Wall Street indices failed to maintain rebound after ISM data 📉US30 loses 0.8%; Copart drops 7%

- Wall Street indices failed to rebound after only slightly stronger than expected ISM Services data

- US30 loses 0.8%, weakening the most among major US indices

- Pharmaceutical sector loses; Novo Nordisk (NVO.US) and Eli Lilly (LLY.US) drop 2.7% and 3.8% respectively

- Nvidia erases early gains; dropping from $110 to $106 per share; Nasdaq100 loses almost 0.5%

- Weak Copart (CPRT.US) and Hewlett Packard (HPE.US) quarterly reports; both stocks decline

US stock market sentiment is weakening, dragged by weaker than expected labor market data. Also, ISM Services Employment reading came in weaker, signalling further softening. Investors are afraid of stagflation and recession scenario; analyzing still high premium across the US equities valuations. After ISM publication data, volatility index (VIX) was almost 7% lower on a daily basis; now the benchmark is down only 1% signalling very high appetite (and price) of risk hedging ahead of Friday US NFP report.

Services ISM / PMI Data for August:

- ISM Non-Manufacturing Prices: actual 57.3; forecast 56.0; previous 57.0;

- ISM Non-Manufacturing Business Activity: actual 53.3; previous 54.5;

- ISM Non-Manufacturing Employment: actual 50.2; forecast 50.5; previous 51.1;

- ISM Non-Manufacturing New Orders: actual 53.0; forecast 51.9; previous 52.4;

- ISM Non-Manufacturing PMI: actual 51.5; forecast 51.3; previous 51.4;

- S&P Global Composite PMI: actual 54.6; forecast 54.1; previous 54.3;

- S&P Global Services PMI: actual 55.7; forecast 55.2; previous 55.0;

ADP Non-farm Private Employment Change: 99k vs 144k exp. and 111k previously

US jobless claims change: 227k vs 230 exp. and 231k previously

- Continued jobless claims surprisingly dropped to 1.838M vs 1.867 exp. and 1.868 previously

- Revised US labor costs dropped to 0.4% MoM vs 0.8% exp. and 0.9% previously; productivity came in the same at 2.5% higher YoY

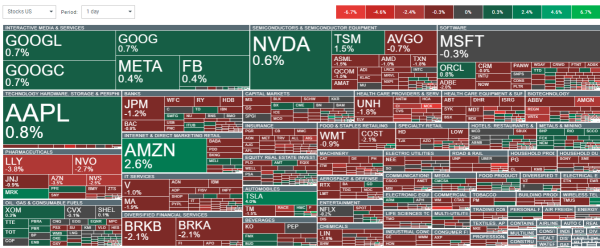

Almost any stock out of US largest caps is traded down today. The strongest ones are Tesla (TSLA.US) and Merck (MRK.US). Healthcare, biotechnology, pharmaceuticals and financial services are the weakest sector today. Source: xStation5

Almost any stock out of US largest caps is traded down today. The strongest ones are Tesla (TSLA.US) and Merck (MRK.US). Healthcare, biotechnology, pharmaceuticals and financial services are the weakest sector today. Source: xStation5

Source: xStation5

Source: xStation5

Companies news

- C3.ai (AI.US) slides 19% after the software company reported 1Q subscription revenue that’s weaker than expected.Frontier Communications (FYBR.US) loses 10% after agreeing to be purchased by Verizon Communications.

- Brazilian financial services provider PagSeguro (PAGS) fall 11% after Morgan Stanley analysts downgraded the Brazilian digital payments company, saying the market has likely reached saturation.

- Also, Hewlett Packard Enterprise (HPE.US) slips 3% after the computer hardware and storage company reported weaker-than-expected margins.

- Tesla (TSLA) rises 3% on plans to launch the advanced driver assistance system that it calls Full Self Driving technology in China and Europe in the first quarter of next year, pending regulatory approvals. Also NIO ADRs (NIO.US) gain 3.5% after the automaker reported 2Q gross margin that came ahead of estimates.

Copart (CPRT.US) slips 7% after posting 4Q operating income that missed estimates. Company Q4 (calendar Q2 2024) and full-year fiscal 2024 financial results increased but not as much as Wall Street expected. Quartlerly sales increased by 7.2% to $1.1 billion, but gross profit decreased by 0.9% to $454 million. Net income dropped by 7.3% YoY to $323 million. Fully diluted EPS for Q4 was $0.33, also down 8.3% YoY, while Copart stock increased 10% in this period. For the full fiscal year 2024, Copart's revenue grew 9.5% to $4.2 billion, gross profit increased 9.8% to $1.9 billion, and net income rose 10.1% to $1.4 billion. Full-year diluted EPS was $1.40, up 9.4% from the previous year.

Copart (CPRT.US, D1 interval)

Shares of Copart, global provider of online vehicle auction and services related to automotive resellers such as insurance, car rental and credit are dropping today below SMA200 (red line), signalling at least short-term trend reversal. Despite strong quarterly report, investors are selling Copart amid valuation concerns and weakening economy fears

Source: xStation5

Source: xStation5