Weekly FX Chartbook: China Stimulus Adds to Fed-Driven Risk-On Ahead of Jobs Day

Key points:

- USD: Downside pressures could persist if soft-landing expectations remain

- JPY: Hawkish PM adds to the bull case

- EUR: Growth headwinds to pave way for ECB’s October rate cut

- AUD: Boosted by China stimulus

-------------------------------------------------------------------------------------------------------

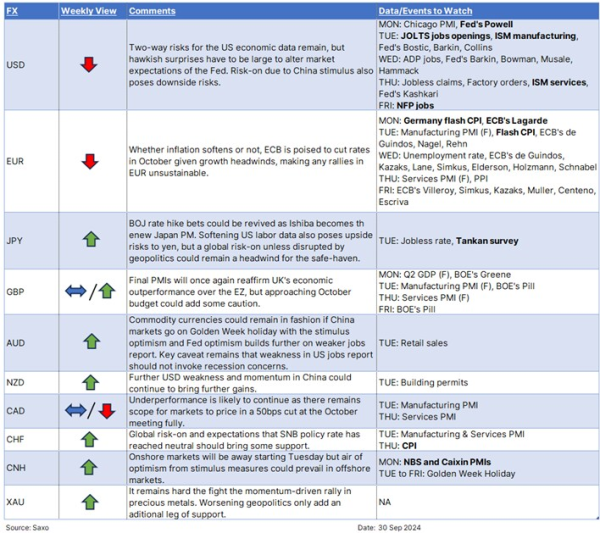

USD: NFP Data is a Key Input Fed’s November Decision

SAXO Analysis: The narrative of a soft landing continues to shape the outlook for the USD, leaning on the weaker side. Recent US data has pointed toward this scenario, which is USD-negative, and the upcoming jobs report is likely to reaffirm this trend. The bar for a hawkish surprise is high, while a somewhat weak headline jobs growth could propel markets to price in another 50bps rate cut from the Fed in November. Meanwhile, China's stimulus measures are boosting global risk appetite, adding further downside pressure on the USD.

This week will also feature remarks from several Fed members, including Chair Powell and the dissent voter Bowman. However, with the dot plot has already laid out the variance of views in Fed's expected path forward, and the commentary is unlikely to break this confusion. Focus remains heavily tilted toward key data points, especially Friday’s nonfarm payrolls but also ISM manufacturing and services PMIs. September's NFP is expected to show 145k new jobs, with the unemployment rate steady at 4.2%, and average hourly earnings growth easing slightly. Before that, Tuesday's ISM Manufacturing and Thursday's ISM Non-Manufacturing PMIs will be scrutinized for signs of how the US economy wrapped up Q3.

For the USD to sustain any gains, both the jobs report and ISM data would need to exceed expectations. However, the odds are stacked toward a balanced, but dovish, outcome, meaning the dollar may struggle to hold ground if the data confirms the soft-landing narrative.

JPY: New PM’s Hawkish Vibes Add to Yen’s Bull Case

In Friday's election, Shigeru Ishiba emerged victorious as the ruling party leader in a run-off against dovish candidate Sanae Takaichi, signaling a potential shift in Japan’s economic stance. Ishiba has voiced support for the Bank of Japan’s independence and its normalization strategy, suggesting a firmer focus on tackling deflation. His election could mark a turning point in monetary policy discussions, with the new Prime Minister reportedly planning a general election on October 27.

This leadership change adds a layer of uncertainty for JPY, as markets will look closely at Ishiba's approach to monetary policy and how it aligns with the BoJ's potential hawkish shift. As much as politics and central banks should be independent, there is a fair chance that Ishiba-san’s hawkish comments could feed into BOJ’s policy thinking. We still expect caution on further policy hikes after August’s Black Monday, but wage-price spiral suggests that the BOJ has room to normalize policy further. With the yen already benefiting from lower oil prices, Fed’s 50bps rate cut, and the possibility of BoJ rate hikes, Ishiba’s election win could accelerate bullish sentiment on JPY, especially against currencies like the EUR, where expectations for further rate cuts are firmer.

Commodity Currencies: CAD Could Extend its Underperformance

The outlook for commodity currencies like AUD, NZD, and CAD has shifted with China’s recent stimulus, adding to the positive narrative already building from the Fed's soft-landing scenario, with a 50bps rate cut at the September meeting. However, CAD has been the underperformer, with the Canadian economy facing hard-landing risks. Inflation returned to the 2% target in August, and markets still expect more rate cuts from the BoC, adding to CAD’s downside pressure.

Meanwhile, the RBA has pushed any potential rate cut discussion to 2025, while the RBNZ appears overpriced, with markets forecasting 90bps of cuts over the next two meetings before year-end. CAD’s underperformance may continue for now, especially until US election risks could start to take a larger role in markets. CAD faces fewer tariff risks compared to the other commodity currencies, and its fate could turn if a Republican victory becomes more likely in the US elections.

--------------------------------------------------------------------------------------------------------------------

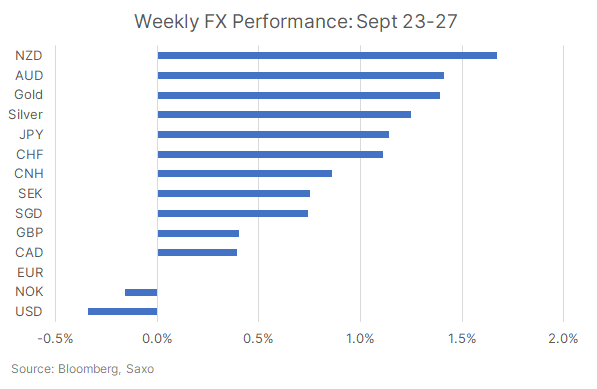

Risk-on mood was boosted by China stimulus after the Fed's 50bps rate cut. and activity currencies like NZD and AUD outperformed. JPY and CHF also gained with the former boosted by local election results and latter by SNB's less dovish-than-feared rate cut.

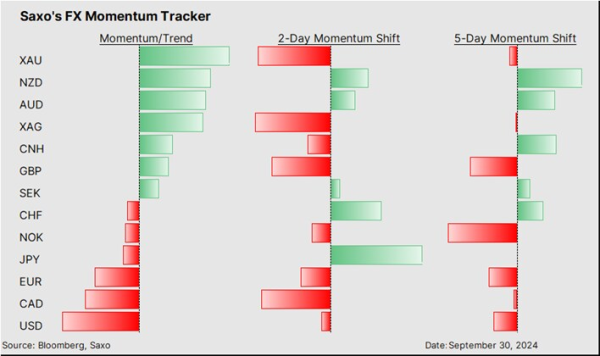

Our FX Scorecard shows bullish momentum in Gold and Silver retreating, and bearish momentum continuing to build further in CAD. JPY and CHF see the most bullish shift in momentum in the last two days.

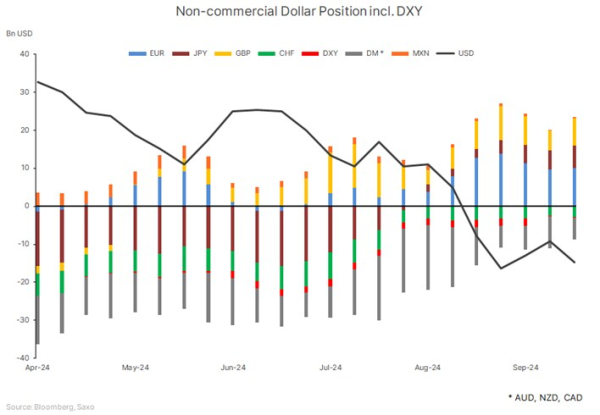

The CFTC positioning data for the week of 24 Sept saw speculators selling USD once again after two weeks of short-covering. All major currencies except CHF saw net buying, led by high-beta currencies GBP and AUD.

-----------------------------------------------------------------------

Recent FX articles:

- 20 Sep: JPY: Bank of Japan’s Tapering Hawkishness

- 11 Sep: JPY: Upside Fueled by BOJ Hawkishness and Election Volatility

- 4 Sep: JPY: Safe-Haven Appeal on Display, Carry Unwind Risks on the Radar

- 3 Sep: USD at Crossroads: End of Strength or Start of a Crisis?

- 28 Aug: AUD: Short-term Gains, Long-term Risks

- 28 Aug: CAD: Rally at Odds with Fundamentals

- 21 Aug: US Dollar: Excessive Weakness or More to Come?

- 16 Aug: FX Markets Face a Tug-of-War: A Scenario Analysis

- 14 Aug: NZD: Rate Cut Cycle Has Kicked Off

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

Recent Macro articles:

- 25 Sep: China's Bold Stimulus Measures: What It Means for Markets

- 24 Sep: Fed’s Rate Cuts, China’s Bazooka Stimulus: Why Emerging Markets Could Shine

- 19 Sep: Fed’s Jumbo Rate Cut: Short-Term Goldilocks, Long-Term Volatility

- 19 Sep: Fed Rate Cuts Are Here: An ETF Playbook (UCITS)

- 16 Sep: Fed Rate Cuts Are Coming: An ETF Playbook

- 12 Sep: US Votes, Asia Reacts: Investment Strategies for a Trump-Harris Showdown

- 5 Sep: Mastering Diversification: A Comprehensive Guide to Balancing Your Investment Portfolio

- 30 Aug: Nvidia's Blackwell Chips: Raising the Bar in Generative AI

- 15 Aug: Warren Buffett’s Portfolio Shifts: New Bets, Big Buys, and Surprising Exits

- 15 Aug: US CPI: Fed Rate Cut Remains in Play, but 25 vs. 50bps Debate Unsettled

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

Weekly FX Chartbooks:

- 23 Sep: Weekly FX Chartbook: Policy Divergences Remain in the Driving Seat

- 16 Sep: Weekly FX Chartbook: Fed to Start its Rate Cut Cycle

- 9 Sep: Weekly FX Chartbook: Mixed Jobs Data Will Make Fed’s 50bps Cut Harder

- 2 Sep: Weekly FX Chartbook: Labor Data Holds the Key to Size of Fed’s Rate Cut

- 26 Aug: Weekly FX Chartbook: Powell Keeps the Door for 50bps Rate Cut Open

- 19 Aug: Weekly FX Chartbook: Over to Policymakers – Fed’s Powell, Kamala Harris, and BOJ’s Ueda in Focus

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

FX 101 Series:

- 26 Aug: Navigating Portfolio Risks Amid Weakening U.S. Dollar

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar

Read More FX Analysis On SAXO Reviews