⏬USDJPY falls by 1.3%

Yen strengthens markedly against likely currency interventions 📌

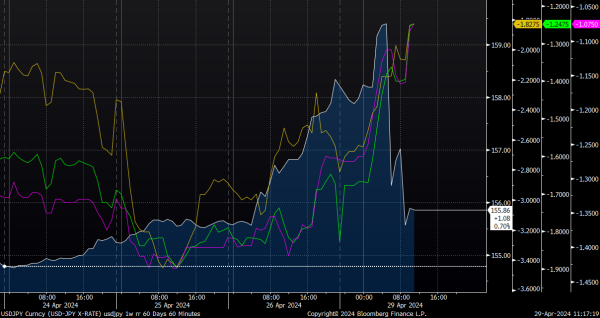

The end of April, coinciding with the start of a new week, brings a significant surprise in the currency market. The USDJPY pair tested the 160 level at 2:35 AM GMT, which was a potential point where the Japanese government might consider intervention. At 5:05 AM GMT, the yen began to strengthen sharply, with the USDJPY pair losing nearly 2% today. Two strong downward waves are noticeable on the pair – an earlier one after 5 AM GM, and a later one after 8 AM GMT, coinciding with the opening of European markets.

Was this a currency intervention? Kanda, the government's currency representative, refused to comment on whether an intervention had occurred, but indicated that the yen is too weak and the government will take appropriate measures against excessive movements in the currency market. Kanda also noted that a report on potential interventions will be released at the end of May. The government is not targeting any specific levels on the USDJPY pair, but the yen's weakness has become a political issue due to rising inflation, including on the import side. A weak yen means increasingly expensive fuel, especially with the current rising price of oil.

The USDJPY pair fell from 160 to 155. The pair tested the lowest levels since April 22. Earlier today, it was testing the highest levels since 1990. Source: xStation5

If the pair falls permanently below 155, the next target would be around 152.60 at the 38.2% retracement. Source: xStation5

Can we expect a sustained strengthening of the yen?

Yields in the US remain high, and the Fed has a pretext to maintain a hawkish monetary policy. If inflation in Japan begins to surprise at higher levels, there is a chance for another rate hike by the BoJ mid-year, which could open the way for a sustained currency strengthening. On the other hand, the determination of the Japanese government may be tested again – currency interventions often aren't very effective in the short term. Furthermore, the options market hasn't significantly changed its stance. While put options are still more expensive than call options, trends in the "risk-reverse" indicators suggest another possible test of recent local highs.

The options market doesn't significantly change its stance following potential interventions on the USDJPY. Source: Bloomberg.