⏬US100 loses almost 1%

Wall Street retreats ahead of BigTech reports pressured by Meta results and GDP 📉

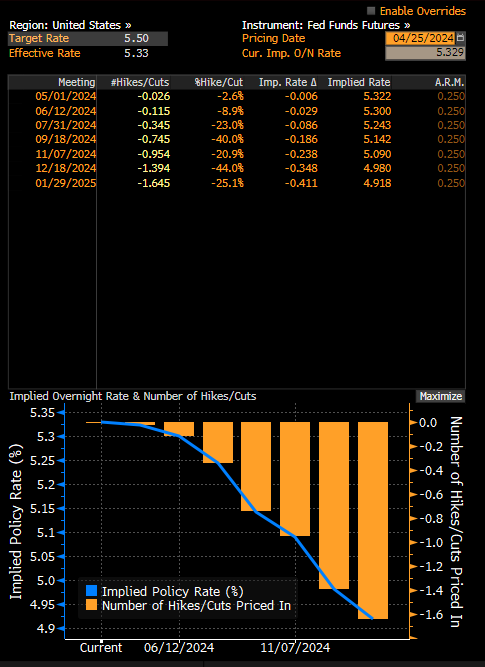

Declines on Wall Street are accelerating after today's release of Q1 2024 GDP data. The annualized change in GDP was just 1.6%, against a forecast of 2.5%. For stock market investors, however, a worse sign is the news of persistently high inflation. The GDP deflator rose to 3.1% from 1.7% at the end of last year, while the PCE Core rebounds to 3.7% from 2.0%, much above expectations. This is the worst mix of all possibles: an economic slowdown and persistently high inflation (higher than GDP = stagflation). In view of this, we are seeing a sharp decline in the valuation of interest rate cuts in the US. The probability for September is 40%, while the cumulative probability is less than 75%. The first reduction (and not all of it!) is priced for November, with December priced with almost 100% probability.

The US reduction is getting further and further away.... Source: Bloomberg Finance LP

In addition to this, it is worth noting the massive declines of Meta, which are related to weak forward guidance, despite high spending on AI. Technology giants such as Microsoft (-3.7%) and Alphabet (-2.8%) are also losing ahead of today's earnings release. We wrote about Meta and today's publishers earlier.

Many key technology companies are losing today. Source: Bloomberg Finance LP

The US100 is losing nearly 1% today, while the Nasdaq cash index is losing as much as 1.6%, which is of course linked to losses by Meta and other tech related companies. The US100 is reducing more than half of its recent rebound, and there are plenty of indications that there may be a renewed attempt to descend near 17,000 points. Slightly below is the retracement of 38.2 of the last Fibonacci upward wave and the extent of a major correction in the uptrend that has lasted since the fall of 2022.

Source: xStation5