USD Gains on Solid Personal Spending Data; Fed Signals Potential Rate Cuts Amid Labor Market Concerns

The US dollar shows signs of strength, buoyed by recent data on Personal Spending. According to the report released on Friday, core inflation, excluding volatile food and energy prices, ticked up by 2.6% year-over-year. This is slightly below market expectations but aligns with the Federal Reserve’s inflation targets. Month-over-month, inflation increased by 0.2%, a figure that had already been anticipated by the market.

Historically, PCE inflation has been a critical gauge for the Fed’s interest rate decisions. However, this time around, medium-term data’s impact may be muted. The Fed’s recent communications have indicated growing confidence that inflation is gradually aligning with the central bank’s 2% target. This shift in focus has led Fed officials to express increasing concern about potential risks to the US labor market, which could influence the trajectory of future rate cuts.

Fed Chair Jerome Powell’s remarks at the recent Jackson Hole Symposium underscored this pivot. He acknowledged that the balance of risks has shifted, implying that the Fed is prepared to act swiftly, potentially with aggressive rate cuts, should the labor market show signs of significant weakening.

Earlier today, European Central Bank Executive Board member Isabel Schnabel made waves with comments that injected a hawkish tone into European markets. Despite recent signs of disinflation in the Eurozone, Schnabel was clear: the ECB is not considering a series of rate cuts just yet. This cautionary stance has provided some support to the Euro, although technical bearish pressure continues to the dominant near-term force that drives prices lower:

According to US interest rate derivatives, there is a 67.5% probability of a 25 basis points rate cut in September, with a 32.5% chance of a more substantial 50 bps cut. Looking further ahead, the market anticipates another 25 bps reduction in November, assuming a 25 bps cut materializes in September.

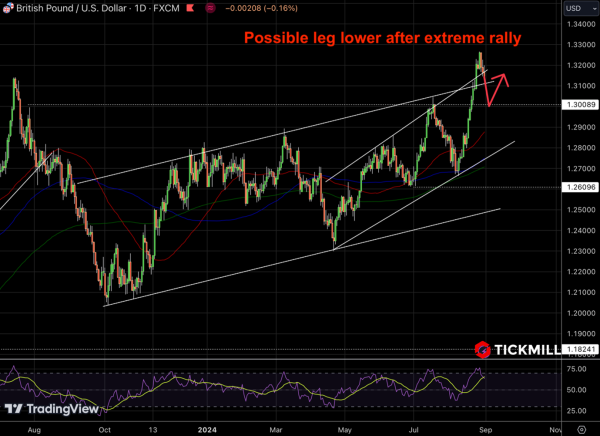

The British Pound exhibits mixed performance against its major counterparts today. Despite this, the broader outlook for the GBP remains relatively strong. Investors are increasingly confident that the Bank of England will adopt a more gradual approach to policy easing compared to other major central banks:

Current money market pricing suggests that the BoE is likely to reduce interest rates by 40 bps by year-end, a more measured approach than the 65 bps expected from the ECB and the 100 bps anticipated from the Fed. This expectation of a shallower easing cycle is supported by an improving economic outlook for the UK. The International Monetary Fund (IMF) recently revised the UK’s GDP growth target for this year upwards to 0.7%. Furthermore, fiscal policies from the new Labour government, led by Prime Minister Keir Starmer, including planning reforms and stronger trade ties with the European Union, are expected to stimulate economic activity.