💲USD gains ahead of PCE reading

📆 US PCE inflation data for February will be released today at 12:30 pm GMT

In spite of Good Friday being a holiday in the United States and many other markets being shut already for the Easter holiday, traders will be offered a key piece of US data in the early afternoon today - PCE inflation report for February. This is Fed's preferred measure of inflation and is closely watched by markets participants. It is expected that the headline PCE will accelerate due to higher wages and spending, as well as higher gasoline prices. However, core PCE is expected to decelerate further or stay unchanged compared to the previous month. Will today's reading change Fed's thinking on rate cuts?

What markets expect?

- Headline PCE (annual). Expected: 2.5% YoY. Previous: 2.4% YoY

- Headline PCE (monthly). Expected: 0.4% MoM. Previous: 0.3% MoM

- Core PCE (annual). Expected: 2.8% YoY. Previous: 2.8% YoY

- Core PCE (monthly). Expected: 0.3% MoM. Previous: 0.4% MoM

- Personal income. Expected: 0.4% MoM. Previous: 1.0% MoM

- Personal spending. Expected: 0.5% MoM. Previous: 0.2% MoM

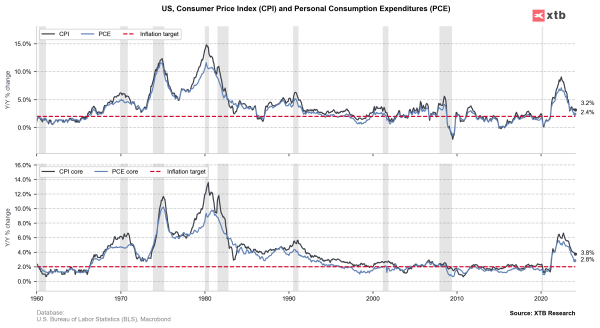

PCE inflation as well as core PCE inflation have been lower than CPI levels. Fed expects headline PCE at the end of this year at 2.4% YoY and core PCE measure at 2.6% YoY. Source: xStation5

PCE is key inflation measure for Fed

We have learned a lot of data since the beginning of this year, indicating that inflationary pressures are not over yet. We have seen higher-than-expected CPI and PPI inflation readings. Additionally, labor market data indicates a still tense situation with demand exceeding supply. On the other hand, Powell has pointed out that slightly higher inflation readings this year may be just "hiccups" on the downward path of inflation. At the same time, core PCE inflation is the preferred inflation measure by the Fed, so today's reading may give us an answer as to whether the Fed will still consider cutting interest rates in the first half of this year. At this moment, Powell doesn't see much certainty that inflation is heading towards its target, but a monthly inflation reading at the level of 0.3% m/m may add some confidence. Each higher reading may delay the timing of the rate cut to the later part of the current year.

Cook and Waller from the Fed recently indicated that there is no rush to cut rates as inflation, has become somewhat stickier, and the risk of premature or too large a cut is too high. Therefore, readings of around 0.3-0.4% for core monthly inflation may not change the current market perception and leave the dollar at its current or stronger level. Only a smaller increase in the range of 0.2% m/m for core inflation and an increase in the range of 0.2-0.3% for headline PCE inflation could be interpreted by the market as bearish for US dollar and increase the chances of a cut in June. Recently, the probability of a June cut has dropped from around 70% to 57%.

How will the markets react?

Most markets are closed on Good Friday, but as usual, the FX market operates normally, and, throughout the holidays, the cryptocurrency market will be active. The EURUSD pair has been declining recently, which was associated with diminishing chances of interest rate cuts in the first half of this year. The pair tested the 1.0770 level today, and attempts to rebound from this level can be observed now. If inflation comes in lower than expected, especially core monthly inflation (which is possible due to the decline in car prices, decreasing rental costs, or a small increase in medical prices), then EURUSD may see an increase today, even up to the 1.0800 level. However, high fuel prices will likely lead to an increase in headline inflation, so a negative surprise and further upward pressure on the dollar cannot be ruled out.

Source: xStation5