➡️US500 Limits Declines Ahead of ADP

Wall Street Indices Stabilize Before Key Labor Data

The US500 tries to rebound today, following a significant pullback in the first part of the week. Notably, we're also seeing strong gains in bond prices, which theoretically should support Wall Street's upside move.

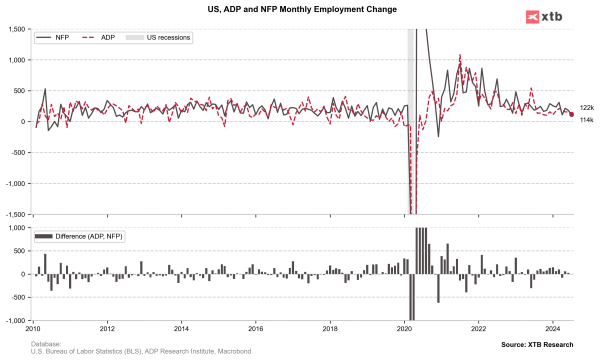

Today, we'll receive another crucial piece of data from the US labor market, following yesterday's JOLTS report. It's worth highlighting that yesterday's weak reading referred to July, aligning with the very weak previous NFP reading. Today's ADP report is expected to show a rebound compared to the previous reading. ADP is set to show a rise to 145k from the previous level of 122k in August. Although the ADP report has been a rather weak indicator for NFP in the last two years, the past three months have shown a clear decline in the difference between these two reports. Therefore, there's a chance that today's ADP reading will set the tone for indices on Wall Street and for the dollar.

It's worth remembering that the July job data published in the beginning of August, which came in at 114k (with an expected rebound to 160k for August), led to significant concerns about the health of the US economy, resulting in a massive correction of almost 10% of US500 in early August. A rebound in US employment should restore market sentiment, but on the other hand, another weak reading closer to 100k could revive market fears and simultaneously significantly increase the likelihood of a 50 basis point rate cut during the September Fed meeting, scheduled for September 18th.

Source: Bloomberg Finance LP, XTB

Source: Bloomberg Finance LP, XTB

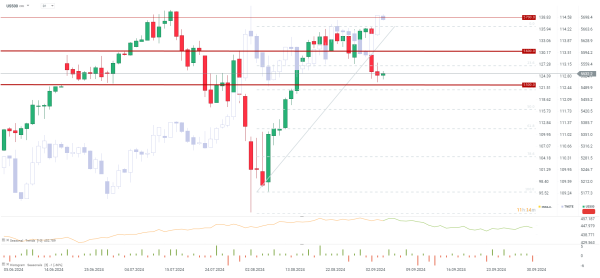

US500

The US500 tries to rebound today, with clear lower candle shadows forming below the 5530 level. However, at the 5555 level, we can notice a resistance in the form of the 23.6 Fibonacci retracement of the recent upward wave. The key demand zone is located at the 5500 level along with the 38.2 Fibonacci retracement. A significantly lower-than-consensus reading should lead to a breach of the aforementioned support. On the other hand, a reading closer to 180-200k could lead to a breakout above 5600 points. A reading close to the consensus should allow for a moderate rebound to the 5555 level.