Volatility skyrockets across the board after an eventful week – Volatility Watch

Euro/dollar volatility surges to the highest level of the month

Volatility in commodities reaches new monthly high

Stock indices experience very high volatility

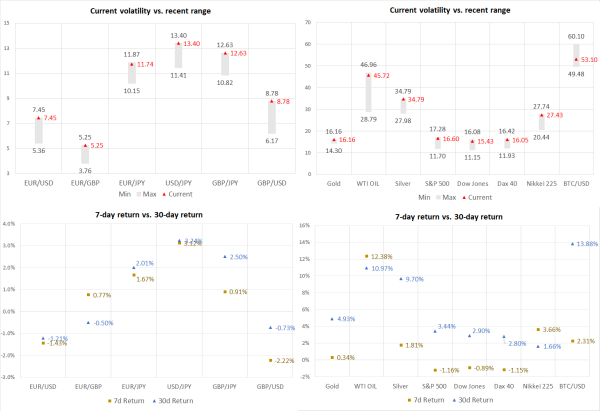

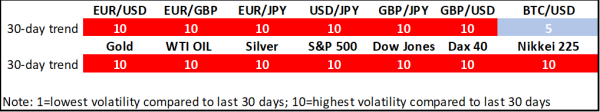

Euro/dollar volatility has reached the highest level of the past 30 days, as the FX market was rocked by the strong US labour market report, denting the possibility of another 50bps Fed rate cut in November. Similarly, the volatility of yen crosses has risen aggressively, with the yen surrendering a good chunk of its recent sizeable gains on the back of weaker data and a snap election called for late October.

Volatility in the commodities space remains very elevated as both gold and silver recorded weekly price gains due to further episodes in the Israel-Iran conflict, and despite the strong dollar outperformance. In the meantime, WTI oil volatility reached a new monthly high, after its price jumped by around 12% on back of the latest Iranian attacks against Israel and fears of an Israeli retaliation targeting Iran’s vast oil installations.

With most stock indices recording weekly losses due to the latest developments in the Middle East, volatility is staying very high. Market participants are also digesting the fact that the Fed will most likely adopt a more conservative easing strategy ahead, with the focus firmly turning to Thursday’s US CPI report.

Finally, bitcoin is experiencing average volatility, well below last week’s level, as it managed to rally on a weekly basis despite the risk-off reaction seen in equities and the dollar's strong performance.