Volatility Report – December 19, 2023

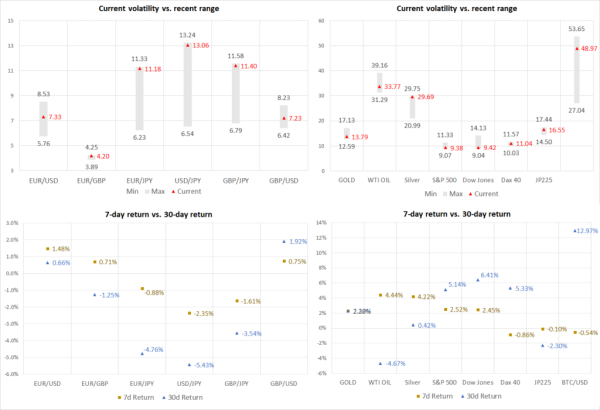

EUR/USD volatility eases aggressively, major JPY crosses remain in turbulent waters

Gold and oil volatility at their midpoints, silver expected to experience sizeable moves

Volatility drops in stock indices except JP225; Bitcoin returns to calmer periods

EUR/USD expected volatility dropped to the lowest level of the past 30 days as the market appears to be preparing for the much-needed break. However, volatility in yen crosses remains extremely elevated but it is eventually expected to embrace the festive spirit.

In commodities, gold volatility is fading despite the recent upside move. On the flipside, silver continues to experience very high volatility, amidst a strong 4%+ weekly rally. Surprisingly, oil volatility has picked up a bit but remains below its 30-day midpoint.

Turning to risky assets and implied volatility across major stock indices has been falling despite Dow Jones and Dax 40 registering new all-time highs. Interestingly, the JP 225 is the only equity index to exhibit increasing volatility, while Bitcoin has returned to the middle of its volatility range.

We have prepared a video and a guide detailing the Implied Volatility Report's structure and importance.Please see the following report

We have prepared a video and a guide detailing the Implied Volatility Report's structure and importance.Please see the following report