US rate cut expectations pared back to June following hot inflation print

US rate cut expectations have been pared back to June

The Federal Reserve (Fed) officials are taking a cautious approach when it comes to rate cuts, as they believe more time is needed before implementing any changes. This sentiment was reinforced by the recent inflation reading, which came in higher than expected.

Currently, the market only sees a 20% chance of a rate cut in May, compared to an 80% likelihood of a cut in June. This shift in expectations follows the January consumer price index (CPI) rising 0.3% on a monthly basis and 3.1% annually, surpassing forecasts.

Fed Chair Jerome Powell and other officials are advocating for six more months of positive inflation data before considering any policy easing. Some experts even argue that a full year of moderating inflation is necessary, suggesting that the earliest rate cut could occur in June.

Previously, investors believed that a rate cut could happen as early as March, but Powell has ruled that out. Despite significant progress in reducing inflation, other Fed speakers have urged patience.

The hot January CPI was driven by sticky services inflation and rising shelter costs. However, the Fed's preferred metric, the Personal Consumption Expenditures (PCE) index, showed more improvement in December.

The cautious stance taken by the Fed is likely to push rate cuts closer to the second half of 2023, which coincides with an election year. This approach carries the risk of facing criticism from both political parties if the cuts are perceived as either too early or too late.

Nevertheless, the Fed is expected to prioritize its mandate of fighting inflation and disregard political pressures.

Impact on stock indices, yields, US dollar and gold price

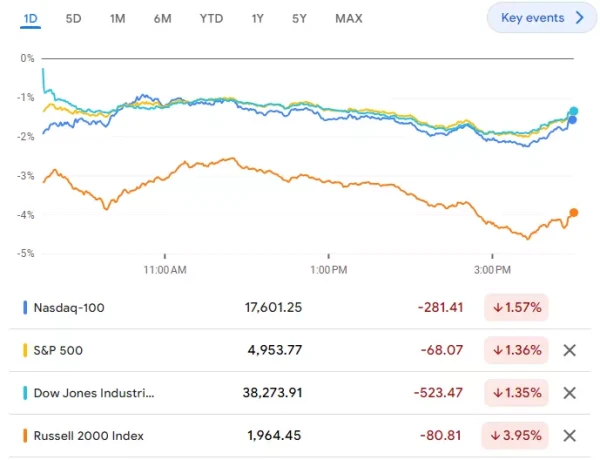

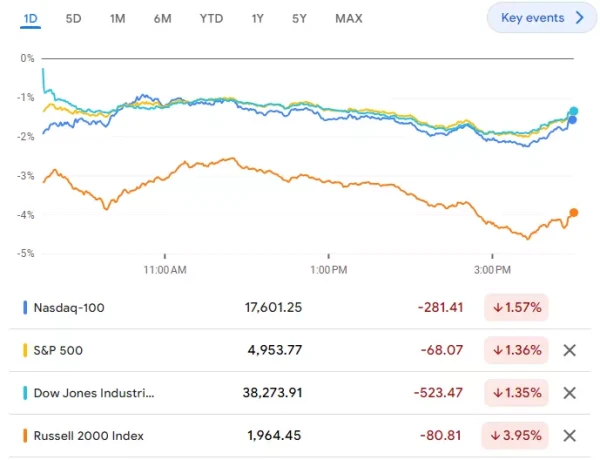

US inflation slowing less than expected led to a swift sell-off in US stock indices, tearing the Dow, S&P 500 and Nasdaq 100 from their record highs and leading to over 1% losses on Tuesday. The small caps once again bore the brunt, though, with the Russell 2000 tumbling by close to 4%.

US yields rallied - 10-year Treasuries by 10 basis points (bp) in a single day - and in response the US dollar surged higher as well while the gold price fell by 1.2%.