above 0.3% MoM, could diminish the likelihood of a September rate cut. This would likely lead to a stronger US dollar and could exert downward pressure on stock markets.

Fed still needs more of the same inflation data

The Federal Reserve has indicated a cautious approach, preferring to wait for more consistent inflation data before making substantial policy shifts. Even with softer inflation readings, the Fed might only signal a potential rate cut in September without fully committing to it unless there is a notable downturn in economic conditions.

Japanese Yen remains on edge

The US dollar has seen fluctuations in recent weeks, especially against currencies like the Japanese yen, however its downside has remained relatively well contained despite a sharp surge in the yen this week. This is because of the high yield of the US dollar as well as the US election risks.

The Japanese yen remains the most at risk with the release of June PCE today.

A lower-than-expected PCE reading could push the dollar lower against the yen, with USDJPY likely moving lower to test 152 once again.

Conversely, a higher print could spur a dollar rally, potentially reversing yen’s gains and pushing USDJPY back above its 100-day moving average at 155.50.

Recent FX articles and podcasts:

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

- 26 Jun: AUD, CAD: Inflation Rising, Can Central Banks Stay on Pause?

- 21 Jun: JPY: Three-Way Pressure Piling Up

- 20 Jun: CNH: China Authorities Loosening their Grip, But Devaluation Unlikely

- 19 Jun: CHF: Temporary Haven Flows Unlikely to Fuel SNB Rate Cut

- 18 Jun: GBP: UK CPI Details and Elections Will Keep BOE on Hold

- 13 Jun: BOJ Preview: Tapering and Rate Hike Talk Not Enough to Boost JPY

- 10 Jun: EUR: Election jitters and ECB rate cut add to downside pressures

Recent Macro articles and podcasts:

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

- 28 Jun: UK Elections: Markets May Be Too Complacent

- 24 Jun: Macro Podcast: Is it time to diversify your portfolio?

- 12 Jun: France Election Turmoil: European Equities Amidst the Upheaval

- 11 Jun: US CPI and Fed Previews: Delays, but Dovish

- 10 Jun: Macro Podcast: Nonfarm payroll shatters expectations - how will the Fed react?

- 3 Jun: Macro Podcast: It is a rate cut week

Weekly FX Chartbooks:

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar