⏬USDJPY trades lower ahead of NFP

USD is weakening the most against the yen ahead of key labor market data 🔎

Key data from the U.S. labor market is ahead, which may increase expectations for more significant interest rate cuts by the Fed, and more importantly, further raise concerns related to a recession. Although market consensus remains high, recent signals indicate that the labor market remains weak and may weaken further in the coming months. What to expect from today's report, and how will the market react?

Market expectations and signals from the labor market:

- The market consensus for today's reading suggests non-farm employment growth in the range of 160-165 thousand.

- The "whisper number" among traders on the Bloomberg platform is 152 thousand for the main reading, while Bloomberg Economics suggests a reading of 145 thousand.

- The previous reading was 114 thousand.

- The lowest forecast from Bloomberg is 100 thousand, and the highest is 208 thousand. Readings below or above this range could lead to extreme market movements. The largest number of forecasts point to 160 and 175 thousand, with a median of 165 thousand.

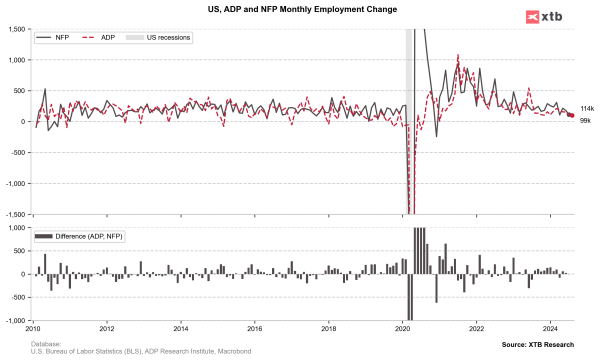

- The ADP report for August was weak and indicated employment growth of 99 thousand.

- The Challenger report showed a significant increase in planned layoffs, the number of open job positions according to the JOLTS report decreased, the Fed's Beige Book pointed to weak economic and labor market prospects in the coming months, and the ISM sub-indices for the labor market also indicated a worsening situation compared to the previous month.

- The market expects the unemployment rate to decrease to 4.2%, as the increase to 4.3% in the previous report was due to one-time factors. However, Bloomberg Economics points to the possibility of the rate remaining at 4.3%.

- Historically, NFP employment changes for August have disappointed by about 30 thousand, and August has usually been the most disappointing month of the year.

Although the ADP report has not been strongly correlated with NFP in the past two years, the last three months have shown a clear decrease in the difference. If the NFP employment change comes out similar to ADP, investors may increase expectations for interest rate cuts by the Fed, further sell off the dollar and stocks on Wall Street, and increase exposure to safer assets like the yen or gold. Source: Bloomberg Finance LP, XTB

How will the market behave?

-

Of course, many times this year, we have had situations where everything pointed to a weak NFP reading, but it ended up being positive. The BLS also clearly revised employment over the past year.

-

Therefore, it's hard to say what reading we should expect today. Nevertheless, anything around 100 thousand or lower will most likely weaken the dollar and also weaken indices on Wall Street, indicating a high risk of recession.

-

On the other hand, if the NFP comes out as expected or higher, the dollar may recover recent losses, and the US500 might try to bounce back.

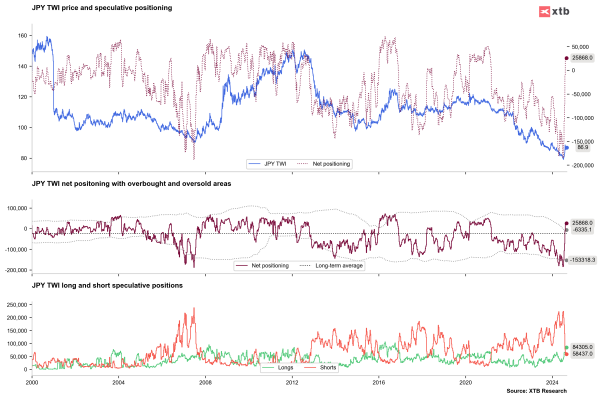

JPMorgan increased the number of long positions on the yen ahead of today's NFP report, expecting a weak reading. As the chart below shows, we are currently observing an extremely large number of net positions on the yen, and the situation is very similar to what we saw in 2007 and the following years.

Source: Bloomberg Finance LP, XTB

USDJPY

The USDJPY pair today is close to the 142 level, which is the lowest level recorded for the pair since the beginning of January this year. A very low reading below 100,000 and an increase in the unemployment rate could push the pair to drop below this support. A reading around 150 or higher may lead to a corrective rise to the 144-145 range.

Source: xStation5

US500

The US500 is clearly losing ground ahead of the NFP report. A reading below 100,000 could lead to a decline to the area of 5400 points at the 50.0 retracement level. Readings between 100,000 and 150,000 could lead to a test of 5450 points but also a subsequent rebound from the demand zone. Readings above 150,000 and a drop in the unemployment rate could push the index above 5500-5550.

Source: xStation5