US500 bounces up ahead of the NFP report 📌

Yesterday, the US500 lost nearly 2% and today it is trying to reduce declines before the NFP at 01:30 GMT PM 🔎

Investors are slowly starting to doubt the possibility of a quick rate cut by the Fed. Although so far the stock market has not paid much attention to when a potential cut might occur, now the timing of monetary policy normalization seems to be moving further away, which may in turn discourage new investors from adding to the heavily bought market. Could the NFP change this? It's noteworthy that the U.S. labor market remains tense and at first glance does not show signs of weakness. Is there, therefore, a chance to reignite optimism about a cut if the NFP shows a weaker situation?

What does "good data" mean?

The market consensus points to another solid report from the American labor market. Theoretically, good data is a sign of a strong economy. On the other hand, it moves us away from a rate cut. What will be key for investors?

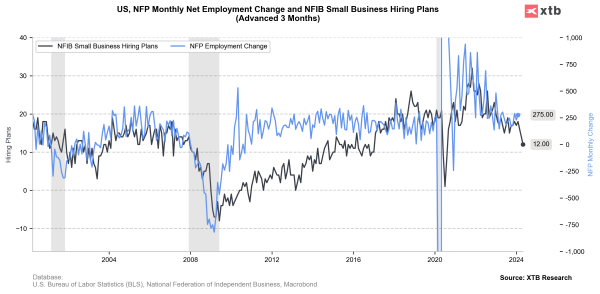

- The NFP employment change is expected to be 200,000 with a previous reading of 275,000.

- The private report is expected to show an increase of 160,000 compared to a previous reading of 223,000.

- The unemployment rate is expected to remain at 3.9%.

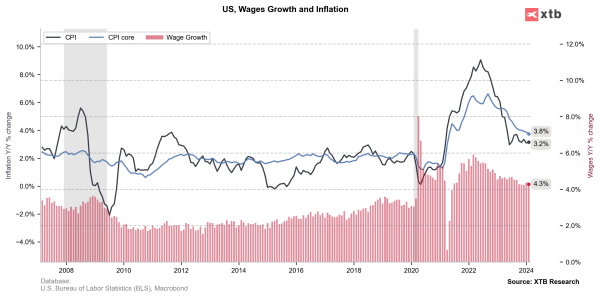

- Wage dynamics are expected to drop to 4.1% year-on-year compared to the previous level of 4.3% year-on-year. On a month-on-month basis, it is expected to be 0.3%, compared to the previous reading of 0.1%.

The ADP report was higher than expected, but has been significantly below the NFP report for many months. Source: Bloomberg Finance LP, XTB

The NFP remains very strong in recent months, averaging 250,000 over the last year. The ADP report wasn't as good in recent months, but still, the March reading showed an increase of 180,000, above expectations of 150,000. More importantly, the labor market report based on household surveys showed an average increase of 157,000. This significant discrepancy is partly due to the counting methodology and the fact that many people takes more than one job.

What do other readings show?

- The ADP report showed an employment index increase of 180,000, against expectations of 150,000 and a previous reading of 155,000. ADP has been consistently below NFP, but the latest reading is exceptionally strong.

- The employment sub-index from the ISM manufacturing rose to 47.4 from 45.9 but remains below the 50-point mark.

- The employment sub-index from the ISM services rose to 48.5 from 48 points, still below 50 points.

- The Challenger report showed an increase in planned layoffs to 90,310 from the previous level of 84,640.

- JOLTS shows an increase to 8.756 million open jobs from 8.748 million.

- Unemployment benefit claims rose to 221,000 from 212,000, stabilizing above 200,000 this year.

- Regional Fed reports and the NFIB small business report show weaker employment prospects.

A further decline in wages will be important for the direction of inflation. If wages turn out worse than expected, it will be a sign for the Fed that everything is heading in the right direction. On the other hand, there are voices within the Fed itself that inflation may be sticky (partly due to oil prices), which may significantly delay the first rate cut. Source: Bloomberg Finance LP, XT

Generally, many factors have been indicating a weakening in the labor market for some time, but NFP reports remain very strong. Additionally, NFP usually differs from the consensus, often showing significantly better readings. It is therefore difficult to specify exactly what to expect from today's report. Theoretically, the report should be solid, so how the market reacts may largely depend on the wage index. If wages meet expectations or will be weaker, there is a chance to recover some of yesterday's losses. However, if wages remain unchanged or increase, then there is a chance for a continuation of the downward movement in the US500 and a recovery of losses on the dollar.

The NFIB report indicates a possible worsening in the employment situation. On the other hand, the NFP report has long been beating market consensus. Source: Bloomberg Finance LP, XTB

S&P 500 holds the important support zone

The S&P 500 index contract, or US500, defended an important support yesterday in the form of the range of the largest correction in the upward trend that began at the end of October. On the other hand, there was a breakthrough of the uptrend line. The last such breach of the uptrend line resulted in a correction from the local peak of about 5.5%, which would mean a drop to just above 5000 points with a 23.6% retracement. At the same time, if the labor market report turns out to be much worse than expected, particularly in terms of lower wages, a rebound to around 5270 points, where the opening of yesterday's bearish candle is located, cannot be ruled out. Such a scenario is supported by the recent rebound in TNOTE bond prices from around an important support area.

On March 8th, during the previous NFP report, the initial reaction was positive, partly due to lower wages, but then the US500 underwent a correction of over 1%. Source: xStation5.