US100 retreats ahead of Microsoft earnings 📉

🚨 Nvidia stock drops 5.5%, testing key support level

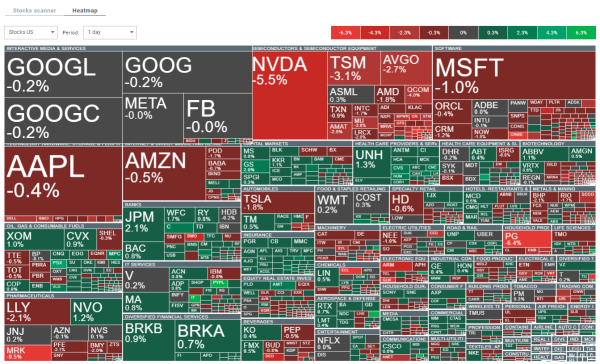

A day before the Federal Reserve's decision announcement, we observe increased uncertainty among investors and a shift of capital to safer assets like the dollar and bonds. Today's sell-off on Wall Street primarily affects technology companies and the semiconductor sector. Additional market uncertainty is also fueled by the release of Big Tech's quarterly reports this week, including Microsoft and AMD after today's session closes.

The clear leader in declines on the American stock exchange is the new technology and semiconductor sector. The sell-off is driven more by increased investor uncertainty and profit-taking. The largest declines are observed in Nvidia, which at the time of publication is down 5.5% to $104 per share. Source: xStation 5

US100

At the time of publication, US100 is down 1.15%, with bulls trying to maintain the support level around 19,000 points. The drop from peaks around 21,000 points is now almost 9.50%. The next closest support level in the event of continued correction is above 18,600 points.

Source: xStation 5

Nvidia

The largest intraday declines today are observed in Nvidia shares. The company is down 5.5% to $105.19, breaching the 100-day exponential moving average (purple curve), which has been a key support point on the chart for the company's shares this year.

From its peaks, Nvidia shares have already lost 25%. Consequently, the shares are testing support defined by the 38.2% Fibonacci retracement of the growth channel that began at the start of the year. Source: xStation