💲USDIDX gains 0.25% ahead of FOMC minutes

🗽Wall Street await latest FOMC minutes scheduled at 7 PM BST

The FOMC Minutes will be one of the most important events of today's session, although it cannot be ruled out that the tone for financial markets will be set by a series of statements by Fed bankers just before today's event. Prior to the release of the minutes, we will be able to hear statements from Bostic, Logan, Goolsbee, Barkin and Jefferson. Collins will also speak after the minutes as soon as the Wall Street session closes. In view of this, the latest statements by Fed members will be a fresher look at monetary policy than the transcripts of the talks from the meeting 3 weeks ago.

What will the FOMC minutes show?

Despite the fact that it has been 3 weeks since the last interest rate decision, it is worth noting what drove bankers to decide to cut interest rates more. If bankers are confident in the economy, this should not hurt US assets much. However, if the decision was driven by major concerns about the labor market, it could hurt the dollar and Wall Street. What is worth noting in the minutes?

- Mixed Fed views, because the decision to cut was made, but Bowman voted for a 25 basis point cut, while macro send signals of improvement, amid higher oil prices

- Of great importance is the voice of the chief himself, who pointed out the legitimacy of a larger move and most likely could convince most of those undecided about a larger cut

- If the minutes show that Powell had to convince a large portion of FOMC members, those members may now opt for a 25 basis point cut at the next meeting

A 50 basis point cut could signal a recalibration of policy, and any subsequent move would be more of a standard one

The reason for more reductions may be economic weakness, which is not so evident in the data (especially the recent ones)

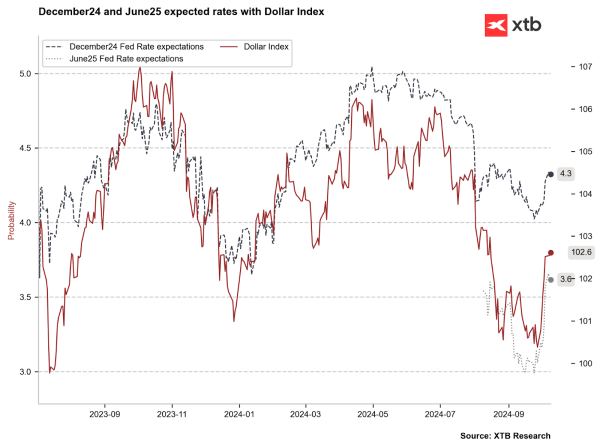

Given the recent better data from the U.S. economy (especially from the labor market), there is a chance that most of the undecided members who were persuaded by Powell will bet on a smaller 25 basis point cut at the November meeting. Currently, the market sees two more cuts this year and an average effective rate of 4.3%. In contrast, for next June, the market sees 4-5 cuts with an effective rate of 3.6%.

Expected rates for the end of this year and the middle of next year have risen, which has been met with a strengthening of the dollar. Source: Bloomberg Finance LP, XTB

How will the market react?

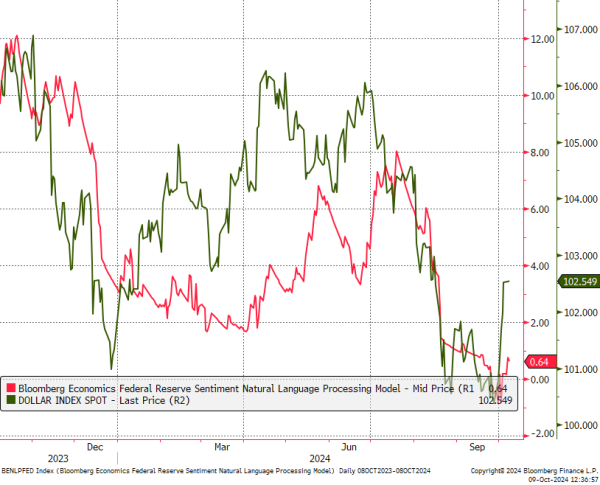

According to the Bloomberg model, to process the Fed members' statements, their attitude has not changed significantly, so the justification for the recent strengthening of the dollar will depend on their words. If they rule out the possibility of a 50 basis point cut, the dollar still has the prospect of strengthening. However, if it turns out that they would like to see a continuation of stronger reductions, then the dollar is likely to resume its downward trend. However, Powell stance is still 'dovish' with his pivotal 'speech' (reflecting overall FOMC policy stance) amid September rate cut, so overall volatility after today FOMC may be not as high, especially if the report will not show any major surprises.

The sentiment index of Fed members' statements did not change significantly, and the dollar strengthened. Source: Bloomberg Finance LP

The US dollar index (USDIDX) has rebounded more than 2.5% since the end of September and is now at its highest since mid-June. The dollar is also currently quite oversold, looking at CFTC data. At the same time, seasonality points to dollar weakness through the end of October. However, keep in mind that there are many interesting events ahead: today's FOMC, CPI inflation for September (tomorrow at 1:30 PM BST), followed by PCE inflation and the NFP report for October. All these events will take place before the presidential election, and two days after the election there will be a Fed decision. As you can see, there will be plenty of reasons for volatility.

USDIDX (D1 interval)

USDIDX is currently testing an important resistance zone between the 38.2 and 50.0 Fibo retracement of the last downward wave. If the Fed minutes show that the 50bp cut was a one-off affair, and bankers hint at 25bp, then there is a chance to break through at least to the 103 level. A rise to 104 would require higher inflation than expectations and a number of positive other readings from the US. Even with a rise to 103, a quick start to a correction would be possible. Nevertheless, if today's minutes show dovishness, then the target would be the range around the 23.6 retracement and at the 101 level for the dollar index.