USD Gains Strength as PCE Inflation Surges

Greenback flexes its muscles, propelling EUR/USD to cling to the lower 1.070s range in the wake of robust US inflation figures unveiled by the Personal Consumption Expenditures (PCE) report. The data, showcasing a steeper-than-anticipated climb in the Fed's preferred inflation metric, rings alarm bells as it breaches market forecasts.

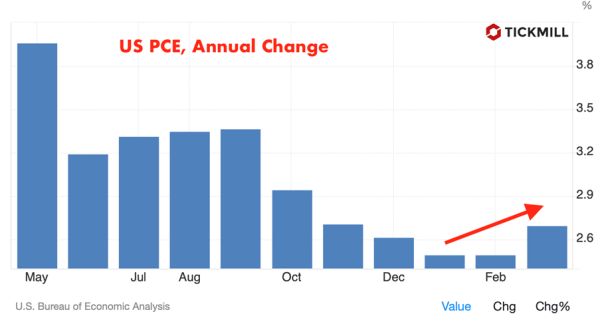

March's annual PCE inflation notches a resilient 2.7%, surpassing February's 2.5%, and notably eclipsing market expectations by 0.1%. This uptick signals an escalating inflationary environment in the US since the year's inception, aligning closely with revised market sentiments regarding the anticipated timing of the Federal Reserve's easing cycle:

The core PCE Price Index, excluding volatile components like food and energy, maintains its robust stance, holding firm at 2.8% year-on-year, defying analysts' projections by 0.2%. A monthly analysis reveals a consistent 0.3% uptick in both the PCE Price Index and its core counterpart, underscoring the enduring inflationary pressures.

Further dissecting the report, Personal Income marks a monthly ascent of 0.5% in March, paralleled by a hearty 0.8% surge in Personal Spending. Such buoyancy in consumer behavior underscores a resilient domestic economic landscape.

The Federal Reserve's recalibrated Summary of Economic Projections (SEP), elucidated through the dot plot post-March meeting, projects a year-end core PCE inflation of 2.6% for 2024, a notable uptick from December's forecast of 2.4%. This upward revision underscores the central bank's acknowledgment of inflationary momentum.

Nevertheless, Thursday's narrative saw the Greenback stumble amid the US Bureau of Economic Analysis's revelation of a modest 1.6% annualized expansion in first-quarter real Gross Domestic Product (GDP), markedly divergent from market expectations of 2.5%. However, a silver lining emerges as the GDP Price Index surges to 3.1% from 1.7%, buttressing the USD against steeper declines.

As US stock index futures soar after the upbeat economic report, the prevailing risk-on sentiment could temper the USD's bullish trajectory in the American trading session.

Market indicators, particularly Federal funds futures, signal a substantial 90% probability of the Fed maintaining the policy rate unchanged in June. With investors having digested the quarterly PCE Price Index adjustment, the monthly inflation data is poised to exert a fleeting influence on rate expectations.

There was a kind of ambiguity in the short-term technical picture of EURUSD since the market managed to stage a recovery and, after a failed test of the 1.07 level, made a second attempt at a breakthrough. Fresh inflation insights, however, usher in a newfound consensus, anticipating prolonged resistance at the 1.07 level and a potential swing lower towards the lower bound of the bearish channel before a transition to a bullish trend is possible: