Volatility surges across the board – Volatility Watch

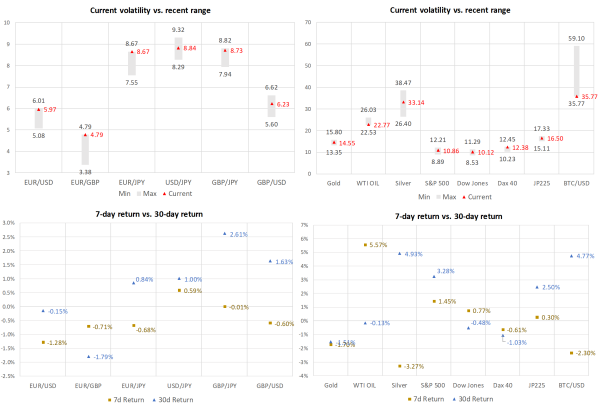

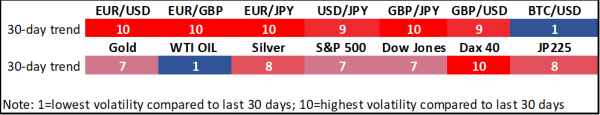

Forex pairs are very volatile after strong NFP report

Volatility in gold and silver ticks up, oil swims in calm waters

US equities exhibit volatility jump amid correction fears

Volatility in dollar crosses has picked up as the stronger-than-expected NFP report dialed back rate cut expectations, while investors are bracing for the FOMC meeting and the CPI print later this week. Euro pairs are in a similar position after the EU elections sparked a wave of politically instability across major countries like France and Belgium.

In commodities, gold and silver have experienced a volatility boost driven by the moves in the greenback. Meanwhile, oil volatility seems surprisingly low given that it has grabbed the headlines after OPEC+'s latest meeting.

Turning to risky assets, volatility in US stocks has increased as the prospect of fewer rate cuts by the Fed might have increased fears of an impending pullback. In Europe, volatility in stock indices rose as the continent is facing political instability after this weekend’s EU elections.