Volatility Report – January 9, 2024

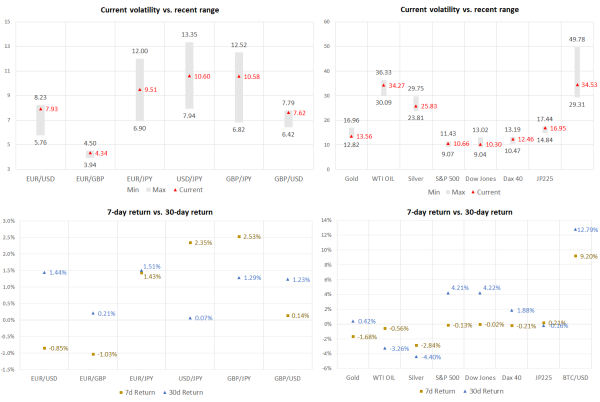

EUR/USD and GBP/USD volatility picks up, JPY crosses seem quiet

Gold and Silver volatility inches lower, oil and Bitcoin set for big moves

US indices in calm waters; DAX and JP225 volatility at monthly highs

EUR/USD expected volatility remains high after a market moving NFP report and ahead of the US CPI data on Thursday. On the flip side, yen crosses are expected to experience very low volatility going forward.

In commodities, gold and silver implied volatility has fallen substantially compared to last week, with both metals extending their retreats. In contrast, oil prices remain on top of their volatility range fueled by a resurgence of geopolitical concerns in the Middle East.

Turning to risky assets, the implied volatility of major US stock indices has dropped ahead of the upcoming earnings season, which unofficially starts on Friday. However, DAX remained highly volatile after some stronger-than-expected economic data releases from Europe on Monday, while JP225 volatility surged in the aftermath of the powerful earthquake.

In the meantime, Bitcoin’s volatility has also risen due to the buzz around an impending spot-Bitcoin ETF approval, with the king of cryptos posting an impressive 9.2% weekly return.

We have prepared a video and a guide detailing the Implied Volatility Report's structure and importance.Please see the following report

We have prepared a video and a guide detailing the Implied Volatility Report's structure and importance.Please see the following report